Data pipeline management company Datavolo has taken a step forward in cloud giant Snowflake’s journey to data management. This move, announced alongside Snowflake’s Q3 2025 earnings, aims to enhance data integration and management for Snowflake’s customers, ultimately streamlining their workflows and improving overall efficiency.

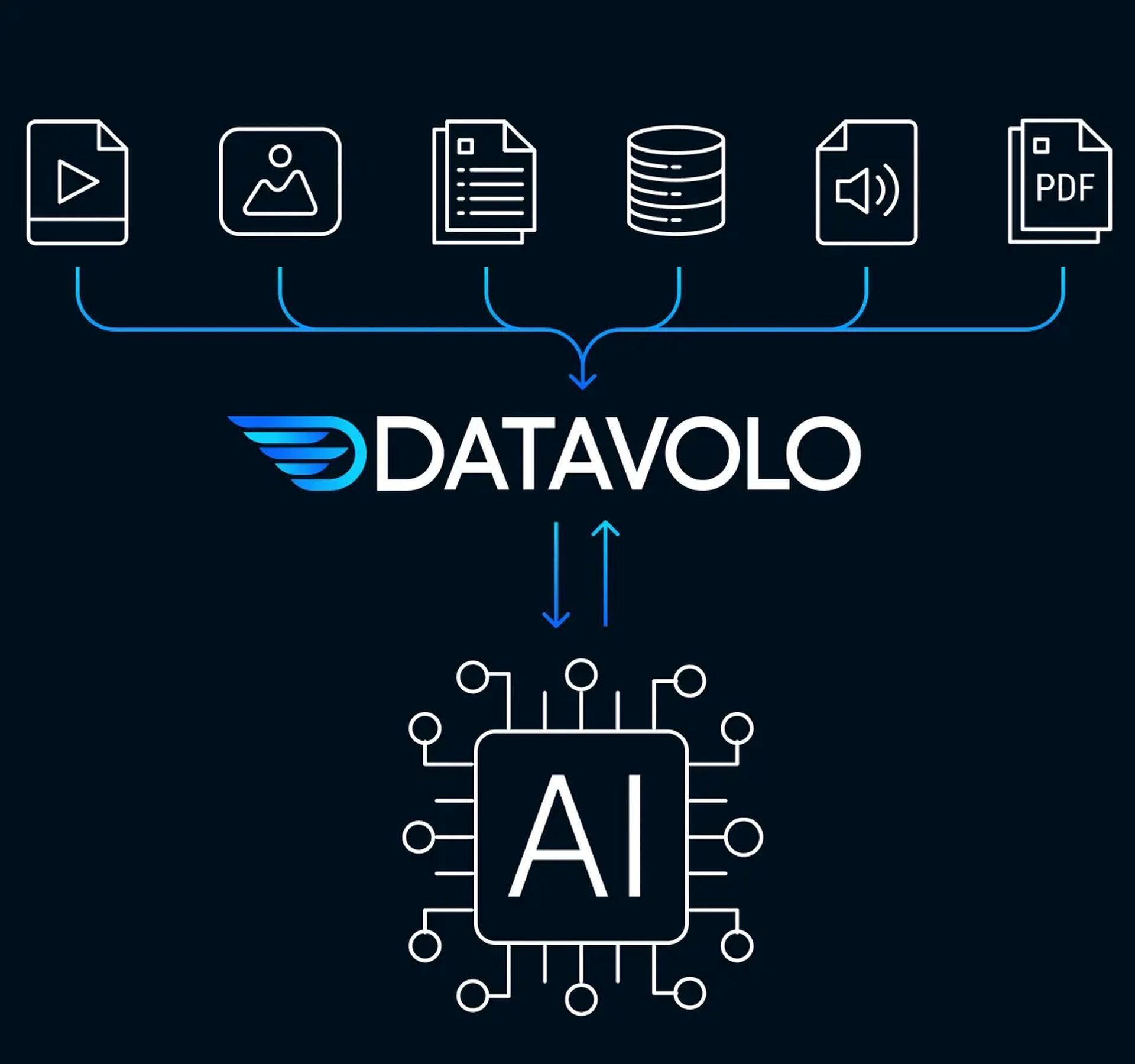

DataVolo was founded in 2023 by Joe Witt and Luke Roquet, who held key positions at Hortonworks and Cloudera before Datavolo. The company’s platform, based on Apache NiFi, an open-source project pioneered by the NSA for data processing, automates and helps data flow across multiple enterprise systems. Before the acquisition, Datavolo raised $21 million in venture capital from investors, including Citi Ventures and General Catalyst.

Will Snowflake’s Datavolo acquisition reshape the future of data pipelines?

Snowflake CEO Sridhar Ramaswamy said that the acquisition enables customers to easily move from the point, single-use data connectors to more agnostic pipelines that are seamless for moving data from the cloud and on-premises to Snowflake’s data cloud. “By bringing Datavolo into the Snowflake fold, we are expanding how much of the data lifecycle Snowflake captures,” Ramaswamy stated. This integration is intended to enable customers to experience simplicity, cost savings, and data extensibility.

‘I’m glad this happened,’ Witt said, adding that Snowflake’s resources could help Datavolo build faster, better solutions. “Data engineering at scale can be incredibly costly and complex,” he pointed out, acknowledging that their alliance with Snowflake aims to simplify customer experiences.

This acquisition underscores the need for a surge in demand for effective data management solutions, based partly on the rise of AI. Fortune Business Insights, in a statement, noted that the global enterprise data management market could be about $224.87 billion by 2032. This, as revealed by a survey from Great Expectations, is why matters that can be solved with the help of Datavolo’s offerings still matter: 91 percent of organizations have faced data quality problems that disrupted performance.

But right after the announcement of better-than-expected earnings and this strategic acquisition, Snowflake’s share of its stock improved a whopping 19 percent. Besides, Snowflake announced a multi-year partnership with AI startup Anthropic and plans to integrate its models into Snowflake products such as Cortex AI and Cortex Analyst.

This latest acquisition strengthens Snowflake’s market position and public sector offering, allowing federal organizations to deploy Datavolo. Once complete, Snowflake will continue to support the Apache NiFi project and pledge support to the open-source community.

Snowflake has made its mark despite an impressive 30% year-over-year product revenue rise to $829 million for Q2 of fiscal year 2025. However, it remains unprofitable, with an operating income margin of -38.89%. However, analysts forecast a turnaround this year, potentially accelerated by the successful integration of Datavolo’s technology into Snowflake’s platform. Snowflake has had strong revenue growth of 31.21% over the past year and is positioned to use its financial strength (more cash than debt) to continue pursuing growth initiatives.

Image credit: Datavolo