The promise of easy riches can be enticing, especially in the sometimes volatile and lucrative cryptocurrency market.

However, would-be investors need to exercise caution, as a recent case highlights the risks involved when dealing with unregulated digital assets.

The case of Robert Robb has once again warned us about the dangers of fake campaigns, run by fake investors.

Allure of the automatons

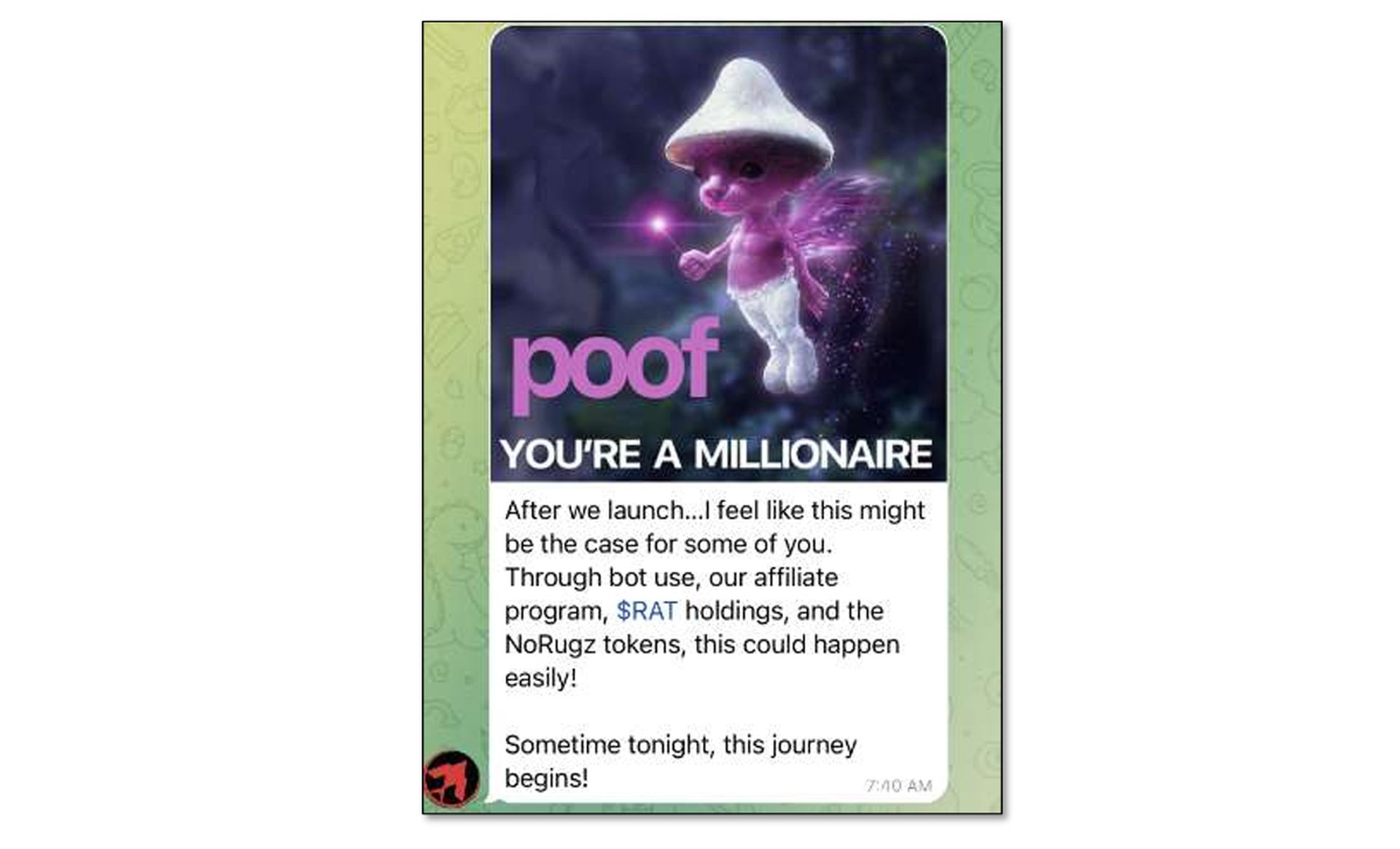

Robert Robb allegedly lured investors with a tantalizing prospect: a cryptocurrency trading bot promising to automate trades and generate substantial profits. His pitch, as victims claim, was simple yet compelling: “Poof, you’re a millionaire“. But as the FBI charges (PDF, viewed by 404media) allege, this automated fortune proved to be an elaborate illusion.

The allure of trading bots is understandable. These software programs can analyze market data, spot trends, and execute trades far faster than any human trader. In theory, they offer the potential to capitalize on market fluctuations with precision and speed. However, this potential relies on the bot being expertly designed and functioning flawlessly – a far cry from Robb’s alleged scheme.

The curious case of funds amiss

According to the FBI, Robb solicited approximately $1.5 million from investors, ostensibly to develop his miracle crypto trading bot. The indictment, however, paints a different picture. Prosecutors claim that rather than being used to build cutting-edge trading software, these funds were diverted for personal use. The promise of a wealth-generating machine, it seems, was merely a facade.

This case is a stark reminder of the risks inherent in investing in unregulated and opaque assets like cryptocurrencies. While there are legitimate projects and opportunities within the space, there are also bad actors seeking to exploit investor enthusiasm for their own gain.

Investor woes and a trail of suspicion

Robb’s alleged victims were left not only disappointed but also financially harmed. Their hopes of automated wealth vanished, allegedly replaced by the bitter reality of lost savings. This case underscores the importance of thorough due diligence before investing in any cryptocurrency project, particularly those promising extraordinary returns.

The FBI’s investigation into Robb’s alleged scheme highlights the ongoing challenge law enforcement agencies face in policing the cryptocurrency landscape. While digital assets offer new possibilities, they also present novel opportunities for fraud and exploitation.

Key takeaways from the tangled trail

The case of Robert Robb and his alleged cryptocurrency scam offers several important lessons for potential investors:

- If it sounds too good to be true, it probably is: Promises of instant riches or guaranteed returns are classic red flags of investment scams.

- Do your research: Thoroughly investigate any cryptocurrency project or bot before investing. Look for information on the developers, their track record, and the technology’s underlying mechanisms.

- Be wary of pressure tactics: Legitimate investments don’t need high-pressure sales tactics. If someone tries to rush you into a decision, it’s wise to step back and reassess.

- Consider the risks: Cryptocurrency investments are inherently risky, even when dealing with legitimate projects. Be prepared for potential volatility and the possibility of loss.

A cautionary tale in a burgeoning space

The tale of Robert Robb’s alleged crypto trading bot scam is a cautionary one for anyone considering investing in the world of digital assets. The promise of easy money can be blinding, but it’s crucial to approach cryptocurrency investments with a healthy dose of skepticism and careful research.

Featured image credit: Emre Çıtak/Bing Image Creator