It wasn’t long ago that owning a piece of an original Monet painting was in the realm of possibility for billionaires alone. The dynamics of art investments have changed dramatically thanks to Masterworks, a trailblazing app, and fintech platform.

This innovator has successfully fused the seemingly disparate worlds of fine art and financial technology, tearing down the velvet ropes of art investments and creating opportunities that are as intriguing as Banksy and as promising as Basquiat.

The concept of Masterworks

If you’re looking for a way to describe the Masterworks platform, one could say it’s the Robin Hood of the art world, by taking the privilege of art investment from the hands of the uber-wealthy and making it accessible to everyday people.

With Masterworks, you’re not buying shares in a publicly traded company, you’re buying shares in a piece of art. You can own a piece of a multi-million dollar artwork, just like owning a piece of a leading social media company.

Using the platform, you can buy fractionalied pieces of a Warhol, Condo, or Solages painting, all of which are artists whose works have been known to appreciate significantly over time.

As such, this opens up a new asset class to the public and allows retail investors to diversify their portfolios beyond traditional stocks and bonds.

The growth of Masterworks

Since its inception, Masterworks has seen exponential growth, both in terms of assets and user base. In 2020, the platform had $36 million in assets and 80,000 users. Fast forward to today, and Masterworks boasts over $500 million in assets and a user base of over 500,000.

This rapid growth is a testament to the app’s disruptive value proposition and its ability to tap into a previously unexplored market.

