The third month of 2023 saw Bitcoin (BTC) outperform nearly all of the 500 top publicly traded firms in the United States as the cryptocurrency market fought through the financial catastrophe that has already destroyed several significant banking institutions.

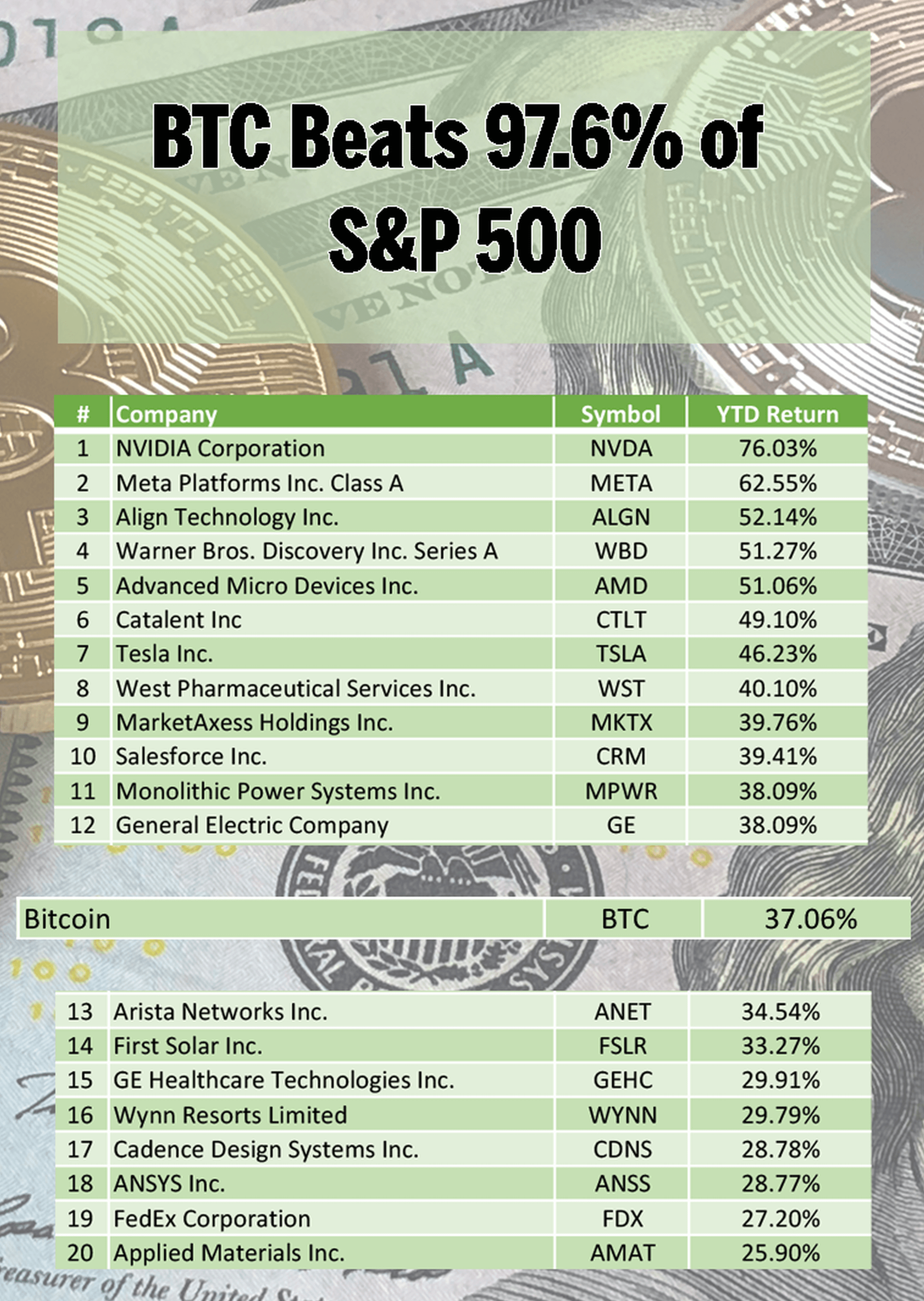

Indeed, the price of Bitcoin has increased by 37.06% since March 10 and by more than 72% since the year’s beginning. The leading cryptocurrency also recorded better year-to-date (YTD) returns than 488 or 97.6% of S&P 500 companies, including FedEx (NYSE: FDX), Apple (NASDAQ: AAPL), and Amazon (NASDAQ: AMZN).

Given the closure of Silvergate Capital and Signature Bank, two of the largest lenders to the cryptocurrency industry, the recent growth has come as somewhat of a surprise. The pillar of the technology startup sector, Silicon Valley Bank, also failed.

Many connect Bitcoin’s recent rise to the possibility that people are becoming more and more concerned about keeping their money in the banking system in the wake of the recent collapse of Silicon Valley Bank. Many of these people will be searching for alternative strategies to recover control over their finances, feel empowered again, and keep their money secure.

Bitcoin is the 13th company among 500 in YTD returns

As seen in the table below, Bitcoin has surpassed FedEx’s YTD returns of 27.2%, Apple’s YTD returns of 19.3%, and Amazon’s YTD returns of 17.8%. In contrast, only 12 firms in the S&P 500 have been able to surpass the barrier of 35% in YTD returns.

With Bitcoin just exceeding $27,000 (£22,000), the cryptocurrency market is heating up, and it won’t be long before crypto is once again the talk of the town. From $20,376.32 to $27,929.17 since March 10th, the price of bitcoin has increased by 37.06%.

It is also important to note that the flagship cryptocurrency has outpaced commodities in 2023, especially gold, “the top-performing old-guard commodity,” approximately 10-fold, suggesting it may be in a “super cycle,” according to Michael McGlone, a commodity specialist for Bloomberg.

Although more than 70% of its holders are currently in the black and the majority of them have held on to the first decentralized finance (DeFi) asset for a year or longer, Bitcoin is also putting down accomplishments in other areas.

However, despite the fact that the price of Bitcoin is today far lower than its all-time high, investors who began dollar-cost averaging (DCA) Bitcoin at its peak price of $69,000 in November 2021 are currently seeing 10% returns on their regular investment (ATH).

The greatest digital asset by market capitalization gained almost $200 billion to its market cap in 2023, another achievement in comparison to traditional finance, while the combined $100 billion was drained from five of the biggest U.S. institutions as the banking industry continued to suffer losses.

In order to maximize their chances of long-term success and the security of their finances, however, both novice and experienced investors alike must make wise investments before entering or returning to the cryptocurrency market. Therefore, if you would like to take some action with Bitcoin, it is still the time of caution as the near future doesn’t really offer a clear picture: Crypto users are alarmed as Binance suspends withdrawals and spot trading

Meanwhile, there were no surprises in the keenly anticipated Federal Reserve System (Fed) announcement. By raising rates by 0.25 percentage points, the FED effectively achieved what was largely anticipated. Bitcoin initially responded by falling, to somewhere about 26,700 USD per coin, before bouncing back again.