Former SEC official John Reed Stark comments on the U.S. government’s robust oversight over Binance following its recent plea agreement. Discover the comprehensive and unprecedented monitoring measures imposed on the world’s largest crypto exchange.

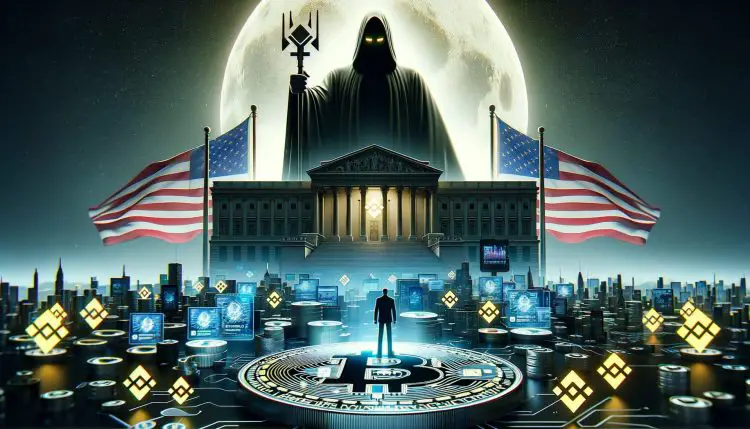

Binance, the world’s largest cryptocurrency exchange, has entered into a plea agreement with the U.S. government, leading to an unprecedented level of oversight by various U.S. regulatory bodies. This development comes after Binance agreed to pay over $4 billion in fines for violations of U.S. laws, including money laundering, sanctions breaches, and operating an unregistered money-transmitting business.

The scope of the government’s oversight

DOJ’s extensive monitorship

The U.S. Department of Justice (DOJ) has unveiled a detailed and wide-ranging monitorship over Binance’s operations. This was highlighted in filings made by the DOJ, which John Reed Stark, former chief of the SEC’s Office of Internet Enforcement, referred to as so comprehensive that it required a 13-page document outlining Binance’s obligations. The monitorship includes access to the company’s documents, resources, and even personnel, as deemed necessary by the appointed monitor.

Additional regulatory surveillance

In addition to the DOJ’s direct oversight, Binance’s plea deal involves five years of oversight by the Financial Crimes Enforcement Network (FinCEN). Furthermore, various sections of the DOJ’s criminal division, including those for money laundering, asset recovery, national security, counterintelligence, and export control, will also closely monitor the exchange’s activities.

Unprecedented measures

Stark emphasized the unprecedented nature of this level of supervision of a global financial firm. He pointed out that the DOJ and FinCEN’s supervision is a first-of-its-kind for such a company, indicating a new era of regulatory stringency in the crypto industry.

Binance’s compliance and admissions

Amidst these stringent measures, Binance and its former CEO, Changpeng “CZ” Zhao, have admitted to violating U.S. anti-money laundering and terror financing laws. This admission is part of their agreement to pay $4.3 billion in fines, marking a significant chapter in regulatory actions against crypto exchanges.