The Masterworks mobile application

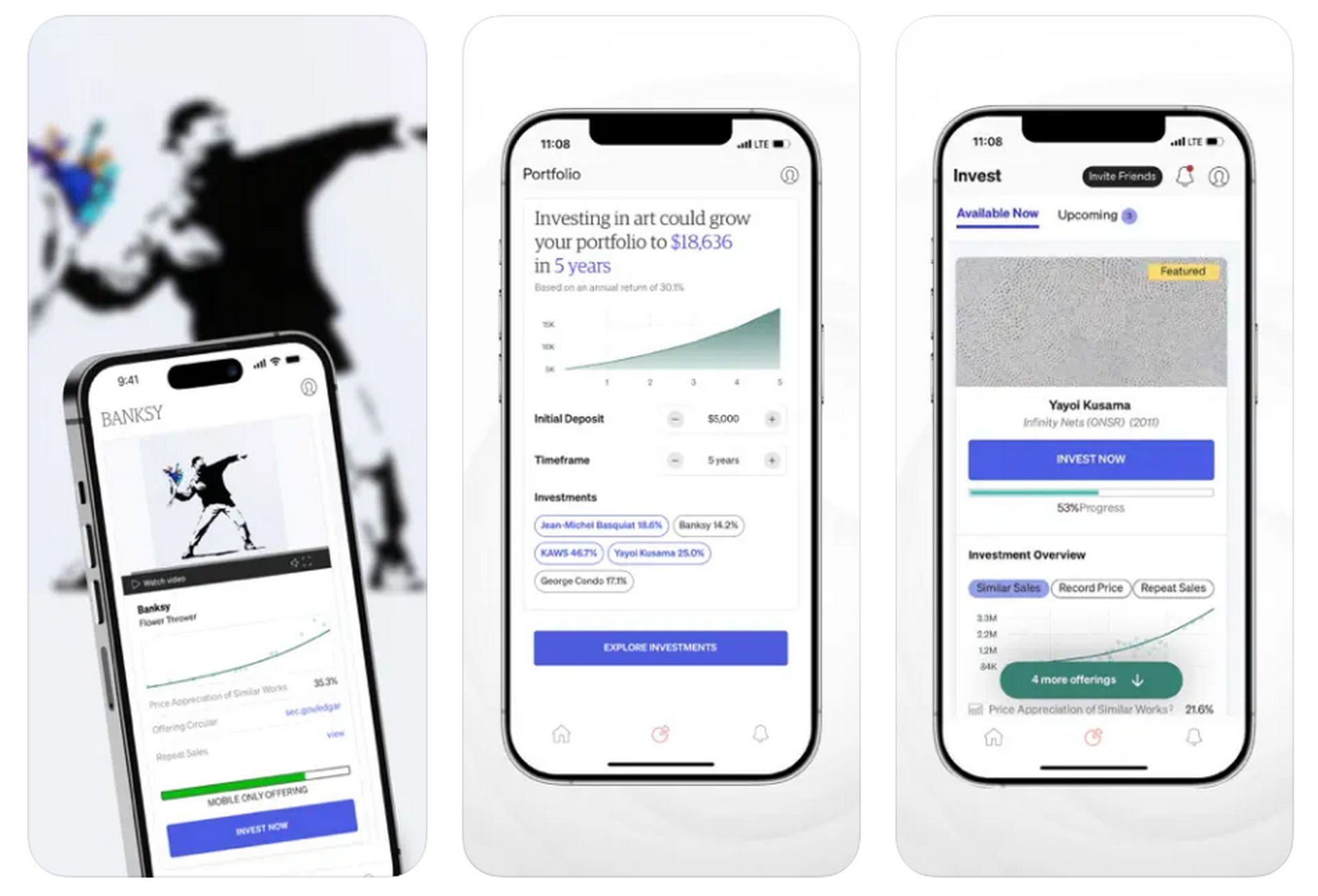

To make art investment even more accessible, Masterworks has developed a mobile application available on both Android and iOS platforms. The app brings the world of fine art investment to your fingertips, allowing you to buy and sell shares, manage your portfolio, and learn about the art market, all from the palm of your hand.

The Masterworks app is designed with user experience in mind. Its intuitive interface makes it easy for users to navigate through the platform and make informed investment decisions.

You can check historical prices, and future projections, and use a calculator to estimate what your portfolio may be worth depending on how long you want to hold and the initial amount invested. Of course, any investment comes with risks and is hardly an exact science, so these can be handy insights.

The app also provides educational resources about the art market, helping users understand the nuances of art investment and make informed decisions. After all, this is an asset class that is not exactly on the radar of the everyday person, so there is the potential for a steep learning curve when entering the world of fine art investment.

How does it actually work?

