Less than an hour into Monday, November 15, Bitcoin hit a historic high of over $75,000, breaching previous records as the world marvels at the digital currency’s continuing climb. It comes just as the cryptocurrency market heats up, with more people expressing interest in the results of the U.S. presidential election. Bitcoin was on a roll thanks to a wave of excitement generated by the election results confirming Republican Donald Trump, the 47th president of the United States.

Bitcoin hit a new all-time high on Coinbase on November 6 at $75,000.85, with more at $73,800 on March 13 being the all-time high before Saturday. This reflects the decaying political atmosphere and the traders’ frantic demand to look for alternatives as the traditional markets react to an untested political read. New York markets opened, and Bitcoin continued to rally, rising more than 3% to $70,577, an intra-day high before it continued to rise.

New all-time high for bitcoin. pic.twitter.com/x6npEVy2oJ

— Tuur Demeester (@TuurDemeester) November 6, 2024

Crypto rallies as Trump leads in results

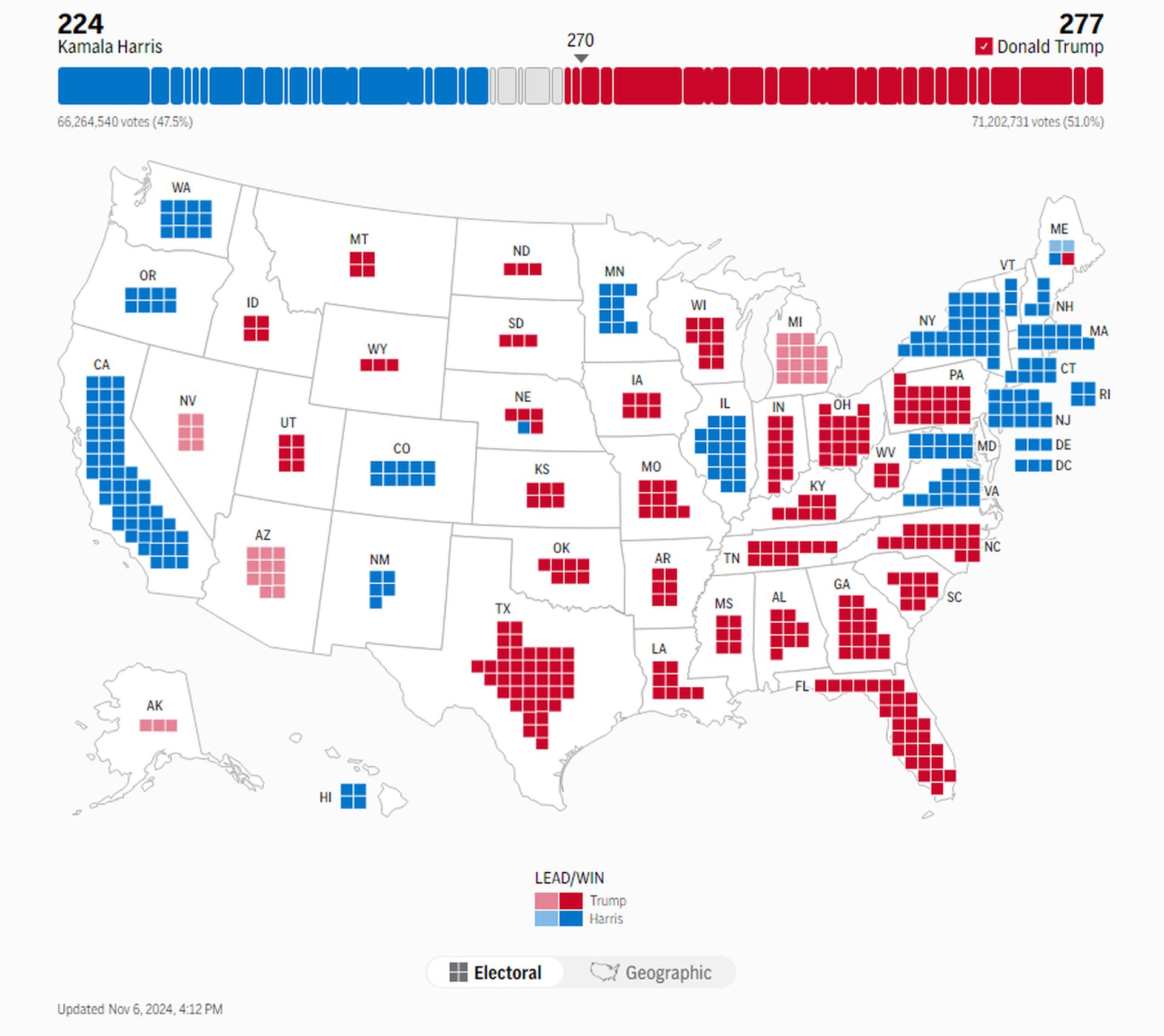

The latest U.S. election developments seem closely linked to Bitcoin’s record-breaking momentum. Early election results from the Associated Press suggested Trump had 277 electoral votes, compared with Kamala Harris’s 224. But Bitcoin’s value echoes traders’ speculation of how election outcomes may impact cryptocurrency regulatory policy.

Analysts have expected this election-driven rally, and some crypto communities have expected a Trump win to further boost Bitcoin’s value. The crypto rally is current with election news that’s more favorable for Trump, aligning with traders’ thesis that there’s a chance for the win to lead to a better environment for Bitcoin and other cryptocurrencies, tweeted Bitcoin analyst Tuur Demeester. As Bitcoin crossed the $70,000 threshold, Trump’s odds soared over 60% on Polymarket, a decentralized prediction platform, and increased the speculation that these are related.

Volatility looms despite the new high

Despite the new peak, Bitcoin’s market outlook is still slightly positive, similar to high volatility as election results become known. Traders are prepared for sharp movements in Bitcoin value to continue after the election, according to market observers who expect price fluctuations to persist. Spot Bitcoin ETFs saw outflows of $541.1 million on November 4 as investors repositioned holdings in the face of market volatility. These outflows hit major funds at Fidelity, ArkInvest, Bitwise, Grayscale, and GBTC. BlackRock’s IBIT also continued to draw in new cash: $38.3 million simultaneously, demonstrating the pursuit of Bitcoin as an investment continues among investors.

Traders in the options market were cautious and took protective measures. Tony Stewart, founder of Pelion Capital, explained these shifts by saying traders are still bullish, but others have hedged themselves against possible downturns by buying $64,000 put options. This view is balanced; traders are ready for price moves in both directions as the market evolves.

Election and Crypto

The synergy between Bitcoin’s record-high performance and the U.S. election underscored the cryptocurrency market’s sensitivity to geopolitical tremors. Demand for Bitcoin has not abated despite the clarity surrounding regulatory policies, and options traders are willing to bet further gains for Bitcoin in November.

On 6 November, Bitcoin’s milestone moment is a beautiful example of how global events and speculative interest continue to fuel the cryptocurrency market. As traders and investors closely watch the U.S. election, Bitcoin’s behavior is a bellwether of what’s happening in the traditional and digital markets. Bitcoin’s all-time high is now set, and the market is still waiting to see what these unprecedented circumstances might mean for crypto investment.

Featured image credit: Furkan Demirkaya/Gencraft