Today we are going to review which virtual investing app is the best. Choosing specific equities to buy instead of index funds makes investing challenging, enjoyable, and rewarding.

Following market news, placing wagers on businesses you believe will succeed, and winning may be quite lucrative.

Perhaps you desire the experience of being a day trader or stock picker but don’t want to risk your retirement funds on particular equities.

Or, perhaps you simply want to understand how individual security investing works. You may play the market with the help of investment simulators without putting your real money at danger.

Why use a virtual investing app?

There are a number of scenarios where using an investment simulator makes sense.

You can test your stock picks without any risk

The desire to practice investing in the market without taking any risks is one of the most popular justifications for using a stock simulator.

Even though you may be certain that Apple’s newest iPhone would boost the company’s stock, you may not be sufficiently confident to gamble your retirement savings on it.

You can invest fictitious money and observe how your investment would have done with an investment simulator.

Long-term tests of your abilities are conceivable, as well as setting objectives for oneself like swiftly doubling your money or creating a portfolio with little volatility.

You can test yourself and various investing methods using one or more simulations without having to risk any of your own money.

It is a great tool to learn how stock market works

When it comes to investing, the proverb “learning by doing” remains true.

Although the theory can be studied, sometimes it takes actual market experience to fully grasp how daily headlines and apparently arbitrary chance can affect outcomes.

Before you decide to invest your real money, you can gain that experience by using an investment simulator.

Children can learn about investment by using investing simulators, which are a terrific resource.

You could invest in a share of your child’s preferred company and open an account for them, but giving your child the reins and letting them make decisions is probably going to work better.

You won’t have to allow your youngster put your actual money at risk because simulators don’t care if your child is old enough to create a genuine brokerage account.

You can compete with friends using a virtual investing app

You may all enroll in a stock simulator if you’re ready for some friendly rivalry. Establish the time frame, the amount of initial capital, and any other guidelines you desire.

Decide who is the best investor after that. You might try to make as much money as you can by taking reckless chances or playing it safe.

By using a simulator, there is no danger and everyone may compete on an even playing field. No one will benefit from having more money or a higher income.

4 recommended virtual investing apps

These are the top four investment simulators if you’re thinking about signing up.

