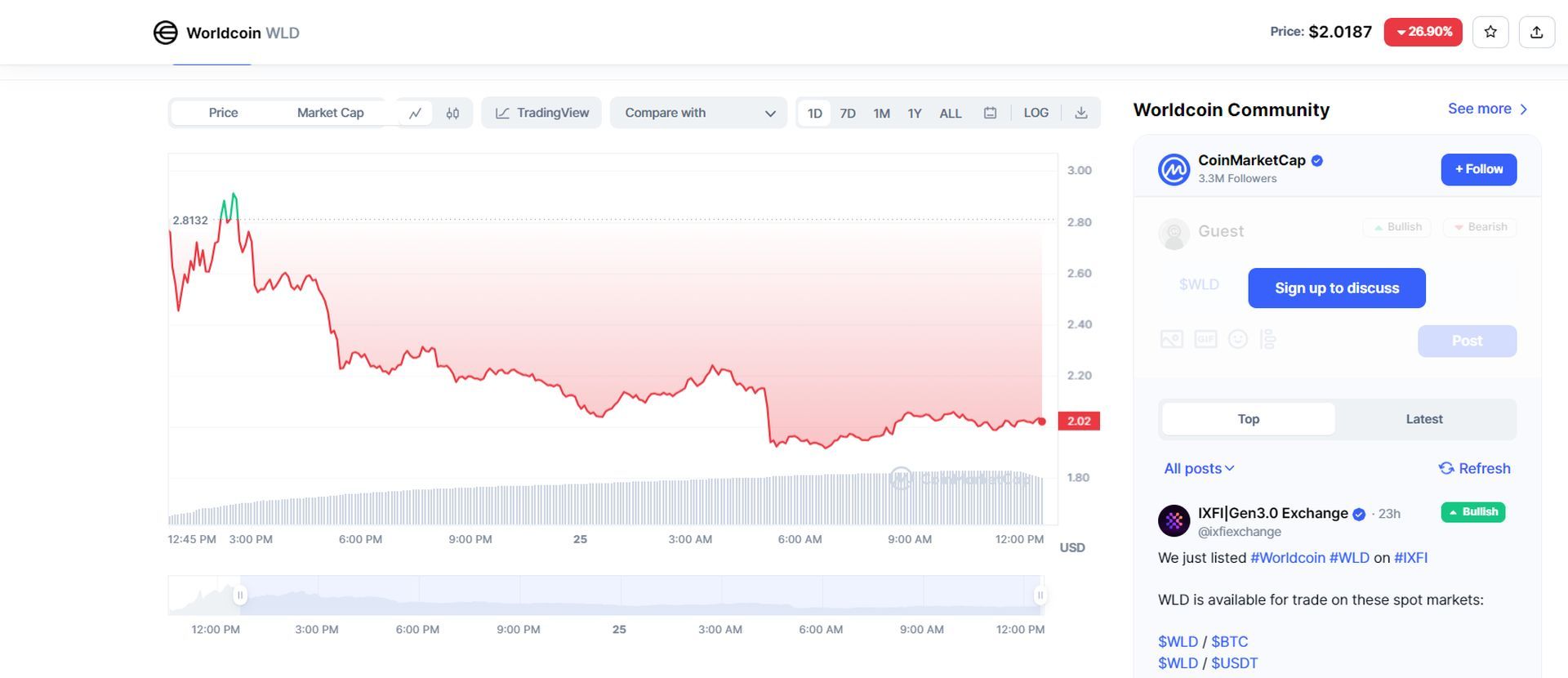

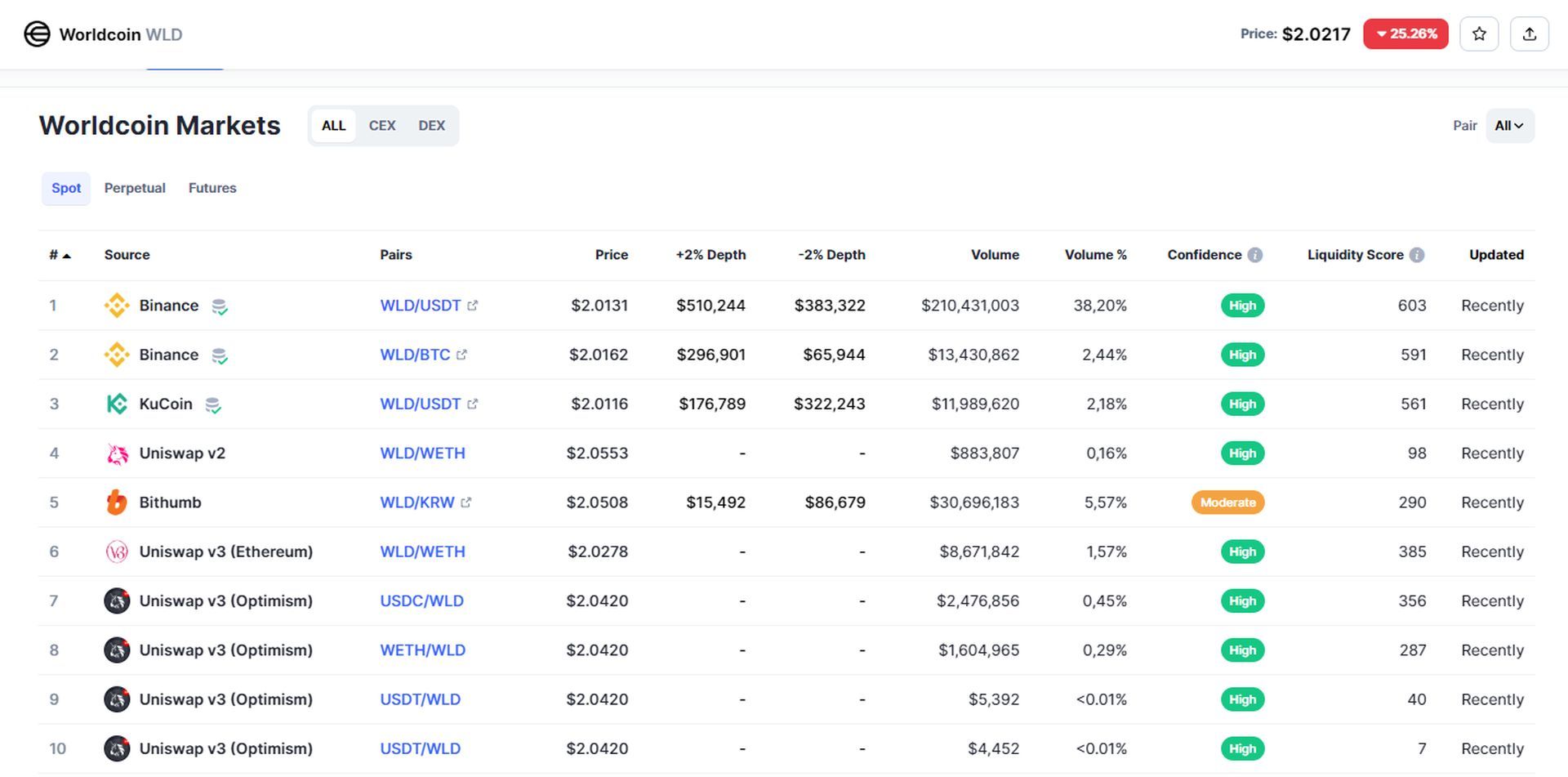

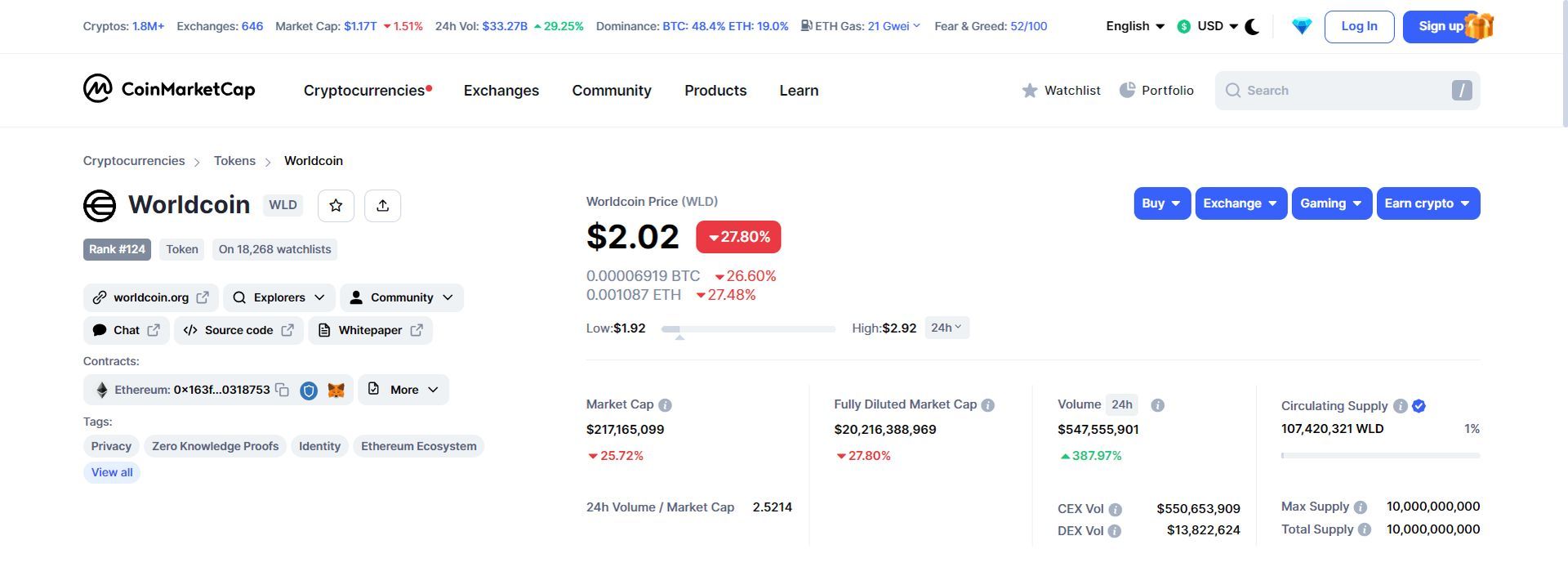

The worldwide community’s attention has recently been drawn to Worldcoin (WLD coin), an innovative combination of digital identification and cryptocurrency that has garnered a lot of interest. Many people are interested in learning more about its possibilities for the future because its current price is $2.01, which is a noteworthy 17.88% growth over the past 24 hours

The following is an in-depth study that forecasts the path that WLD Coin will take. Let’s have a look at the forecast for the WLD price, shall we?

Caution: This write-up on coins is fueled by curiosity, not financial advice. Stay adventurous, but always consult a financial expert before making any coin-inspired leaps!

WLD Coin: Price Prediction

Understanding the present is crucial before making future predictions. The current trend for WLD Coin has been favorable. A notable 24-hour gain of 17.88% has indicated a bright future for its investors. Due to its distinctive strategy of granting everyone access to the global economy, it has aroused the interest of investors all over the world.

As its name indicates, WLD Coin is not your normal cryptocurrency. their special system for identifying and distributing tokens can significantly affect their pricing. A higher adoption rate will probably lead to greater demand, which will raise the cost. Given that the token is distributed freely, a big rise in supply may also have an effect on the price.

We may make an attempt to anticipate the future price of WLD Coin based on a number of variables like adoption rate, global cryptocurrency market trends, and technical advancements, even though cryptocurrency values can be difficult to predict owing to their inherent volatility.

The price may theoretically reach about $28.6 if the present daily growth rate of 17.88% is maintained for a month (assuming no market corrections). However, without regular adjustments, such exponential growth rates are rarely long-term viable.

Given the lack of specific information on the mood of each individual crypto asset, determining the market sentiment for Worldcoin (WLD Coin) in comparison to other cryptocurrencies can be challenging. Nevertheless, a careful review of the evidence at hand offers us a number of insights.

