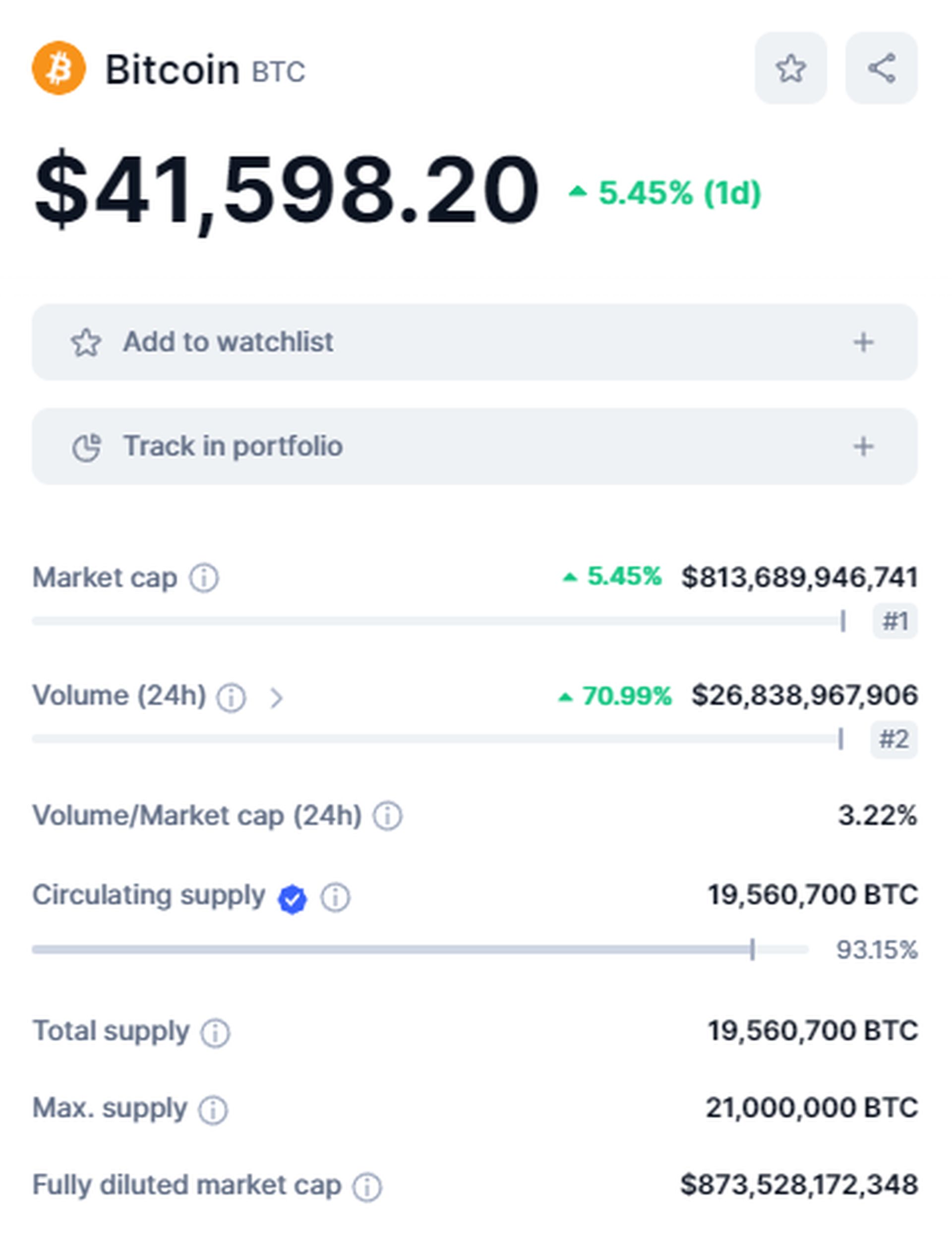

Bitcoin unexpectedly broke through the $40,000 barrier, breaking through the limits for the first time since April 2022. The surge came amid growing anticipation around the potential approval of a Bitcoin spot exchange-traded fund (ETF) in the United States. Ethereum also benefited, trading above $2,200 for the first time since May 2022. Here are all the details…

The rise of Bitcoin and Ethereum

The rise of Bitcoin and Ethereum has a ripple effect on the cryptocurrency market, with many popular NFT projects posting significant gains over the past 24 hours. According to the NFT Price Floor, the cheapest assets listed on projects such as Pudgy Penguins, DeGods, and Azuki have experienced double-digit percentage increases.

This sudden resurgence of interest in cryptocurrencies has led many to wonder if we are entering a new era for digital assets. With the SEC in talks with companies applying for Bitcoin spot ETFs, institutional investors may soon have greater access to the cryptocurrency market. These ETFs could pave the way for mainstream adoption and increased stability in the space.

However, it is worth noting that the journey to this point is far from smooth. Bitcoin’s price fell in the months following its previous high in April 2022, leading some to question the longevity of the cryptocurrency market. Yet, with the current price surge and growing excitement around ETFs, the tide may again favor cryptocurrencies.

As always, time will tell what the future holds for Bitcoin, Ethereum, and the rest of the cryptocurrency world. But for now, investors can rejoice in the prospect of a potential new era for digital assets.

Did you know that the President of Argentina, Javier Milei, boosted Bitcoin by 3 percent? For detailed information, you can visit our related article.

Featured image credit: André François McKenzie / Unsplash