Apple recently launched the Apple Card Savings account, a high-yield savings account that has quickly become popular among iPhone users. According to Forbes, the account received nearly $1 billion in contributions within the first four days of its launch.

Although Apple and Goldman Sachs, the partner responsible for the initiative, have not confirmed this deposit figure, the account’s early performance has been discussed with two individuals familiar with it.

Apple Savings Account loved

Apple Savings Account loved

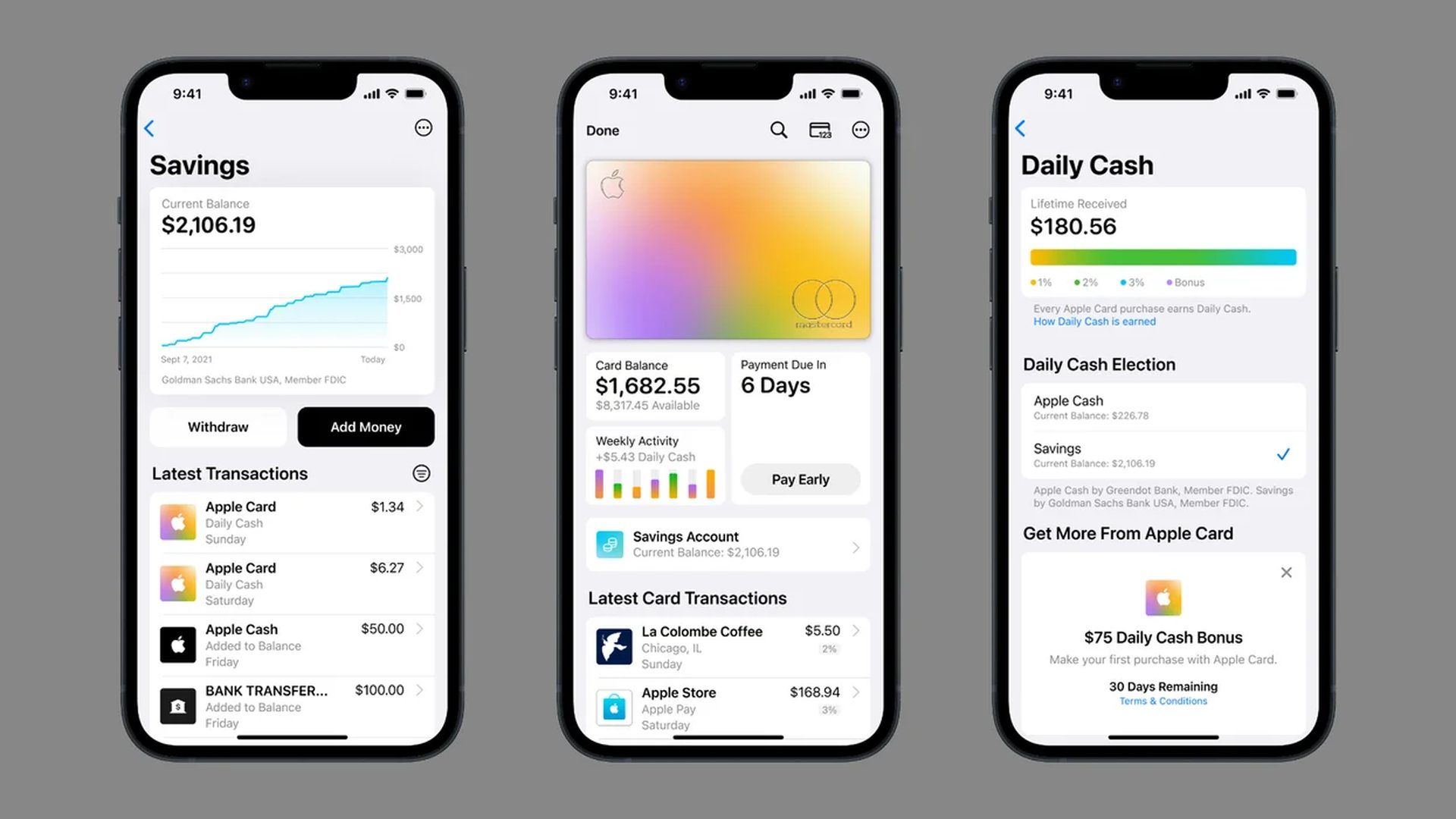

Only Apple Cardholders can open an Apple Savings account, where Apple Cash rewards can be deposited, and users can transfer funds from a linked checking account to accrue interest. The account has a low minimum deposit and a competitive annual percentage rate (APR), making it an attractive option for users. With no fees or minimum deposit required, the account is easy to set up and operate similarly to other savings accounts. However, it should be noted that the account is subject to the $250,000 FDIC insurance cap.

Compared to other high-yield savings account providers, Apple Savings stands out with its user-friendly interface and competitive APR. Most traditional banks and credit unions cannot match Apple’s APR on savings accounts, making it a viable digital option for customers. Citi Bank’s rate is 3.85%, while Discover offers 3.75%. APRs from American Express, Capital One, and Barclays range from 3.75% to 4%.

The Apple Savings account is administered using the Wallet app, where profits are clearly displayed, just like with the Apple Card. The account’s convenience, competitive APR, and user-friendly interface make it a tempting option for Apple Cardholders looking to maximize their savings.

What about the future?

As technology continues to advance, we can expect to see a growing trend toward digital banking and savings options. Given the early success of the Apple Card Savings account, we can anticipate that other tech giants may follow suit and enter the digital savings account space. As the competition heats up, we may see even more attractive offers and incentives from these companies, including higher interest rates and more user-friendly interfaces. Additionally, we can expect traditional banks and credit unions also to begin offering more digital savings options to keep up with the changing demands of customers.

Ultimately, this trend toward digital savings accounts will provide consumers with more options and flexibility in managing their finances, and we may see a significant shift away from traditional brick-and-mortar banking in the coming years.