Barclays Plc is investing in Copper crypto, a firm that includes former chancellor Philip Hammond among its advisers, Sky News reports.

Barclays invests in crypto company Copper

The investment round for the crypto company has a number of new investors, including the UK lender, who will contribute a few million dollars, according to the report.

“As the funding round is ongoing, we’re unable to comment on this report,” the head of Communications at Copper, Sophie Arnold, stated.

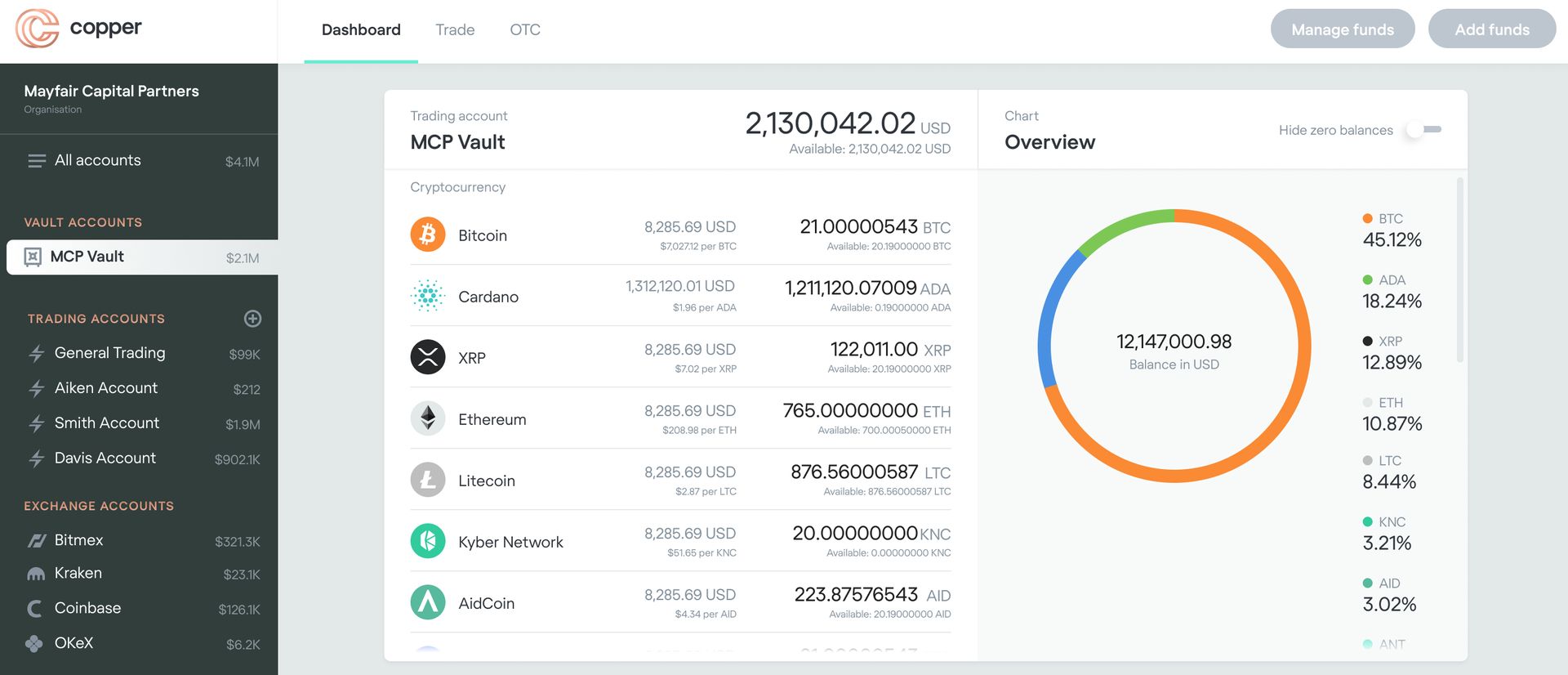

Institutional investors in crypto assets can access custody, prime broking, and settlement services from the crypto company. According to Sky, Barclays and Copper declined to comment on the report.

In 2015, Barclays encouraged charities to accept the emerging asset class as a form of gift, becoming the first bank in the UK to support cryptocurrency, specifically bitcoin. The bank has a troubled history with the sector, including refusing to work with dominant exchange operators Binance and Coinbase.

Delays brought on by the company’s dispute with the UK’s Financial Conduct Authority regarding that nation’s Temporary Registration Regime had complicated investor negotiations, particularly with Tiger Global, a repeat investor.

When Copper opened a hub in Zug, Switzerland as a result of a partnership with the world’s largest traditional custodian State Street, frustrations over the UK financial watchdog’s rule—which required digital asset service providers to apply for temporary registration in order to continue trading—reached a fever pitch in March.

Due to the decline of key digital tokens like Bitcoin and other risk assets globally, companies associated with cryptocurrencies have had a difficult year. Some of these companies have even had to file for bankruptcy.

Is Copper a regulated custodian?

Following a license registration impasse with the Financial Conduct Authority, a regulator in the United Kingdom, Copper, which counts former British Chancellor Philip Hammond as an adviser, has decided to become regulated in Switzerland.

Dmitry Tokarev founded Copper crypto company in 2018, which offers institutional investors custody, prime broking, and settlement services. In June of last year, the company completed a $50 million Series B investment round with an undisclosed valuation. Do you know how does crypto affect the environment, we explained everything in detail for a more sustainable world.