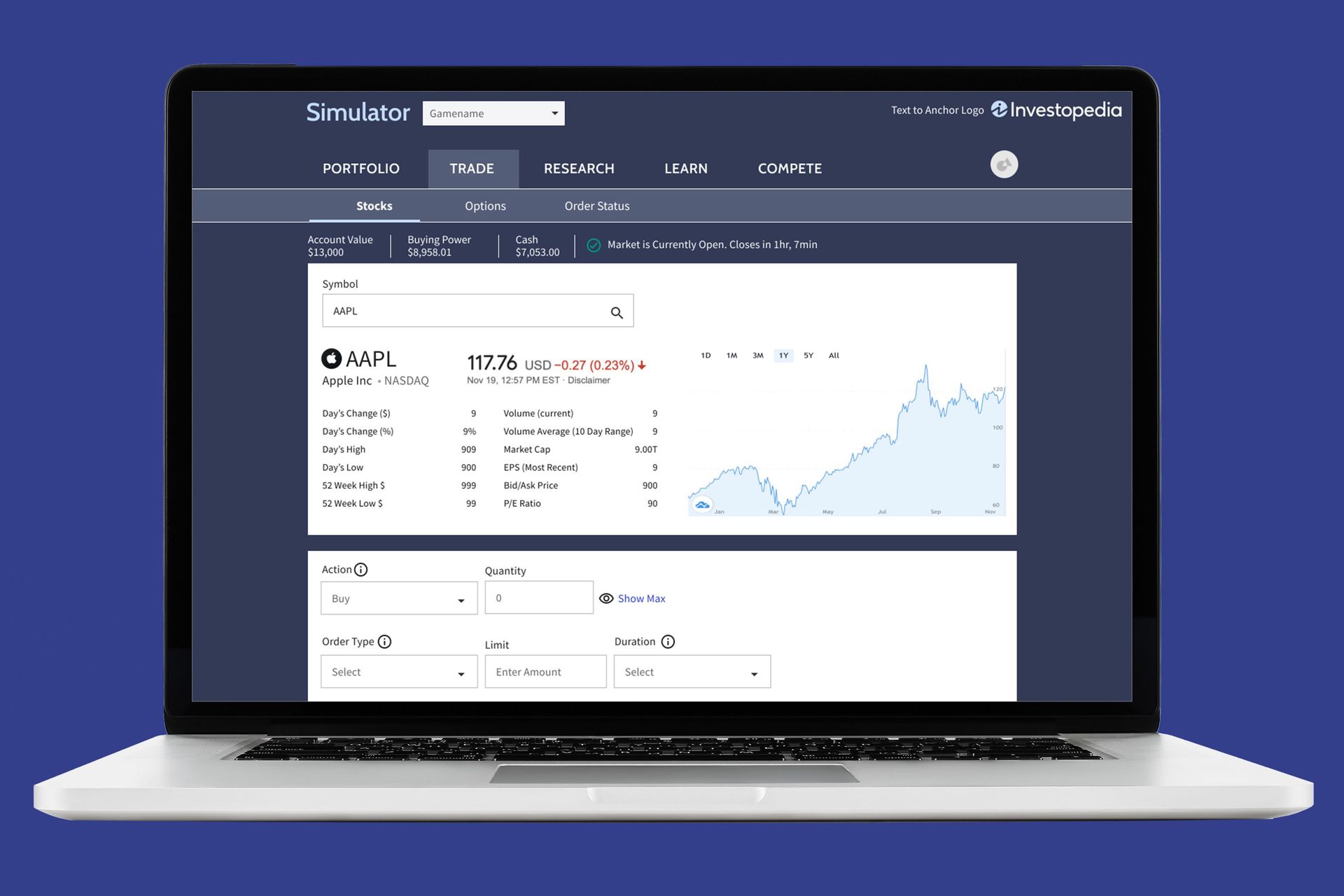

Investopedia Stock Simulator

You have the chance to practice investing with the Investopedia Stock Simulator. You’ll receive $100,000 in virtual money when you sign up.

With that money, you can make whatever investment you like and compete against the more than 700,000 other people who have registered for the simulator.

You can create challenges to compete with only the individuals you invite if you’d rather a private competition with pals.

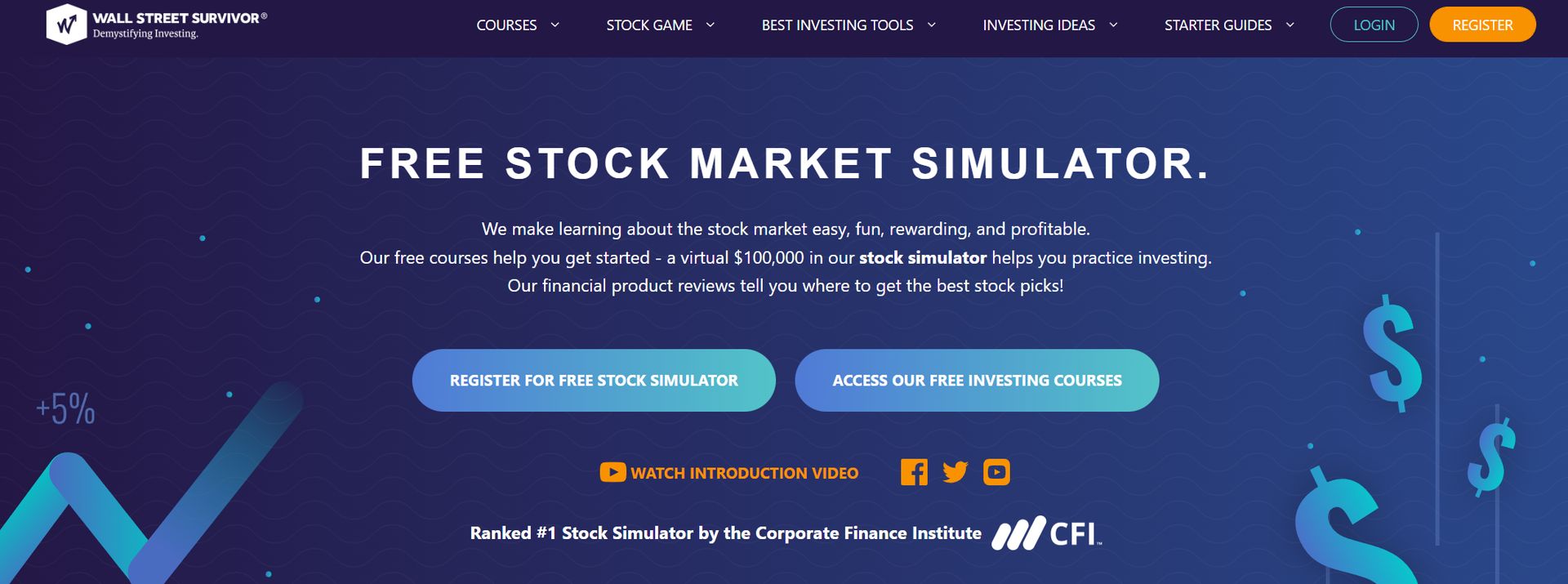

Wall Street Survivor

An investment simulator with a strong focus on competition and education is called Wall Street Survivor.

