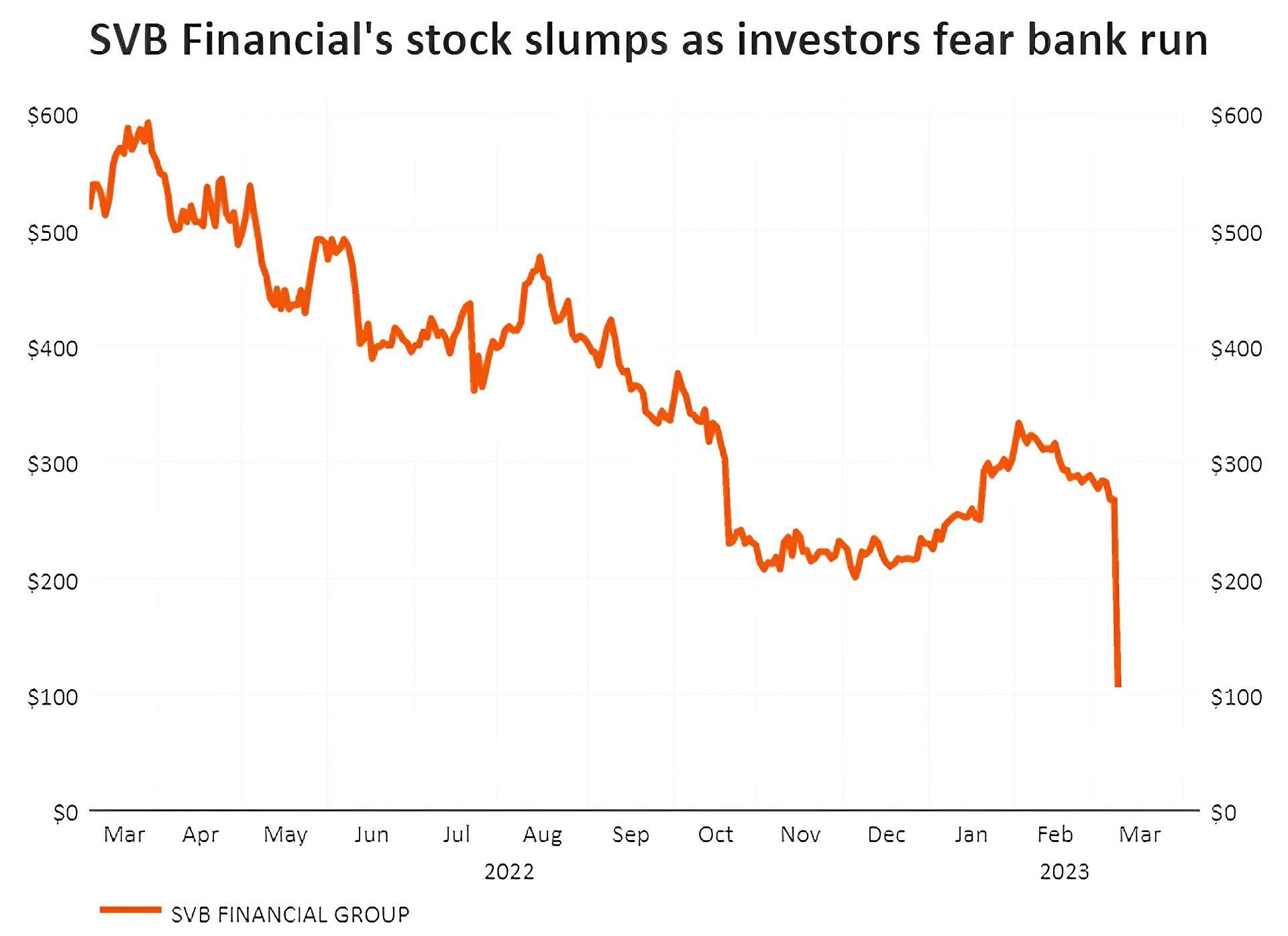

Following a capital offering that caused Silicon Valley Bank Financial Group’s stock to collapse 60% and contributed to the loss of over $80 billion in value from bank shares, the company hurried on Thursday to convince its venture capital clients that their money was safe.

