If you want Apple High Yield Savings explained to you, we’ve got you covered. Making the most of your cash back if you have an Apple Card is about to become simpler. The establishment of high-yield savings account from Goldman Sachs for the Apple Card was announced by Apple today. Soon, cardholders will have the choice of having their Daily Cash automatically placed into a savings account where they may start collecting interest.

Because you receive your rewards considerably quicker with the Apple Card’s Daily Cash feature than you would with the majority of cash-back credit cards, it is a consumer favorite. The new savings account from Apple is a good method to increase this advantage. Here is all we currently know about it.

Apple High Yield Savings explained

There will be no charges, no minimum contributions, and no minimum balance restrictions for the Apple Savings account. Given that U.S. banks are raising their rates and that this is a high-yield savings account, the interest rate will probably be rather high. It is also being offered by Goldman Sachs, whose Marcus by Goldman Sachs savings account is well-known for its high annual percentage yield (APY).

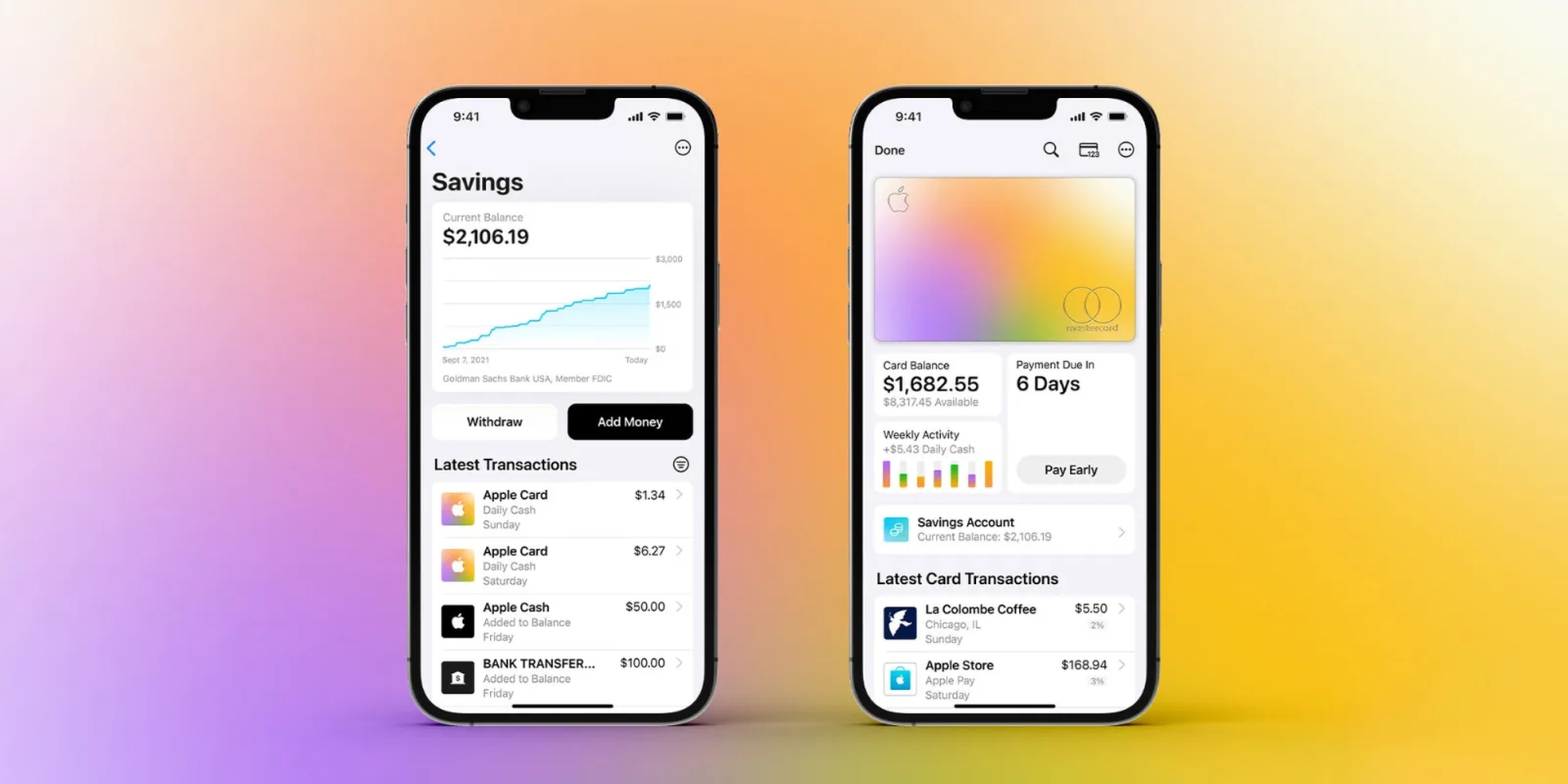

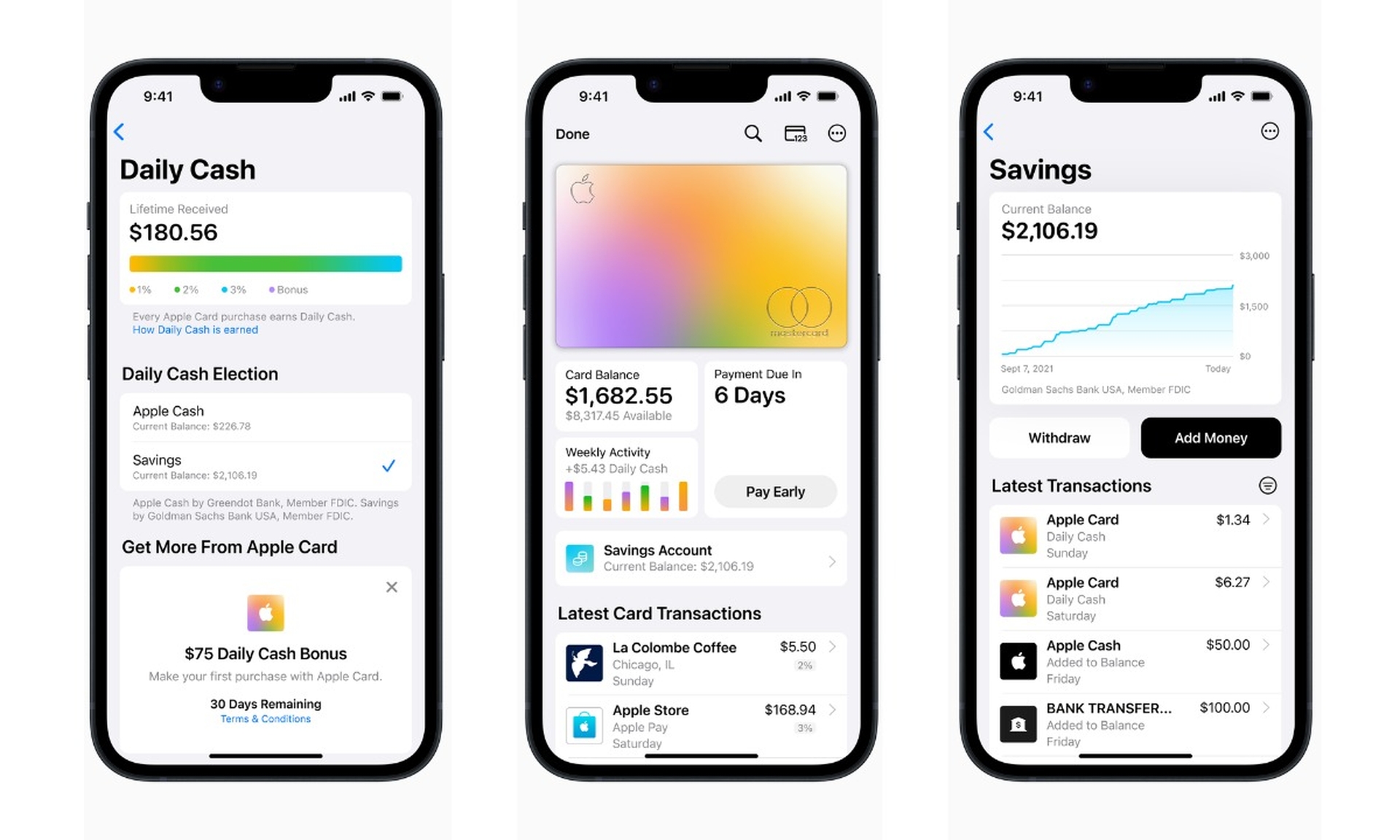

The ability to start a savings account and set up automatic transfers for Daily Cash earned by Apple Card holders. Additionally, users can transfer money from any linked bank account they have to their savings account. Withdrawals to connected bank accounts or an Apple Cash card can be done whenever you want.

