Bullish Bitcoin Signal shows that you have to watch out for sudden price changes in Bitcoin. Its transaction volume is at an all-time high.

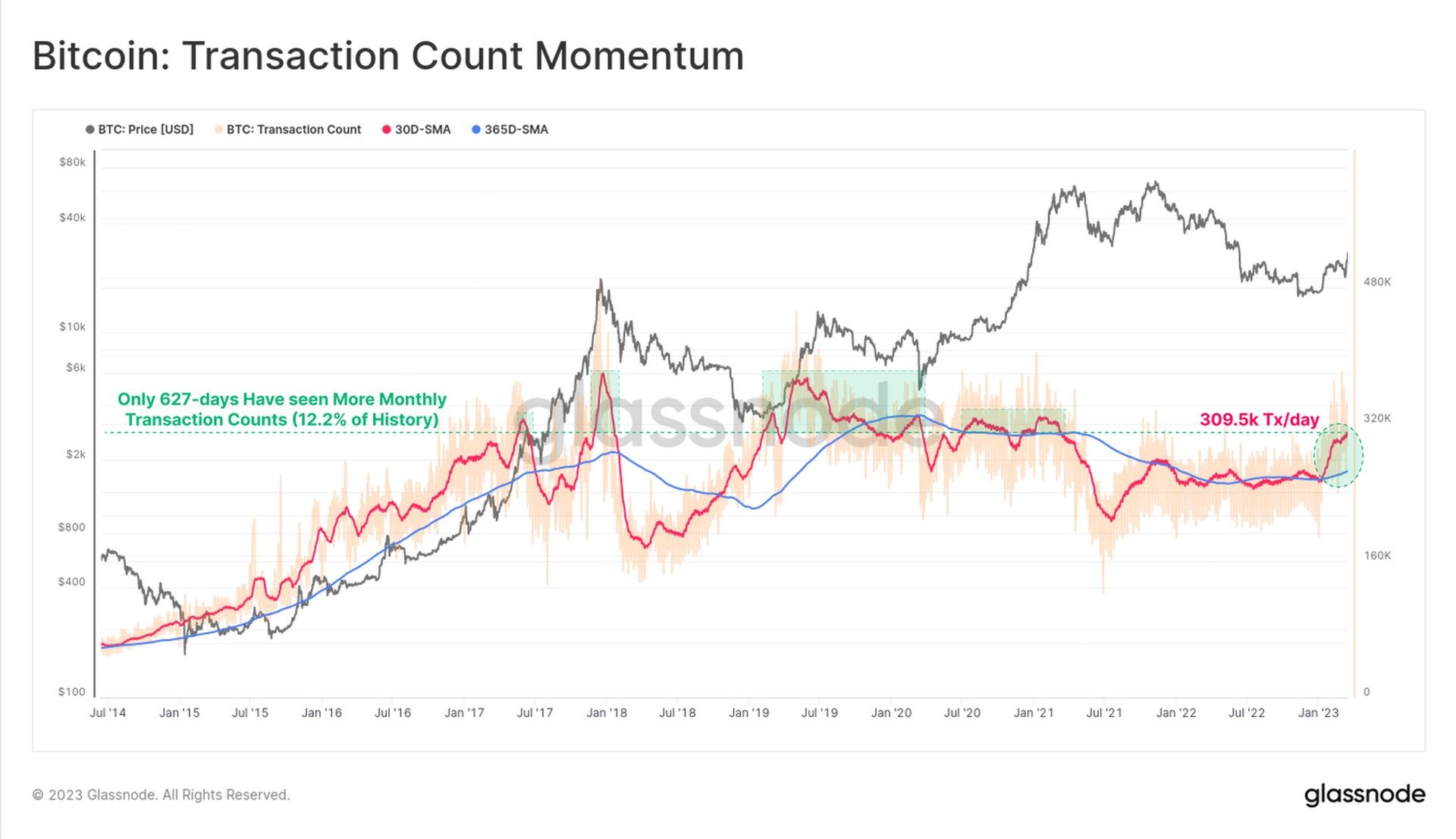

Bitcoin’s transaction count is currently at its highest level since April 2021, signaling a potential bullish trend for the cryptocurrency. According to Glassnode’s latest weekly report, the average daily transaction count on the Bitcoin blockchain has surged to 309,500, significantly above the average for the year.

The transaction count is an important indicator of the level of activity on the Bitcoin network. When the value of this metric is high, it suggests that many transactions are taking place, which is typically a sign of active traders in the market. On the other hand, low values indicate a lack of activity and could suggest a lower level of interest in the cryptocurrency among investors.

The recent surge in transaction count indicates that cryptocurrency adoption has surged, with both old and new users joining the network. This sustained high level of activity could provide a strong foundation for bullish momentum in the long term, as new users transacting on the chain help keep the Bitcoin economy churning. This might be the Bitcoin Signal you are waiting for.

Interestingly, the recent levels of the transaction count are higher than what was observed during the bull run in the second half of 2021. In fact, there have only been 627 days in Bitcoin’s entire history (equal to 12.2% of its lifetime) with a higher 30-day average daily transaction count.

The chart below shows the monthly average values of the transaction count during the leadups to the 2017 bull run, the April 2019 rally, and the 2021 bull run. In each case, the high transaction counts in the leadup signaled a surge in interest and activity on the Bitcoin network.

BTC price and the Bitcoin Signal

In addition to the surge in transaction count, Bitcoin’s price has also been on the rise. At the time of writing, Bitcoin is trading around $27,800, up 14% in the last week.

The combination of rising transaction count and price is a strong Bitcoin Signal that the cryptocurrency may be entering a bullish phase. However, it’s worth noting that Bitcoin’s price is notoriously volatile and subject to sudden fluctuations.

Despite the volatility, the recent surge in transaction count suggests that there is a strong level of interest in Bitcoin among investors. The sustained high level of activity on the network could help support a long-term bullish trend, particularly if new users continue to join and transact on the chain.

In conclusion, the recent surge in transaction count on the Bitcoin network is a Bitcoin Signal that could indicate a potential bullish trend for the cryptocurrency. While the price of Bitcoin is notoriously volatile, the sustained high level of activity on the network could provide a strong foundation for bullish momentum in the long term.

Can you trust Bitcoin signals?

According to recent reports, utilizing signals in the cryptocurrency market has yielded a remarkable 76% success rate. These signals provide crucial information such as entry and exit points, take-profit and stop-loss prices, and specific risk-reward ratios, allowing investors to make informed decisions regarding their trades.

The high success rate of these signals suggests that they could potentially offer a valuable tool for investors looking to maximize their profits and minimize their risks in the volatile cryptocurrency market.

In addition to the benefits of using these signals, certain platforms provide additional incentives to traders who deposit via their verified and regulated brokers.

Platforms like eToro, LongHorn, and Eightcap offer free access to crypto signals to VIP account holders, allowing them to capitalize on the potential advantages of these signals without any additional cost. This could be an attractive option for investors looking to test out the effectiveness of these signals before committing to a subscription or purchase.

If you are new to crypto trading, check out our article about the best crypto app for beginners.