You can begin by enrolling in the courses offered by Wall Street Survivor once you create an account.

You will learn the fundamentals of these subjects, including how to read a stock quote and choose the finest stocks to invest in.

You can start or join a league if you’re ready to start making investments with your virtual money.

Wall Street Survivor sponsors a sponsored league each month. A monetary award is given to the top three investors in that league.

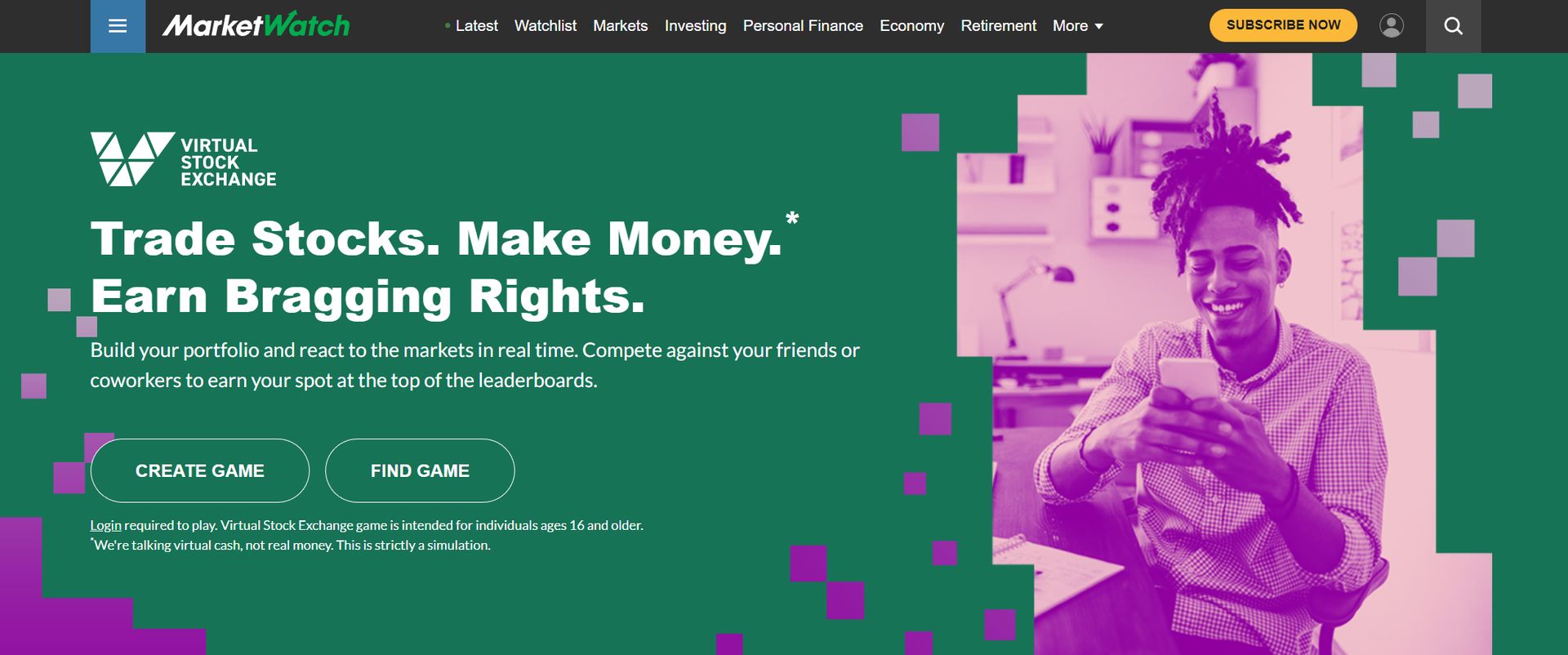

MarketWatch Virtual Stock Exchange

You can create games on the MarketWatch Virtual Stock Exchange where you can face off against loved ones, friends, colleagues, and students.

It differs from other simulators in that you may fully customize the experience to suit your preferences.

For instance, you can decide whether to accept sophisticated trading options like limit or stop orders. To make it simpler to invest precise amounts in the companies you choose, you may also allow game players to buy partial shares.

The MarketWatch simulator can also be used to simulate margin trading.

