Everyone wants an ARM chip. Until recently, it was common for Qualcomm or MediaTek to produce the SoC, which controls everything.

Apple and Samsung were the first to leave the camp and start producing their own mobile processors, but this is becoming increasingly popular: Huawei is another well-known firm, and Google Tensor has now debuted. Oppo is considering the release of its own SoCs in 2023 or 2024, along with numerous other firms. This is the era of the “do-it-yourself mobile chip”.

If you want something done right, do it yourself?

For many years, mobile phone manufacturers have given almost everything to third-party developers: their devices had minor design differences and certainly in areas such as mobile photography, but their control over those elements was always restricted.

One of the restrictions was imposed by the SoC, which is the brain of every smartphone. This chip combines the CPU, GPU, 4G/5G modem, ISP, and other components such as AI processors that are becoming more essential.

The issue is that brands had no say in the matter: manufacturers like Qualcomm or MediaTek, for example, provided a variety of alternatives similar to Intel and AMD do in the PC industry, while mobile device manufacturers “assembled” the best chip for each of their devices.

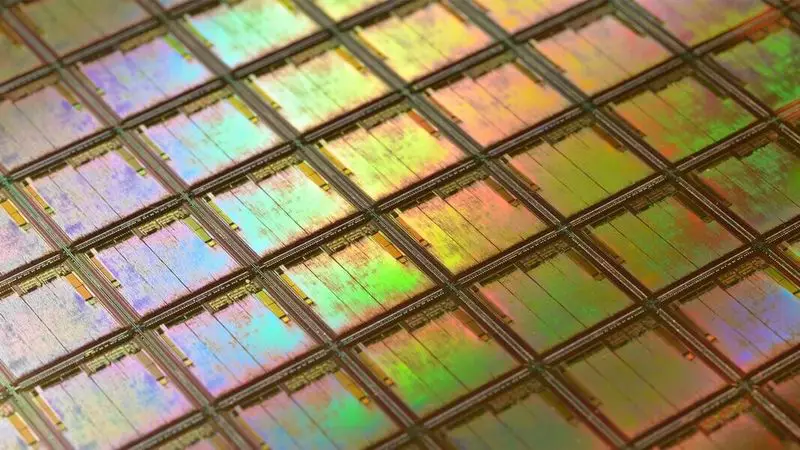

There is a significant difference, however, in the mobile world between processors for PCs and laptops. Intel and AMD design and manufacture their CPUs in mobile, but they do not exclusively license them; instead, the landscape is dominated by a shared base, which is ARM designs, which are available to anyone who pays for a license.

Qualcomm and MediaTek acquired those designs years ago, and a variety of devices were subsequently produced based on them. Some mobile firms, however, recognized they might also manufacture chips for those phones. They just needed to license the ARM technology and set it up on their own.

This is what Apple and Samsung did in 2010, what Huawei started to do timidly in 2012 (the first Kirin would not arrive until 2015), and what Google has also recently ended up doing, which yesterday presented the Pixel 6 and Pixel 6 Pro based on Google Tensor chips.

All of them have realized the benefits of manufacturing their chips: they can fine-tune them to focus on the features that may distinguish their devices most, but they can also change those characteristics based on each product category’s demands.

Apple has been doing this for years with its AXX family of processors the latest, the A15 Bionic in the iPhone 13 but its experience as a semiconductor manufacturer has led it to take an exceptional leap forward with the development of the M1 chips last year, which have recently seen the appearance of their new and powerful successors, the M1 Pro and M1 Max.

It’s an excellent illustration of how to manage these divisions, and while no other firm has made the transition to chips for laptops and desktops, Intel and AMD can rest easy for the time being because what seems clear is that the danger from these efforts affects Qualcomm and MediaTek the most.

The trend is growing. Nikkei Asia recently reported that Oppo also intends to manufacture its chips for its cell phones. The goal is to have them ready in 2023 or 2024.

They also talk about Xiaomi, which several years ago appeared to want to enter this industry and according to Nikkei has lowered its expectations in order to concentrate on camera ISP design for its smartphones. It has already dabbled in that section with the Xiaomi Surge C1, for example.

If you also want to do your own thing on servers and laptops

That ambition is not only becoming apparent in the mobile world, and there are a few companies and not exactly small companies that have been developing chips for another segment for some time: servers. In some of those efforts, that effort might be used to improve PCs and laptops in the future, so keep an eye on it.

They are not the only ones, and there are a few others in the mix. Microsoft is developing ARM-based servers, as well as future Surface devices. Huawei has already unveiled a laptop with an ARM chip, but it’s only available in China.

NVIDIA unveiled its ARM chip for servers, called Grace, a few months ago without the soap opera of the ARM purchase having been concluded.

Qualcomm, on the other hand, which had established no presence previously, has recently acquired Nuvia: it is making a frontal assault on both ARM server processors and those that will compete with Apple’s M1s (or so Qualcomm claims).

It was Alibaba, not MediaTek, that dominated this market and highlighted chips that increasingly offer fascinating possibilities such as for Chromebooks. If that wasn’t enough, just yesterday Alibaba revealed the Yitian 710, an ARM chip with 60,000 million transistors (the M1 Max has 57,000) which is also intriguing.

This is a very different reality from just a few years ago, when all of the major players sought to have their chips and stop relying on third parties. We’ll see whether this odd battle has the impact that these businesses anticipate.