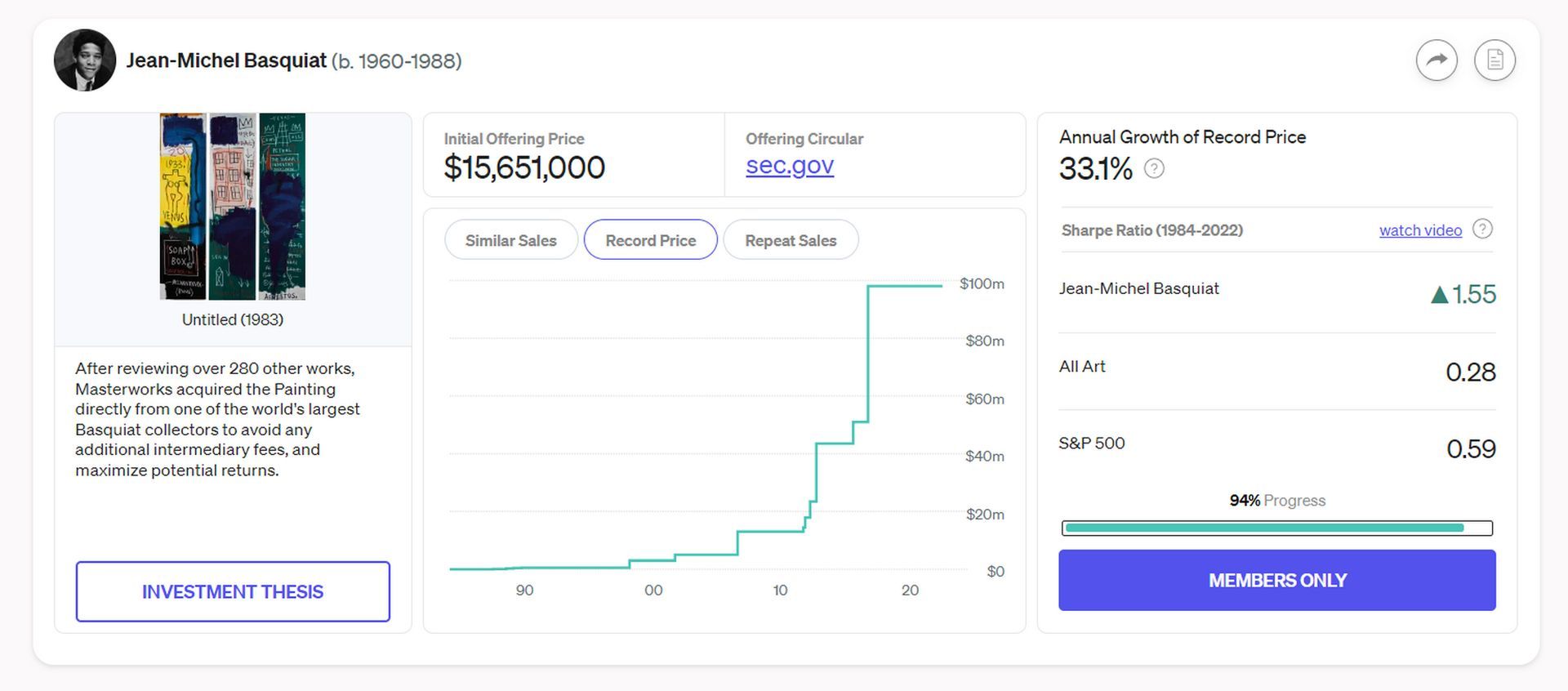

The process of investing in art through the Masterworks app begins with the diligent work of the platform’s research team, a group of seasoned art market analysts and data scientists. They leverage proprietary data and advanced analytics to identify artist markets with the most promising investment potential. This is not a random selection; it’s a data-driven decision based on market trends, historical performance, and artist momentum.

Once a promising artist is identified, the baton is passed to the acquisitions team. This team, composed of art market veterans, scours the global art market to locate a piece that not only represents the artist’s best work but is also available at an attractive price. This process involves extensive negotiations, due diligence, and a keen understanding of the art market dynamics.

With the artwork acquired, the next step is securitization. Masterworks file an offering circular with the Securities and Exchange Commission (SEC), a process that transforms the artwork into an investable asset. This SEC process ensures regulatory compliance and provides a layer of protection for investors. It’s a testament to Masterworks’ commitment to transparency and investor protection.

Once the SEC approves the fractionalized offering, the artwork is ready for investment. Investors can buy shares representing a fraction of the artwork’s value, much like buying shares in a company. But the investment journey doesn’t end there. Masterworks holds the artwork for a period of three to ten years, a strategic decision based on market trends and projected appreciation.

During this holding period, the artwork is stored in a secure, climate-controlled facility, ensuring its preservation. Investors will also be able to view some pieces up close and personal in the newly opened Level & Co. art gallery in New York City, a Masterworks subsidiary.

While waiting for the artwork to appreciate, investors are not left in the dark. They have the option to sell their shares on Masterworks’ secondary market, a unique feature that provides liquidity to an otherwise illiquid asset. This secondary market operates much like a stock exchange, allowing investors to buy and sell shares in artworks, giving them flexibility and control over their investment.

Final words

Masterworks stand as a testament to the innovative spirit of fintech, breaking down barriers and democratizing access to a previously exclusive asset class. It has successfully combined the worlds of fine art and financial technology, creating a unique platform that allows everyday people to invest in multi-million dollar artworks.

This has opened up new possibilities for investors, offering an opportunity to diversify portfolios, support the art world, and potentially reap significant financial rewards.