Real World Asset (RWA) tokenization is currently one of the fastest-growing trends within and outside the crypto industry. As of writing, there are over 68,555 RWA token holders on the Ethereum blockchain alone, up from 33,225 a year ago. Moreover, projections by several financial firms show that the RWA space has the potential to grow into a tens of trillions dollar industry by 2030.

So, what exactly is RWA tokenization, and why is this Web3 trend gaining popularity?

Real World Assets (RWAs) explained

Real World Assets, as the name suggests, represent either tangible or intangible assets that exist in global markets. The former includes assets such as art, real estate, or commodities, while the latter encompasses financial instruments like fiat currencies, bonds, equities, or even carbon credits.

Tokenization is the process by which these off-chain assets are integrated with on-chain economies. A unique digital asset is generated or issued to represent traditional assets on the blockchain, allowing for them to be traded through RWA-oriented decentralized exchanges (DEXs) modules such as MANTRA Finance.

Initially, the only places investors could access traditional assets were through centralized market ecosystems, which often came with several hurdles, including ease of access, low liquidity, and lack of transparency, among other issues. RWAs have been designed to tackle some of these shortcomings, as we will highlight in the next sections of this article.

The Catalyst to digital asset adoption

As mentioned in the introduction, the number of RWA token holders has more than doubled within a span of one year. Several traditional financial institutions believe this trend will be the much-needed game-changer in driving crypto adoption. In a recent report, Bank of America termed RWAs as a potential “key driver of digital asset adoption”.