To strengthen its balance sheet, SVB, doing business as Silicon Valley Bank, started a $1.75 billion share sale on Wednesday. It claimed in an investor prospectus that it required the funds to close a $1.8 billion hole left by the sale of a $21 billion portfolio of loss-making bonds, the majority of which were US Treasury bonds. The portfolio was returning an average of 1.79%, which was considerably less than the prevailing yield on the 10-year Treasury note of about 3.9%.

Given the declining fortunes of numerous technology startups that the bank supports, shareholders in Silicon Valley Bank’s stock worried about whether the capital raising would be adequate. When the market closed, shares of the company fell another 26% in extended trade, dropping to its lowest point since 2016.

According to two people with knowledge of the situation, Gregory Becker, the CEO of Silicon Valley Bank, has been calling clients to reassure them that their money is secure with the bank.

How big is the risk for Silicon Valley Bank?

According to the reports, some firms have been encouraging their founders to withdraw their funds from Silicon Valley Bank as a precaution. One of the reports says one of them is Peter Thiel’s Founders Fund.

One San Francisco-based firm informed Reuters that they sent all of their money successfully out of Silicon Valley Bank on Thursday afternoon, and by 4 p.m. Pacific Time, the money had appeared in their other bank account as a “waiting” inbound wire.

But according to the Information magazine, the bank warned four clients that transfers would be delayed.

Silicon Valley bank still did not answer several requests for comment.

Over half of the US venture-backed technology and healthcare companies that debut on public markets in 2022 are partnered with Silicon Valley Bank, a critical early-stage lender.

“While VC (venture capital) deployment has tracked our expectations, client cash burn has remained elevated and increased further in February, resulting in lower deposits than forecasted,” Becker has explained in a letter to investors seen.

What are the broader risks?

The funding winter is a result of both elevated inflation and the Federal Reserve’s steady increase in borrowing costs during the previous year.

Investors’ worries about broader dangers in the industry increased in response to the Silicon Valley Bank upheaval.

First Republic, a bank with headquarters in San Francisco, saw its shares plunge more than 16.5% after reaching its lowest point since October 2020, ranking second among S&P 500 index decliners. After reaching its lowest point since January 2021, Zion Bank fell more than 12%, while the SPDR S&P regional banking ETF also declined by 8%.

With Wells Fargo & Co. down 6%, JPMorgan Chase & Co. down 5.4%, Bank of America Corp. down 6%, and Citigroup Inc. down 4%, major American banks were also negatively impacted.

The 18 banks that make up the S&P 500 banks index lost over $80 billion in stock market value on Thursday, including a $22 billion decline in the value of JPMorgan.

Separately, Silicon Valley Bank said that private equity firm General Atlantic would acquire its shares for $500 million.

Moody’s downgraded the bank’s long-term local currency bank deposit in the meantime.

The bank’s bonds aren’t performing as poorly as its equities, according to Natalie Trevithick, head of investment grade credit strategy at investment advisor Payden & Rygel.

Future performance will depend on the news, but I don’t see a full recovery in the near future. For many buy-the-dip customers to return, it isn’t quite affordable enough, according to Trevithick.

Despite the most recent worries, analysts at the brokerage Wedbush Securities said that the bank had made a sizable profit from the sale of assets and capital raising.

“We do not believe that SIVB is in a liquidity crisis,” stated Wedbush analyst David Chiaverini in a report, mentioning the company’s stock ticker.

Preparing for higher interest rates

Silicon Valley Bank stated that the bank will quadruple its term borrowing to $30 billion and reinvest the proceeds from the equity sale in shorter-term debt.

“We are taking these actions because we expect continued higher interest rates, pressured public and private markets, and elevated cash burn levels from our clients,” Becker said in the mentioned letter.

“When we see a return to balance between venture investment and cash burn – we will be well positioned to accelerate growth and profitability,” he said, adding that Silicon Valley Bank is “well capitalized.”

Also, the bank predicted that this year’s net interest income would decrease by a percentage of “mid-thirties,” which was higher than the “high teens” dip it had predicted seven weeks earlier.

According to John Luke Tyner, a fixed-income analyst at Aptus Capital Advisors, “risk-off sentiment” and concerns about systemic threats to the sector continued to weigh on bank stock prices.

Many customers are waiting for Silicon Valley Bank to make a comment regarding the latest stories that were published following the incidents. As time without further explanation passes, it is expected that the bank will suffer heavier consequences. If you want to learn more about the latest developments in multi-billionaire companies, make sure to check out the articles below and keep track of them.