In September, the European Union’s Markets in Crypto Assets (MiCA) law was completed. In October, European Parliament officials voted 28 to 1 in support of the law, which now requires a final vote.

The comprehensive measure addresses everything from stablecoins to cryptocurrency mining to nonfungible tokens (NFTs) and money laundering. However, there are provisions buried inside it that might have an impact on crypto influencers.

What is MiCA?

Markets in Crypto-Assets (MiCA) is a proposed regulation in EU law. It is intended to help streamline distributed ledger technology (DLT) and virtual asset regulation in the European Union (EU) whilst protecting users and investors.

The full name of the 24 September 2020 proposal is the “Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on Markets in Crypto-assets, and amending Directive (EU) 2019/1937 COM/2020/593 final”. MiCA is part of a Digital Finance Package that intends to transform the European economy in the coming decades.

MiCA provides legal certainty around crypto assets – cryptocurrencies, security tokens and stablecoins. It is similar to Europe’s Markets in Financial Instruments Directive (MiFID), which is a legal framework for securities markets, investment intermediaries and trading venues. It is expected to be different than the UK crypto regulatory framework that has chosen to start by regulating only a few crypto assets, while EU through MiCA will impose a wider focus.

Groundwork for MiCA started in 2018 due to increased public interest within the EU in cryptocurrencies. The European Commission adopted the digital finance package which included MiCA in September 2020, leading to extensive discussions among the preparatory bodies (the EU Council, the European Central Bank, the Economic and Social Committee).

Crypto influencers can face charges

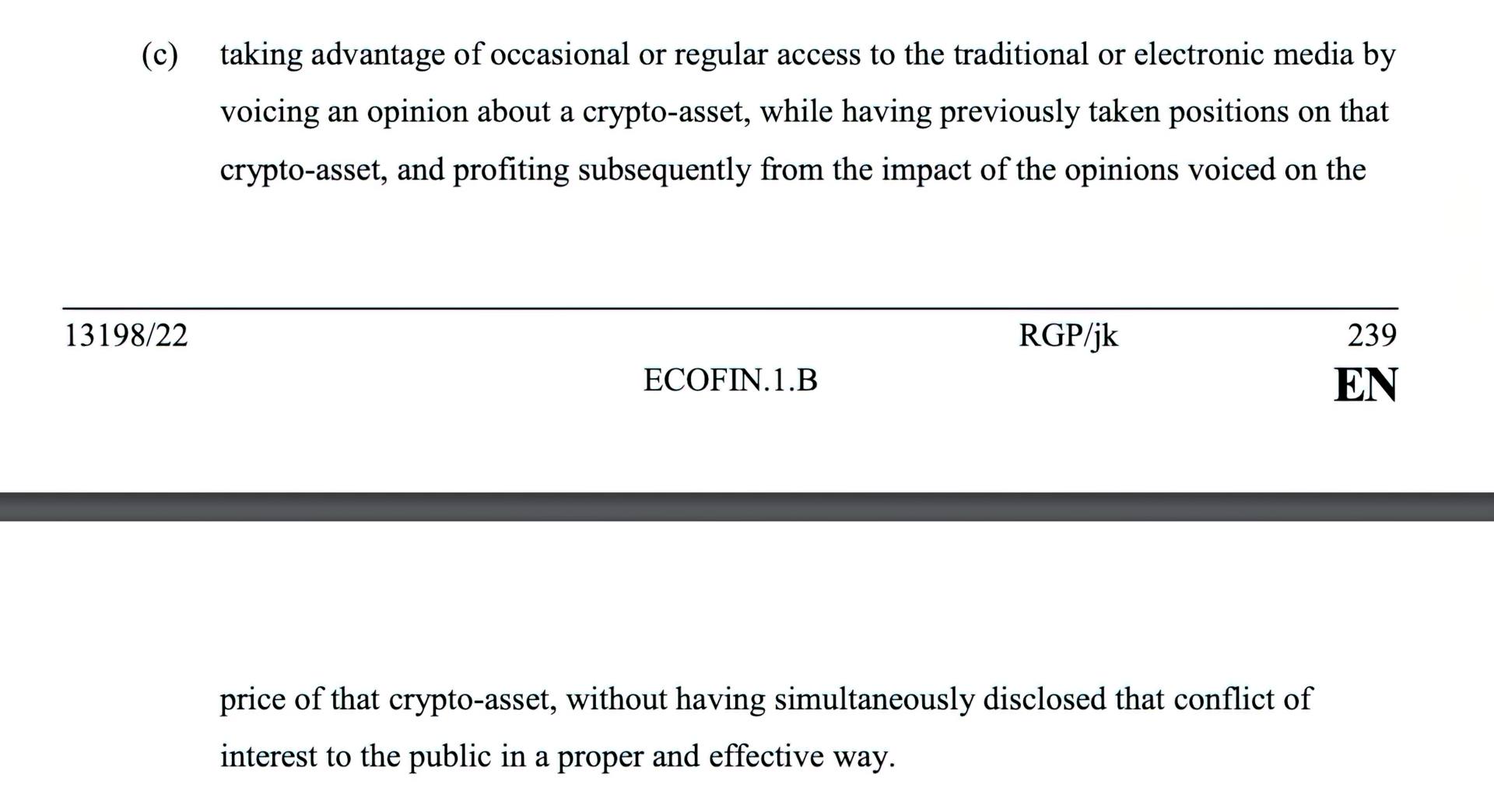

Patrick Hansen, Circle’s EU strategy and policy director, unearthed one of these sections on November 1. Crypto influencers who remark on social media without disclosing their identity may face legal consequences, according to the fine print. If they are found to profit from the consequences of their activities, it will be considered market manipulation in the EU if MiCA is implemented, he said.

The language is imprecise, but it might include memes like Elon Musk’s Doge-Twit picture, which has been circulating. Some were perplexed as to why the same regulations did not apply to other assets.

Those in support, on the other hand, believe that crypto influencers and coin shills should be more transparent. How it will be monitored and enforced is also unclear. Nevertheless, what is apparent is that the EU is about to make things much harder for the crypto industry and all associated with it.

Regulators are confident that this is a move forward that will make the region more attractive for the crypto industry. On Nov. 2, MiCA rapporteur Stefan Berger said that these regulations are necessary if “Europe wants to be a big player in the crypto game.”

Under the microscope, MiCA

In the interest of consumer protection, MiCA is cracking down hard on DeFi. This, however, may just become it into TradiFi, centralizing and regulating all parts of the industry.

It also intends to govern stablecoins and their issuance, as well as crypto asset service providers (CASPs). This would pave the way for properly regulated exchanges and brokers, perhaps preventing fraudulent activity.

The bill establishes three types of crypto assets. These are determined by whether or not the token strives to stabilize its value in reference to other assets.

Furthermore, it promotes the consumer protection card, although the main reason for MiCA is to combat money laundering. To that end, it seeks to align crypto firm laws with the same framework that governs banks. MiCA is unlikely to become legislation until 2024.

I hope you hated this draconian law as much as I did. If you did, be sure to check out our best crypto Telegram groups article to keep up to date even if your overlords don’t want you to.