You can learn how to use Apple Pay Later with this article. Apple has announced a new free financing feature in Apple Wallet that lets you pay for purchases over time with no interest and we’ll tell you how to use Apple Pay Later in this article.

“Buy now, pay later” services have grown in popularity as inflation continues to grow, and Apple’s entrance into this field will almost certainly help people. Apple Pay Later will launch with the release of iOS 16, expected in September 2022.

Through a new function unveiled Monday at its annual World Wide Developer Conference, Apple has embraced the spirit of buy now, pay later. The feature is known as Apple Pay Later and is built into iOS 16 for iPhone and Apple Wallet. You won’t be charged interest or additional costs if you pay for things or services over time using Apple Pay Later.

The Apple Wallet app on the iPhone is a digital wallet that provides three key services: Apple Pay, Apple Card, and Apple Cash. With Apple Pay, you can save your debit and credit cards to use online or at merchants; Goldman Sachs offers a Mastercard-based credit card that works like a standard digital credit card that can be used with Apple Pay.

Many merchants accept payments from “buy now, pay later” apps like Affirm, Klarna, or Afterpay. Most of these applications provide similar short-term interest-free payment arrangements, while some also have adjustable interest rates over time.

We’ll go over Apple Pay Later in detail now, including how it will operate, where it will be accepted, and when you’ll be able to use it.

How to use Apple Pay Later?

