In a groundbreaking decision that has sent shockwaves through the cryptocurrency industry, Ripple wins lawsuit against SEC by the ruling of U.S. District Judge Analisa Torres, affirming that the company did not violate federal securities law by selling its XRP token on public exchanges. The judgment represents a significant win for Ripple and has caused a surge in the value of XRP.

If you are not familiar with the backstory of how the SEC and other authorities in the U.S. rose up against several cryptocurrencies, check out how KuCoin was sued and Binance was frozen.

XRP is not a security.

This victory for @Ripple is a win for the entire industry and a step toward regulatory clarity in the U.S.

A huge thank you to @bgarlinghouse, @chrislarsensf, and @s_alderoty for their leadership and the #XRPCommunity for their continued support.

— Ripple (@Ripple) July 13, 2023

XRP soars as Ripple wins lawsuit against SEC

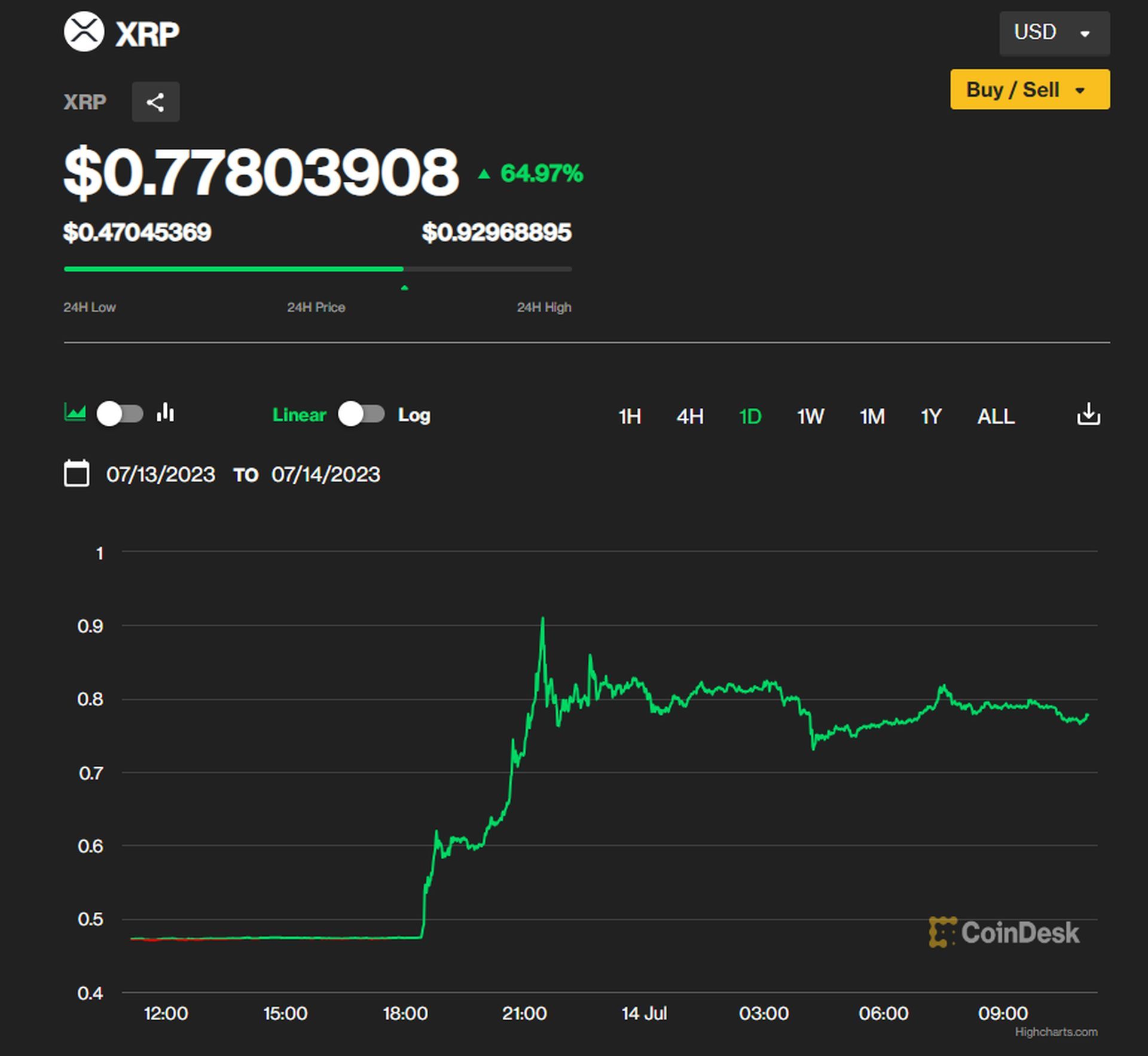

The impact of the ruling was immediate, as XRP experienced an impressive 75% increase in value following the announcement. The decision marks a pivotal moment for the cryptocurrency industry, as it is the first time a cryptocurrency firm has emerged victorious in a case brought by the U.S. Securities and Exchange Commission (SEC). However, it is worth noting that the SEC did achieve a partial victory as well.

While the ruling is specific to the circumstances of this particular case, it is expected to have far-reaching implications for the broader cryptocurrency landscape. The decision provides valuable ammunition for other crypto firms currently locked in legal battles with the SEC, strengthening their arguments against the regulator’s jurisdiction over their products.

SEC acknowledges partial victory on their part

Despite the fact that Ripple wins lawsuit against SEC, an SEC spokesperson expressed satisfaction with a portion of the ruling that held Ripple accountable for violating federal securities law by selling XRP directly to sophisticated investors. The regulator is carefully reviewing the judge’s decision and considering the appropriate course of action. It is important to note that the ruling may be subject to appeal once a final judgment is issued, or with the judge’s permission.

“A major win for the industry”

Ripple’s CEO, Brad Garlinghouse, described the ruling as a monumental victory not only for Ripple but also for the entire cryptocurrency industry in the United States. Garlinghouse emphasized the broader implications of the decision, asserting that it would significantly shape the future of digital assets within the country.

Coinbase to resume XRP Trading

