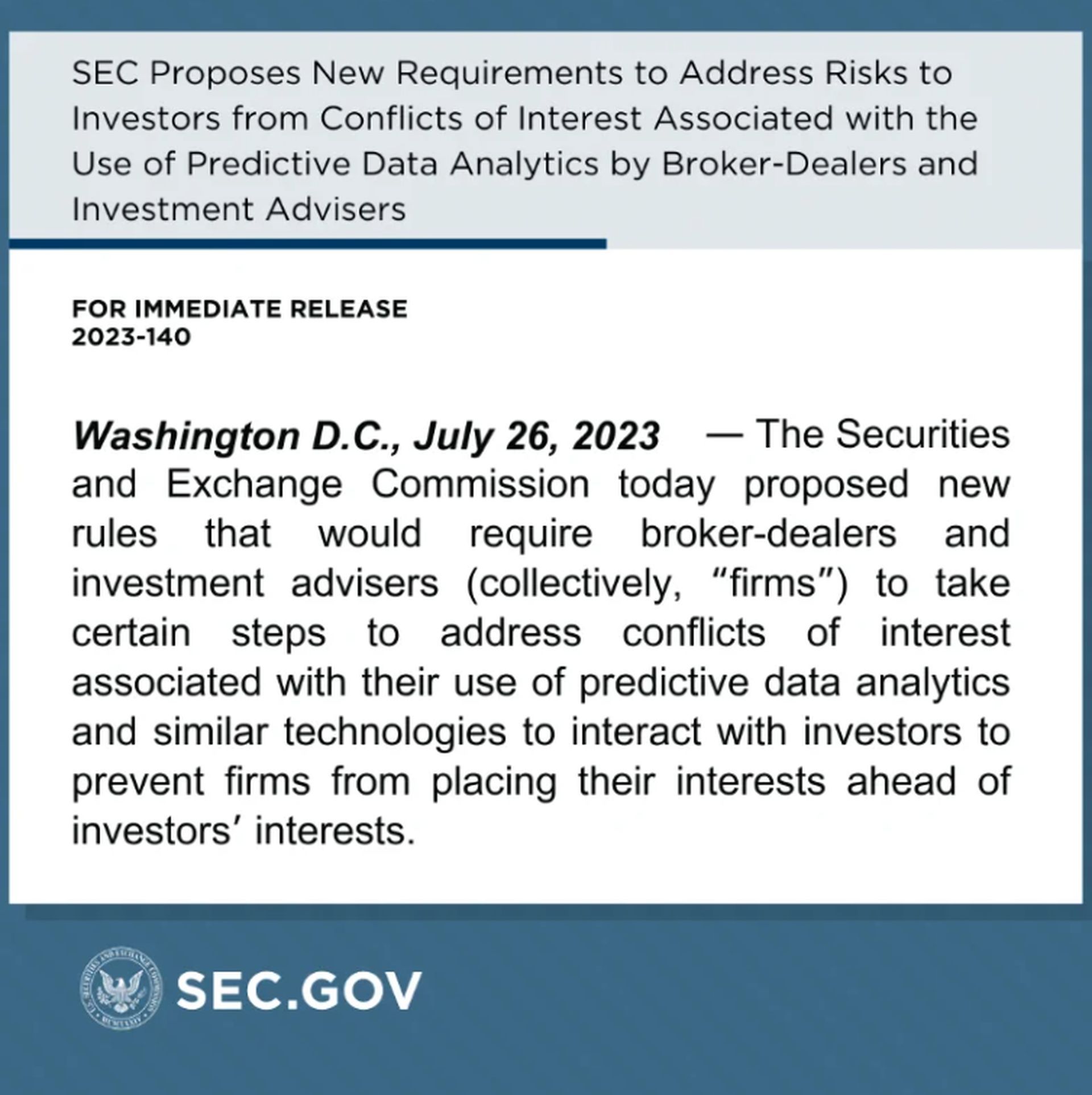

In a significant step towards ensuring fair and transparent practices in the financial industry, the U.S. Securities and Exchange Commission (SEC) recently took into consideration a proposal that introduces a new set of rules governing the utilization of artificial intelligence (AI) and predictive data analytics. Aimed at addressing potential conflicts of interest, the proposal emphasizes the need for companies to prioritize investor interests while deploying AI technologies.

If approved, the proposal will compel companies to disclose the conditions of the investment and the use of AI that was employed during the process, while also having to disclose how they prioritized the interest of investors over their commissions.

This move comes as the latest development for a series of initiatives that are taking place to ensure the ethical and safe use of AI in various fields. Only yesterday, OpenAI, Google, Microsoft, and Anthropic joined forces to regulate ‘frontier AI’s, and Stability AI made a bold move towards ethical AI development with its FreeWilly.

If passed, the new rules will protect investors from broker-dealer companies

The SEC’s proposal, adopted on July 26, comes as a response to the growing use of AI and predictive technologies in financial services. While acknowledging that these advanced tools can be optimized to benefit investors, the SEC remains cautious of potential harm caused when companies prioritize their own interests over those of their clients. The primary goal is to promote transparency, accountability, and fairness in the industry.

Key requirements for companies

Under the proposed regulations, financial firms, including broker-dealers and investment advisers registered under section 203 of the Investment Advisers Act of 1940, must adhere to a set of stringent requirements. These measures aim to identify, eliminate, or neutralize any conflicts of interest arising from the use of AI and predictive analytics. By implementing written policies and procedures for compliance and record-keeping, companies are expected to demonstrate their commitment to safeguarding investor interests.

Cryptocurrency exchanges are under scrutiny

While the SEC has not explicitly stated whether the proposed AI regulations would apply to cryptocurrency exchanges, there are indications that they may fall under the purview of the rules. Past statements from the SEC have asserted that alternative trading systems dealing in digital assets are subject to regulatory requirements, including broker-dealer registration. As a result, cryptocurrency exchanges that operate as broker-dealers could potentially be affected by the new rules.

The prospect of the proposal

Although the majority of the SEC’s voting members favored the proposed AI regulations, two commissioners, Hester Peirce and Mark Uyeda, expressed their opposition. Commissioner Peirce, a prominent advocate for embracing new financial technologies, expressed concerns about the proposal’s hostility towards technology and disclosure. She argued that existing regulatory measures were sufficient and cautioned against potential overbroad applications of the new rules. Despite the dissenting opinions, the SEC moved forward with the proposal, signaling its commitment to enhancing investor protection and market integrity.

Future implications

As of now, the AI regulations remain in the proposal stage and are yet to be formally implemented. Before becoming effective, the SEC will likely review feedback from stakeholders and may make further adjustments to the rules. Financial companies, including those involved in cryptocurrency trading, should closely monitor the developments and prepare for potential compliance requirements in the future.

The SEC’s decision to regulate the use of AI in financial markets marks a significant milestone in ensuring fair and ethical practices within the industry. By focusing on mitigating conflicts of interest and prioritizing investor welfare, the proposed regulations seek to strike a delicate balance between technological innovation and regulatory oversight. As the financial landscape continues to evolve, it is crucial for market participants, including crypto exchanges, to keep an eye on the potential changes in compliance requirements to navigate the dynamic regulatory environment successfully.

Featured Image: Credit