Canada’s Foreign Currency Exchange Services industry has witnessed a notable evolution over recent years. Despite challenges like the COVID-19 pandemic impacting international travel, the sector has shown resilience and adaptability, especially in its integration of technology.

In recent years, Foreign Exchange (Forex or FX) trading has seen a significant surge in popularity, particularly among individual laypersons. This is largely attributable to the expansion and technological advancement of online brokers and trading platforms. Forex trading, known for its high liquidity and continuous operation five days a week, offers substantial opportunities for traders.

Notably, the forex market is the world’s most traded market, with a staggering daily trading volume of US$7.5 trillion (approximately CAD$10.2 trillion as of April 2022). This immense volume underscores the forex market’s position as a major player in the global financial landscape, offering myriad opportunities for retail and institutional traders across Canada.

Trading options and platforms for Canadian traders

The options available to traders in Canada are diverse, catering to a range of needs and preferences. For instance, when a trader opens a position with brokers like Friedberg Direct, the primary cost is the spread – the difference between the buy and sell price, typically counted in pips.

This spread, multiplied by the position size, determines the cost to the trader. Importantly, Friedberg Direct offers its clients the flexibility to choose between fixed and floating spreads, with the former providing stability and the latter adjusting to market conditions. Additionally, they provide access to over 50 Forex pairs, encompassing major currencies, minors, and exotics.

The choice of forex trading platforms is another crucial aspect for Canadian traders. Platforms like WebTrader offer a no-download, user-friendly interface that appeals to many traders for its simplicity and intuitiveness. MetaTrader 4 and MetaTrader 5 are highly popular for those seeking more advanced options, providing a robust and flexible trading environment.

These platforms are suitable for beginners and advanced traders, featuring capabilities for automated trading through Expert Advisors and various order types. AvaOptions, for example, also allows traders to express their market views through calls and puts, with embedded tools designed to maximize returns. Moreover, Mac users aren’t left out, as they can access a Mac-optimized MetaTrader4 and the WebTrader platform.

Let’s focus on technical elements impacting forex trading in Canada and the wider global economy.

Industry growth and resilience

- Growth Amidst Adversity: The Canadian forex industry has experienced a steady increase in revenue, achieving a Compound Annual Growth Rate (CAGR) of 8.4% over five years up to 2023. Remarkably, this growth persisted despite the COVID-19 pandemic, highlighting the industry’s resilience.

- Recovery from Pandemic Effects: The initial decline in travel and economic activities due to the pandemic was met with a robust recovery fueled by pent-up travel demand and a gradual return to normalcy in global movements.

Market dynamics and consumer behavior

- Retail vs. online services: While online forex services have seen an uptick in popularity, retail, particularly in physical locations such as airports, remains a significant player in the market. This segment’s endurance illustrates the balance between traditional and digital preferences among consumers.

- Influence of population and tourism: Canadian exchange houses have strategically aligned their operations with population densities and tourism trends, especially around airports, to maximize accessibility and convenience for their customers.

Technological advancements in forex trading

- Digital transformation: The rise of online services has been a game-changer in the forex industry, extending the reach of services beyond traditional borders. This shift caters to a tech-savvy demographic and enhances operational efficiency and customer experience.

- Adoption of advanced tools: Integrating artificial intelligence, machine learning, and sophisticated trading platforms represents a significant leap in the industry, offering enhanced analytical capabilities and real-time decision-making tools for traders.