In response to the positive outcome of Ripple wins lawsuit against SEC, Coinbase, the largest cryptocurrency exchange in the United States, announced its decision to reinstate trading of XRP on its platform. Coinbase’s Chief Legal Officer, Paul Grewal, took to Twitter to share the news, stating, “We’ve read Judge Torres’ thoughtful decision. We’ve carefully reviewed our analysis. It’s time to relist.” The market responded enthusiastically to the announcement, with Coinbase’s stock witnessing a remarkable 24% increase, closing at $107 per share on Thursday.

W.

W for @ripple.

W for the industry.

W for the builders.

W for a clear rulebook.

W for updating the system.Oh, and XRP is now open for trading.

— Coinbase 🛡️ (@coinbase) July 13, 2023

Only last month, SEC also sued Coinbase, with which Coinbase is going to struggle for a while.

Unregistered securities offering

The case against Ripple revolved around allegations made by the SEC, claiming that the company, along with its current and former executives, conducted an unregistered securities offering, amounting to $1.3 billion, through the sale of XRP. Ripple’s founders created XRP in 2012, and the case has been closely followed within the cryptocurrency industry, challenging the SEC’s assertion that most crypto tokens should be treated as securities, subject to strict investor protection regulations.

XRP sales and the securities question

Judge Torres ruled that Ripple wins lawsuit against SEC because the sale of Ripple’s XRP on public cryptocurrency exchanges did not qualify as securities offerings under the law. The judge argued that purchasers did not have a reasonable expectation of profit directly tied to Ripple’s efforts. She described these sales as “blind bid/ask transactions,” in which buyers were unaware of whether their payments went to Ripple or any other seller of XRP.

Partial victory for the SEC

While the court ruling ensured Ripple wins lawsuit against SEC on the classification of XRP sales, Judge Torres determined that Ripple’s sales of XRP, amounting to $728.9 million, to hedge funds and other sophisticated buyers did constitute unregistered sales of securities. The judge concluded that Ripple’s marketing efforts targeted institutional investors, emphasizing a speculative value proposition for XRP that heavily relied on the company’s efforts to develop the blockchain infrastructure supporting the digital asset.

The legal battles faced by Ripple and Coinbase highlight the need for comprehensive legislative guidelines that establish clear rules for the classification and regulation of digital assets in the United States. The cryptocurrency industry has long called for congressional action to provide greater clarity and regulatory certainty. The recent court ruling has reignited these calls, urging Congress to address the legal status of digital assets and foster a more favorable environment for innovation and growth.

Featured Image: Credit