Analyzing WLD Coin growth: Optimism vs. sustainability

A change from “neutral” to “greed” has been observed in the popular attitude toward cryptocurrencies, especially WLD Coin. This shift reflects an overall favorable attitude toward cryptocurrency. Positive long-term projections are made for WLD Coin. According to predictive models, Worldcoin’s price levels may increase in the future, signaling confidence and optimistic anticipation for Worldcoin’s long-term performance.

The volatility of bitcoin values makes precise forecasting difficult. Nevertheless, based on its current performance, we may make a reasonable estimation.

Given that the price of Worldcoin (WLD Coin) has increased by 17.88% in the past day and is at $2.01, if this trend keeps up over the course of the next month, the price might rise considerably.

However, long-term sustainability is frequently not possible with such exponential development. Therefore, let’s have a look at a more cautious estimate: supposing that the price increases by 5% per day (which is far slower than the current 17.88% but still amounts to significant growth).

An easy computation for this situation is given below:

- Day 1: $1.99 * 1.05 = $2.0895

- Using a daily increment of 5% for 30 days:

- Day 30: $2.0895 * (1.0529) = about $12.08

Please be aware that this is only a very approximate estimate because it presupposes daily growth that is highly improbable given the volatility of cryptocurrency markets.

This estimate also disregards other uncontrollable factors that might affect pricing, like regulatory announcements, shifts in technology or adoption rates, shifts in general market attitude, and others.

Before considering an investment, it is always advisable to do your own research and speak with a financial counselor.

WLC Coin: Factors affecting prices

Since there are several variables that may affect the price of a cryptocurrency, let’s talk about those that could impact the price of WLC Coin:

- Adoption: If WLD Coinis widely used and continues to have high usefulness, demand may rise and the price may go up.

- Regulation: The price of WLD Coin may be impacted by regulatory news and judgments pertaining to cryptocurrencies. A price increase might result from more benevolent rules, and a price decrease could result from restrictive regulations.

- Market movements: The price of WLD Coinwill also be influenced by general market sentiment and cryptocurrency industry movements.

- Technology Development: The WLD Coin ecosystem’s ongoing development and enhancement might increase demand and confidence, which would raise prices.

Which technical indicators can predict WLD Coin’s price?

In order to predict price changes in cryptocurrency trading, technical indicators are essential tools. Here is a closer look at the technical indicators that are most frequently used to forecast the price of WLD Coin:

- Relative Strength Index (RSI): The RSI oscillates between 0 and 100 and serves as a momentum indicator. It can be used as a technique to identify overbought or oversold markets. When the RSI rises above 70 and drops below 30, it is overbought and oversold, respectively.

- Stochastic Oscillator: This momentum indicator evaluates an asset’s price range over a specified interval and compares it to its closing price. It aids in identifying overbought and oversold levels, much as the RSI. Overbought conditions are indicated by the oscillator exceeding 80, while oversold conditions are shown by the oscillator falling below 20.

- Moving Average Convergence Divergence (MACD): The MACD is a trend-following momentum indicator that depicts the relationship between two moving averages of the price of an asset. It is useful for spotting changes in momentum and trends.

- Bollinger Bands: Bollinger Bands help identify probable entry and exit points by measuring market volatility. These three bands—upper, middle, and lower—are used by traders to study price movement and comprehend market behavior. When the price repeatedly touches the top band, there is a strong rise. Additionally, it demonstrates the strength of the uptrend if the price reverses but stays above the middle band before reversing to the upper band.

- The On-Balance-Volume (OBV) indicator, a technical trading tool, forecasts price changes based on volume flow. It is employed to evaluate the pressure on a certain coin to buy and sell. Because it adds volume on days when the price is going up and subtracts volume on days when the price is going down, the OBV is often referred to as the cumulative indicator.

Please keep in mind that price projections might change quickly and that these indications only reflect a small percentage of the tools available. Therefore, thorough study and thoughtful investment choices are always advised.

Do you know the Pepe coin? Check our article before you leave.

Featured image credit: Worldcoin.