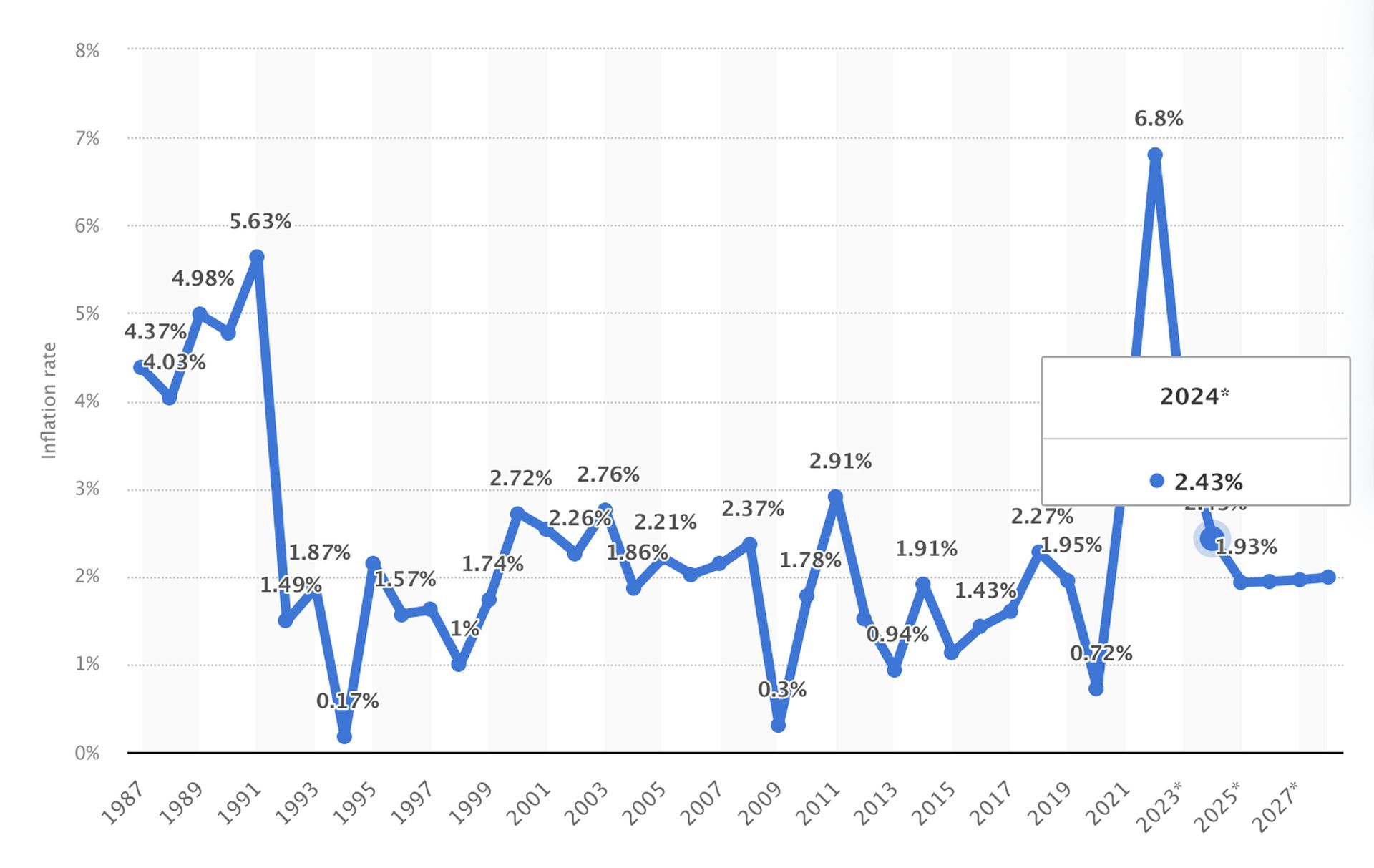

Inflation and economic trends in Canada

- Recent inflation trends: In 2022, Canada experienced an inflation rate of approximately 6.8%, influenced by various factors, including fluctuations in oil and gas prices and food and housing costs.

- Consumer price index insights: The consumer price index, particularly for food and non-alcoholic beverages, has steadily increased, offering insights into the changing economic landscape and consumer spending habits.

Global forex market and international trends

- Dominance of major currencies: The Euro and the U.S. Dollar continued to lead in global SWIFT payments in 2023. This dominance underscores the continued centrality of these currencies in international finance.

- Shifts in global forex dynamics: The concept of de-dollarization, especially in the context of trade sanctions and the formation of new economic blocs like BRICS, poses potential shifts in the global forex landscape. The discussion around creating a new joint currency among BRICS nations highlights these changing dynamics.

- Rise of Central Bank Digital Currencies (CBDC): The emergence and development of CBDCs, like the Inthanon-Lionrock project, point to a future where digital currencies could play a more prominent role in international settlements, challenging the traditional dominance of currencies like the U.S. Dollar.

The Canadian forex trading market is at a critical juncture, shaped by technological innovations and global economic trends. As the industry adapts to these evolving landscapes, it offers significant opportunities and challenges. The future trajectory of forex trading in Canada will be closely tied to its response to technological advancements, regulatory changes, and global market shifts, making it a sector of keen interest for investors, traders, and economic analysts.

Featured image credit: AI