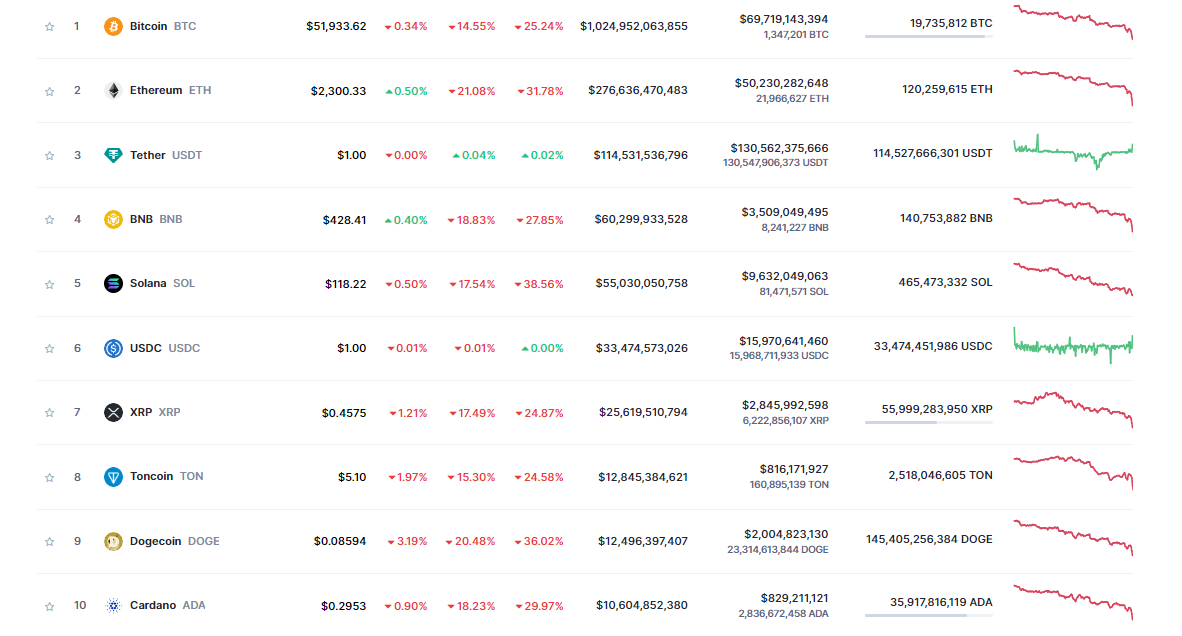

The crypto crash hit the market like a ton of bricks and left investors feeling like they had been punched in the gut. The digital gold rush turned into a digital bankruptcy and suddenly everyone was singing the crypto blues. But the collapse of some could mean the rise of others.

It all started with the opening of a Japanese crypto exchange. The crypto crash saw Bitcoin fall below almost $50,000, a level not seen since February. This sudden drop sent shockwaves through the entire cryptocurrency market, and Ethereum and other major coins followed suit. Over $800 million in derivatives positions were liquidated daily, showing just how volatile the crypto world can be.

August 2024 is the month to remember for the crypto crash

The crypto collapse did not happen in isolation. Several factors contributed to this digital collapse:

Global economic uncertainties played an important role in the crash. The Bank of Japan’s decision to raise interest rates caused volatility in both traditional and cryptocurrency markets. This was because the economic depression had passed and there was talk of interest rate cuts in Western countries. Japan, on the other hand, is one of the developed countries and still raising interest rates has affected the whole world. This move caused the Nikkei stock index to fall and its effects spread to the US markets.

The US Federal Reserve’s hesitation to lower interest rates also contributed to the crypto collapse. Many investors had anticipated a rate cut in September, but the Fed’s reluctance to commit to this move created uncertainty in the market. This uncertainty led some investors to pull out of cryptocurrencies, further fueling the crypto crash.