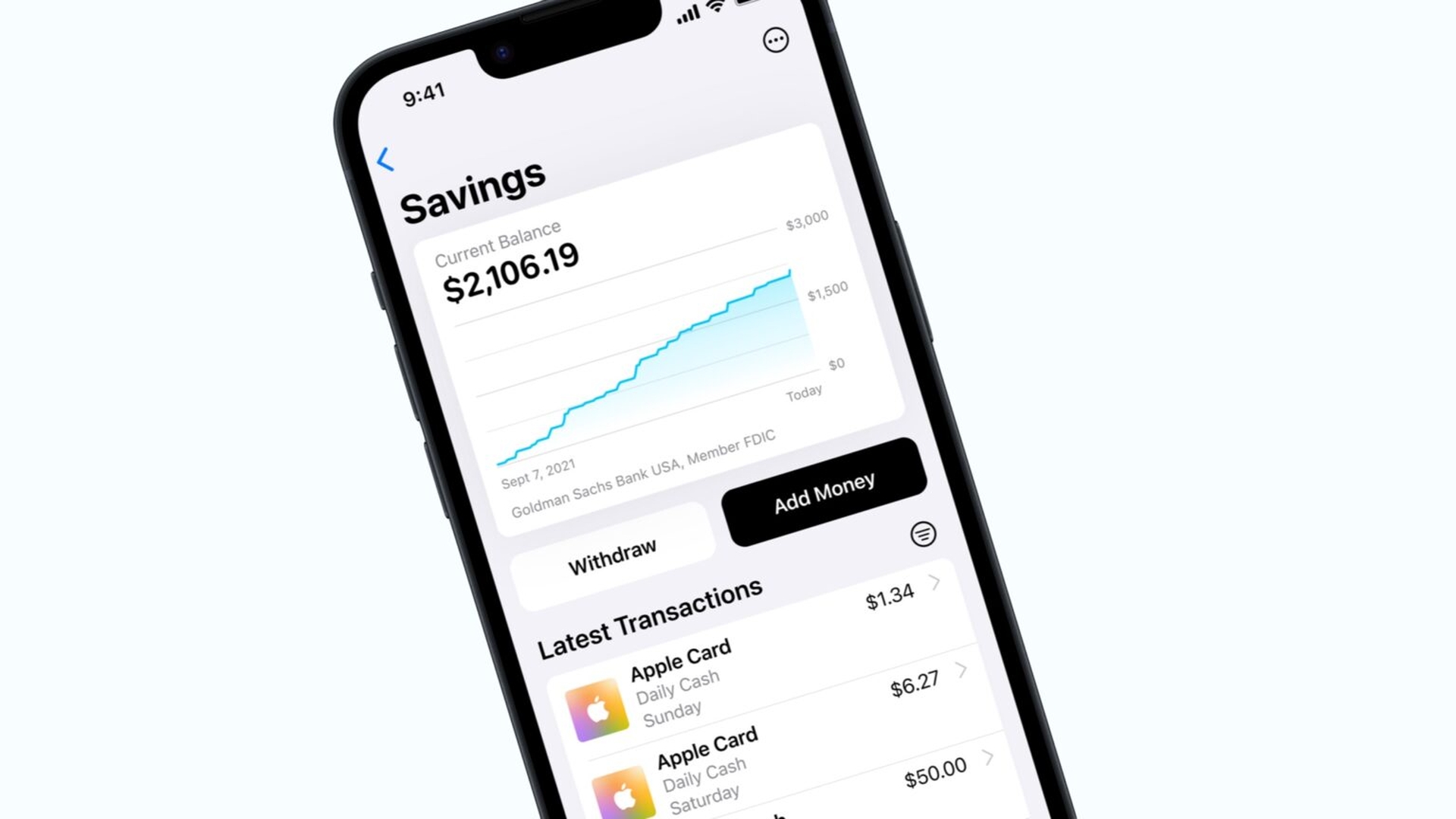

Everything will be visible to you on a savings dashboard in your Apple Wallet. This will comprise both the balance of your account and the interest you have accrued. The owners and joint owners of Apple Cards will be able to open an Apple Savings account. It doesn’t appear to be a savings account that will be accessible to everyone based on the information we currently have. Only cardholders may use it.

Useful new product for Apple Card holders

The annual percentage yield (APY) is typically one of the key considerations in high-yield savings accounts. Apple Card customers will find Apple’s Savings account to be a worthwhile alternative if its APY is comparable to that of other accounts.

With the Apple Card, you may immediately get your cash back every day as opposed to having to wait many weeks for it. You may couple that Daily Cash with instant interest payments by creating an Apple Savings account. In addition to being handier than having to redeem your cash back yourself, you might be able to make a little bit more money than usual from it.

This new savings account isn’t really a cause to rush out and apply if you don’t already have the Apple Card. There are several excellent savings accounts and reputable credit cards to choose from. Even while they’re not nearly as quick as Apple Card redemptions, several other card issuers also enable you to set up automatic cash-back redemptions. However, cardholders should be on the lookout for this new account since it will be among the finest methods to utilize your Daily Cash.

We hope that you enjoyed this article on Apple High Yield Savings explained. If you did, we are sure that you will also enjoy reading some of our other articles, such as what is Apple Pencil hover: How the new feature works, or Apple TV 4K thread support: Thread networking explained.