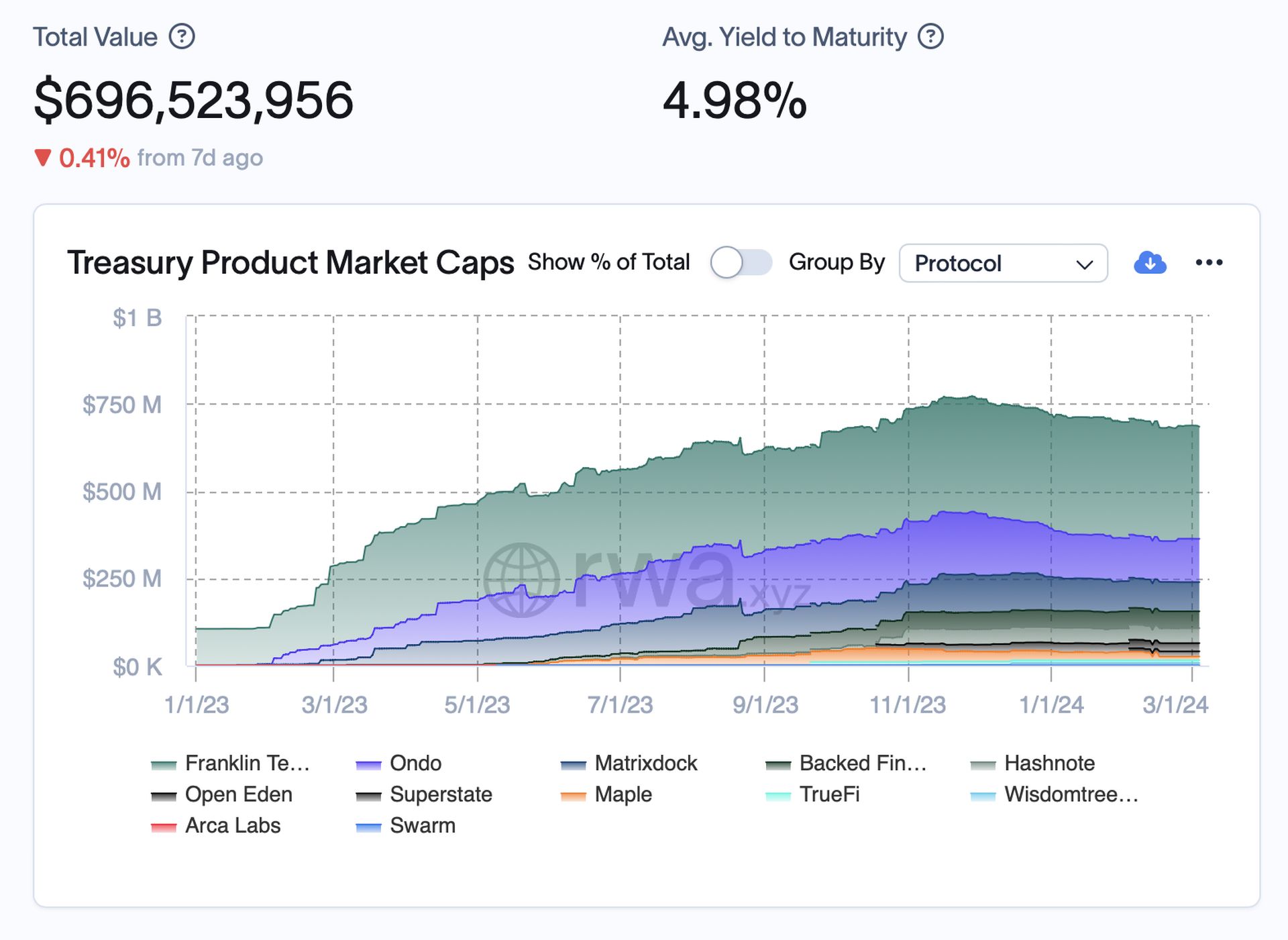

Going by the numbers, and more importantly, the value proposition of RWAs, this isn’t a far-fetched hypothesis. Already, there’s over $696 million worth of U.S. tokenized treasuries and slightly above $637 million tokenized private credit.

Of course, there are quite a couple of reasons why RWAs are picking up so fast. For starters, these digital assets are opening up traditional markets that previously locked out potential investors due to geographical limitations.

The U.S. treasuries market, for instance, is only limited to local investors, but with the emergence of RWAs, even foreign investors can now chase the lucrative yields by simply purchasing a digital asset that represents a specific treasury bill. Franklin Templeton is one of the heavyweight asset managers that have so far tokenized their U.S. government money market fund and currently enjoys a market capitalization of $321 million.

In addition to easing access, RWAs are bringing the core tenets of blockchain into the world of traditional assets. The fact that these assets are recorded and traded via blockchain platforms such as Ethereum, Polygon, or Stellar makes it easier to verify and track an asset’s change in ownership since it was first introduced on the blockchain.

For less liquid traditional assets like property and gold, RWAs could be the solution to creating more active markets. This is because they bring the aspect of fractionalization, allowing investors who would have otherwise passed on buying opportunities to purchase what they can afford (a fraction of the property or gold represented by a digital asset).

“Tokenized gold provides exposure to physical gold, 24/7 real-time settlement, no management fees and no storage or insurance costs. The low minimum investment increases accessibility and fractionalization enables the transfer of physical gold ownership and value that was not previously possible,” – wrote Bank of America analysts.

Bridging the gap between tradfi and digital assets

Although a relatively nascent ecosystem, there are several avenues through which retail and institutional investors can access existing RWA products. For instance, the Franklin Templeton Money Market RWA, currently supported on the Ethereum and Stellar blockchain ecosystems, is accessible through a mobile application dubbed ‘Benji’.

There are also upcoming Layer-1 blockchain ecosystems like the MANTRA Chain which are building regulatory-compliant RWA ecosystems that will support more unique traditional assets, including private equity funds, listed securities, fractionalized real estate assets, and securities backed by sovereign governments such as U.S. treasuries.

This project recently closed a $11 million funding round led by Shorooq Partners, alongside other prominent VCs, including GameFi Ventures, Forte Securities, and Three Point Capital.

“We’re crafting an infrastructure designed for builders, institutions, enterprises, and users keen on exploring RWAs. It’s a testament to our mission of making asset tokenization a cornerstone of financial inclusivity and market development.” said MANTRA’s CEO, John Patrick Mullin.

These RWA innovations are just a few of the examples that are already building avenues to tap into the $16 trillion potential market. Other native DeFi protocols such as Ondo Finance and Maple have also launched institutional grade RWA ecosystems, offering deposits for the U.S. dollar, Treasuries and Money Markets.

Conclusion

The rise of RWAs in the recent past might make it seem that they have only been around for a short time. However, the truth is that RWAs were already in existence and widely used in the form of stablecoins, a crypto subset that has long accounted for the majority of the funds in the market. Now that the trend is catching on with tradfi, there will likely be more activity, with around 72% of global financial institutions already planning to tap into the market as per a 2021 report by BNY Mellon.

Featured image credit: rawpixel.com / freepik