Bitcoin and Ethereum crypto crash: A huge breakdown

The crypto crash saw Bitcoin lose critical support levels, triggering a wave of selling. Here’s a closer look at what happened:

Bitcoin initially lost the $55,000 support level, which led to massive liquidations in the derivatives market. As the price continued falling, it broke other important support levels and dropped as low as $50,000.

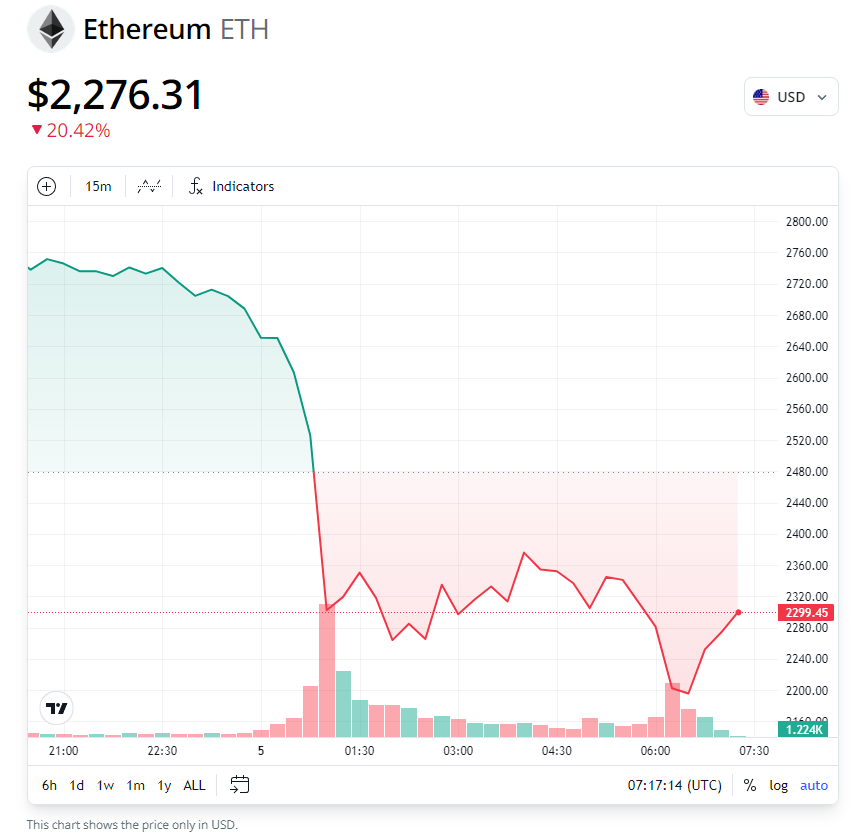

Ethereum, the second-largest cryptocurrency, wasn’t spared from the crypto crash either. It lost all its gains for the year, dropping by over 20% in a single day.

The drop also hit altcoins, as altcoins are already affected by Bitcoin and Ethereum transaction share.

Setting an automatic sell limit is one of the key rules of the crypto market. This drawdown also caused many users to automatically walk away. Bitcoin was expected to rise a lot after the halving. But now that countries are accepting Bitcoin and even their exchanges are selling Bitcoin paper, we can understand that Bitcoin is slowly being included in the capitalist market. This unstable state of threat to all markets at the time also makes users think.

The aftermath of the altcoin crypto crash

The market struggled to find its footing after the crypto crash:

Bitcoin does not remain stable after the initial shock of the crypto crash, momentarily dropping to the 50,000s and rising to 52,000 and $54,000 levels. Unless you’re a tough investor. It’s worth holding on to your money for the time being.

Ethereum also saw a slight recovery following the crypto crash, but like Bitcoin, it remained well below its previous price points. This pattern of partial recovery is common following a crypto crash, as investors try to gauge whether the worst is over or if further declines are on the horizon.

The crypto crash serves as a stark reminder of the volatile nature of cryptocurrency markets. While the potential for high returns attracts many investors, events like this crypto crash highlight the risks involved in digital currency investments.

Featured image credit: catalyststuff / freepik