While margin has a significant level of risk, it also offers the potential for enormous rewards, which can help you outperform your rivals.

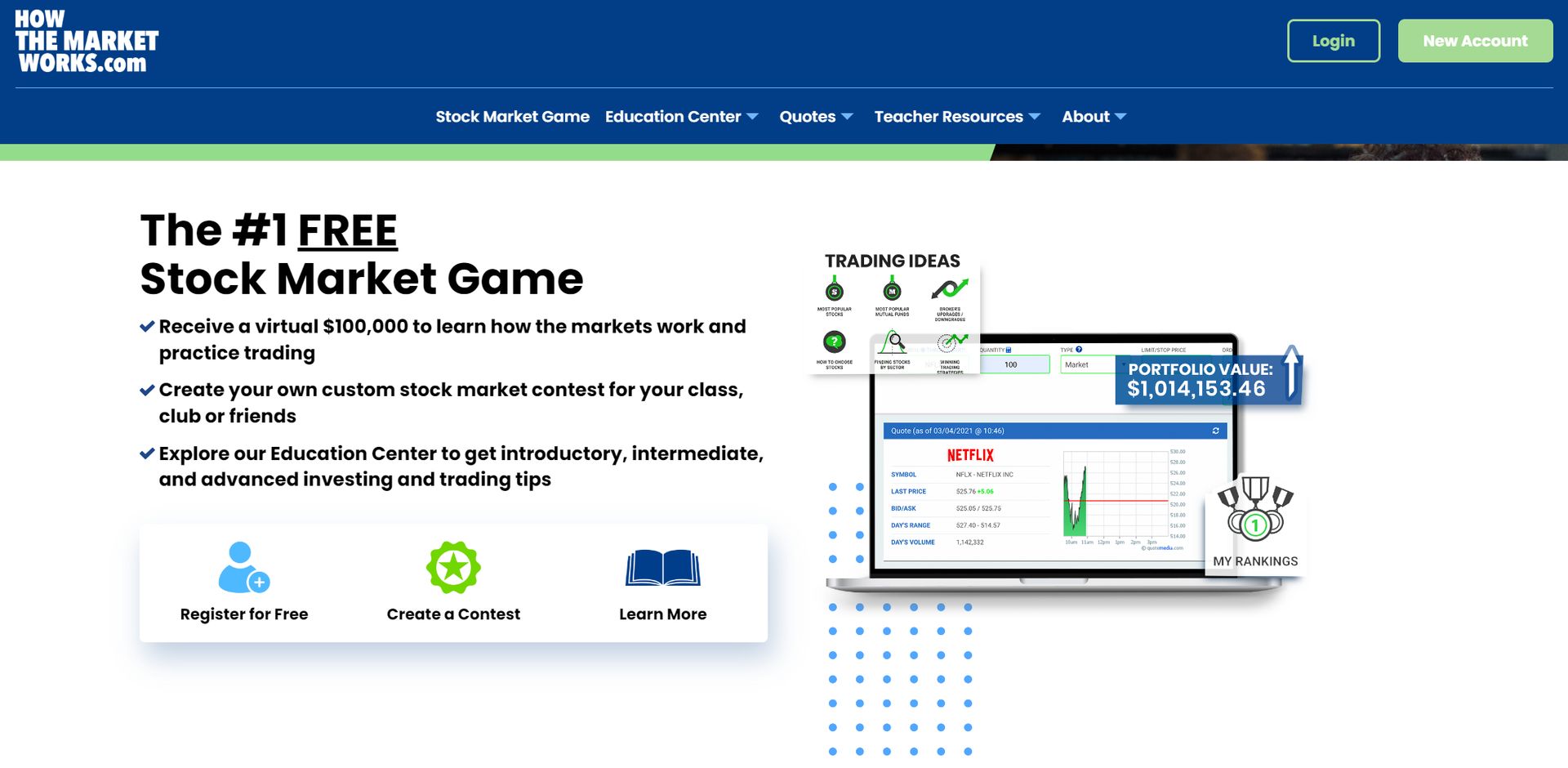

HowTheMarketWorks

HowTheMarketWorks is primarily intended for instructors, but it is a fantastic tool for everyone to practice investing.

The website was utilized by more than 10,000 college, high school, and middle school classes last year.

Along with the simulation, which starts players out with $100,000, the website also provides hundreds of videos, tutorials, and teaching resources that teachers may use in the classroom.

HowTheMarketWorks also holds its own competitions, where the top competitors can earn cash or gift cards as rewards. Don’t forget to check out our tips for investment strategies.