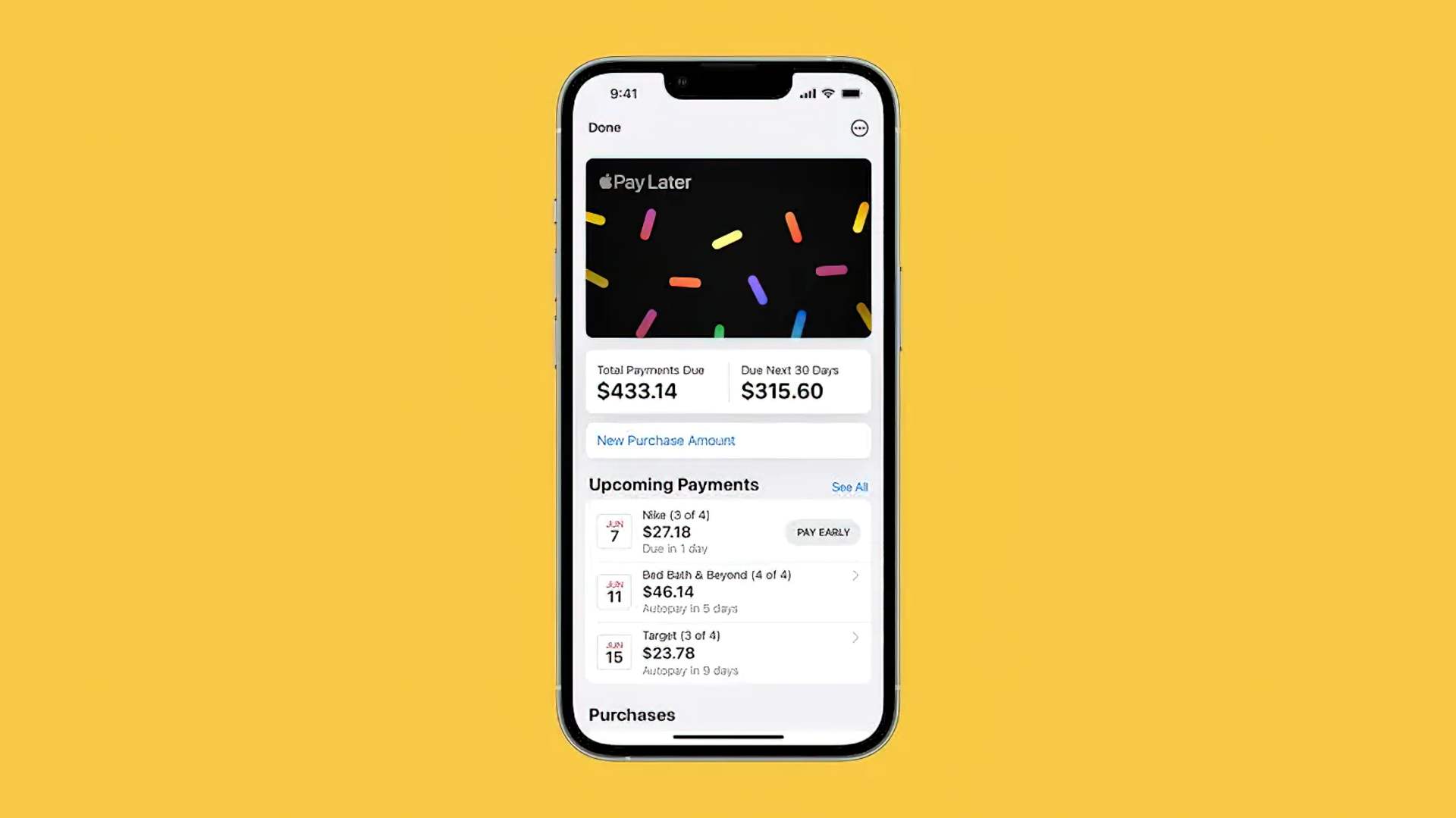

First off, you’ll need iOS 16, that’s not been released to the public yet. You may sign up for the developer program to get the beta access as soon as it releases. So when Apple Pay Later becomes available, you will be able to pay for your purchase in installments. You may split the cost of your item into four equal payments and spread them out over six weeks. The first payment is due when you initially buy, and the remaining payments are due every two weeks after that.

When Apple Pay Later arrives, you’ll be able to complete a purchase in one of two ways: “Pay in Full” or “Pay Later.” Selecting the latter option will display a payment plan showing each payment’s amount and due dates.

According to Corey Fugman, senior director for Wallet and Apple Pay, who discussed it during the WWDC keynote address, Apple Pay Later will be accessible “on any device that supports Apple Pay.” It’s unclear whether Apple Pay Later will be accepted in physical stores.

Apple Pay Later will not require any changes to be made by merchants or stores. Payments through Apple Pay After will work similarly to how they occurred previously. Goldman Sachs is an Apple Pay Later financial partner, so it’s unclear if the bank will also be covering up front expenses for the service.

Apple Pay Later does not appear to have a minimum or maximum purchase quantity. There is no word yet on whether there will be a transaction minimum or maximum for Apple Pay Later. PayPal’s similar program restricts purchases with free financing to values between $300 and $1,500.

What are the Apple Pay Later countries?

“Apple Pay Later provides users in the US with a seamless and secure way to split the cost of an Apple Pay purchase into four equal payments spread over six weeks, with zero interest and no fees of any kind,” Apple said.

When can I use Apple Pay Later on my iPhone?

Apple Pay Later will be accessible with iOS 16, the next planned update of Apple’s operating system for the iPhone. The beta version of iOS 16 is now available to registered developers. In the WWDC keynote, Apple revealed that the initial public beta version of iOS 16 would be released in July.

Apple has typically launched its most recent operating systems simultaneously with its latest smartphones, as it did with iPhone 13 and iOS 15 in September 2021. The iPhone 14 is anticipated to be released in September 2022, and iOS 16 is expected to follow suit shortly thereafter.

How is Apple Pay Later different from Apple Card Monthly Installments?

The Apple Card Credit Card offers you the option to pay your purchases over time with monthly installments. When you use the Apple Card credit card to buy certain Apple products, you may take advantage of this Apple program. The product determines the 0% APR period duration for these items. Installment plans range from six months to two years.

Apple Pay Later isn’t limited to Apple products, and it doesn’t require the Apple Card. You may use your preferred credit card connected to Apple Wallet to finance purchases using Apple Pay Later. In addition, the six-week interest-free installment period for Apple Pay Later is shorter than those offered by Apple Card Monthly Installments.

What else is new in Apple Wallet for iPhone?

Apple Pay Order Tracking, which was unveiled at WWDC and allows merchants to offer customers with more detailed receipts and delivery status updates for their purchases using Apple Wallet, is one of several new features added. Apple also announced that it will be adding support for driver’s licenses and identification cards in Apple Wallet. Following the addition of Colorado and Arizona’s identities to Apple Wallet, support for 11 additional states is expected within the next several months.

These driver’s licenses can be used at certain Transportation Security Administration checkpoints. They may also be shared with other apps that demand identification, such as Uber Eats purchases involving alcohol. Apple is also expanding its Wallet platform to allow users to share access codes for places like hotels, offices, and automobiles. Users will be able to share keys with friends or coworkers using email, text messaging, and other communication technologies. The Apple Pay Order Tracking, driver’s license and key-sharing capabilities will be released to the public after iOS 16 is fully released in September 2022.

What other online services let you buy now and pay later?

PayPal’s Pay in 4 program works similarly to Apple Pay Later, except that purchases must be between $300 to $1,500.

The BNPL’s app Sezzle also uses a four-payment plan over six weeks, however, it includes the option to reschedule one payment for up to two weeks later without charge and postpone further payments for an additional fee. BNPL’s two other apps, Affirm and Klarna, provide interest-free installments for brief durations or longer installment plans with a variable interest rate.

You can read more about WWDC and announced new Apple features here.