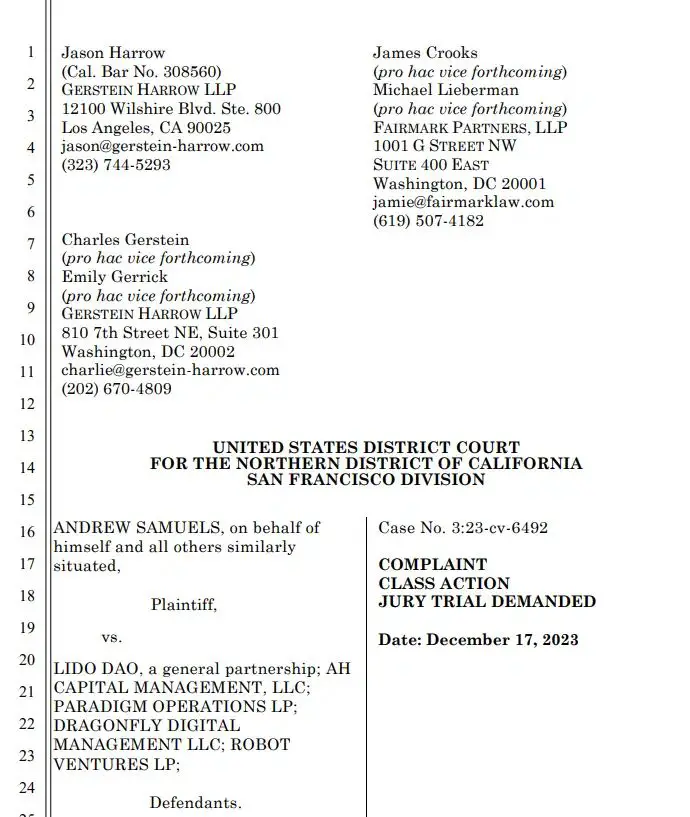

Andrew Samuels, a former investor and resident of Solano County, California, has escalated a legal dispute against Lido DAO, a prominent entity in the cryptocurrency domain, by filing a class action lawsuit in the District Court of San Francisco. The crux of the lawsuit revolves around allegations of mismanagement and unfair distribution of Lido tokens. Samuels contends that the Lido token, serving as the operational fulcrum of the decentralized autonomous organization (DAO), effectively functions as an unregistered security. This classification, if validated, could have profound implications for Lido DAO and its operational legitimacy.

Concentration of power: A core issue in governance

A significant aspect of the lawsuit is the claim that about 64% of Lido tokens are controlled by a small group of founding members and early investors. This group includes notable venture capital firms like Paradigm, AH Capital Management, Dragonfly Digital Management, and Robert Ventures. The plaintiff argues that this concentration of token ownership effectively marginalizes the role and influence of regular investors in the governance and decision-making processes within the Lido ecosystem, raising questions about the equitable distribution of power and control within decentralized finance (DeFi) platforms.

Lido DAO’s shift in strategy and public token sale

Lido DAO’s shift in strategy and public token sale

Delving into the origins of Lido DAO, the lawsuit paints a picture of an organization that initially emerged as a general partnership comprised of institutional investors. Over time, a strategic shift led to the public sale of Lido tokens, facilitated by their listing on centralized cryptocurrency exchanges. This move attracted a diverse pool of investors, including the plaintiff, but subsequently resulted in a downturn in the token’s market value, leading to substantial financial losses for these investors. The lawsuit alleges that the decline in token value and the alleged mismanagement of the tokens by Lido DAO and the involved venture capital firms make them liable for these losses.

Further complicating matters, the lawsuit suggests that Lido tokens might qualify as securities because they are managed by a central group and were purchased by investors with the expectation of profit, primarily influenced by the actions and decisions of this central group. This classification, if upheld, could subject Lido DAO to stringent regulatory scrutiny and potential legal consequences under securities law, a development that could significantly impact the broader DeFi landscape.

Lido DAO, as one of the leading liquidity staking protocols with a total value locked (TVL) recently hitting an all-time high of $22 billion, faces a formidable legal challenge. This lawsuit, if proven, could reshape the regulatory and operational framework within which such decentralized entities operate. As of now, Lido DAO has not released any official statement regarding this issue.