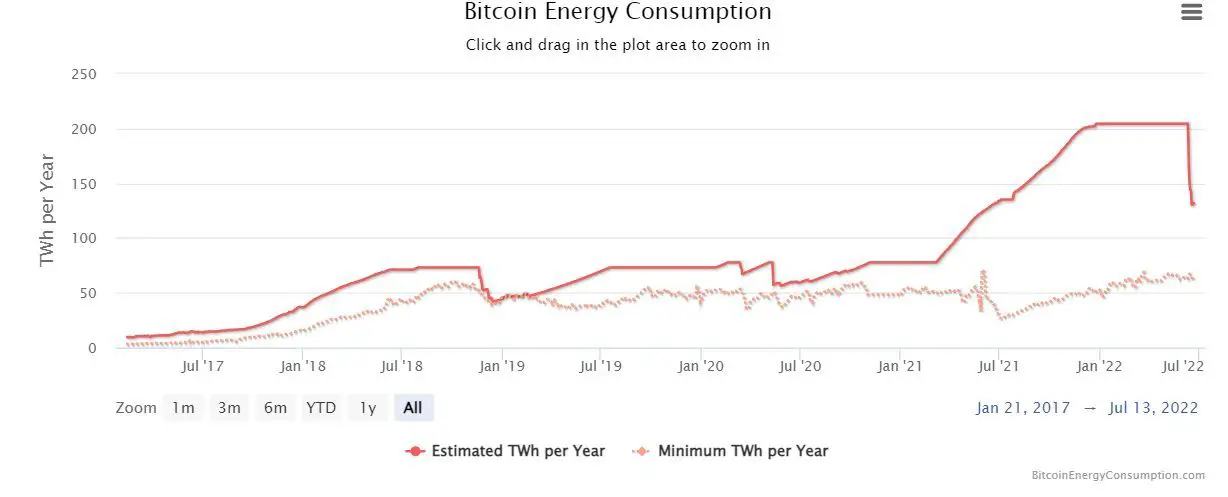

After plummeting in June, the price of Bitcoin has remained at such a low level that it is causing the blockchain’s high electricity consumption to do the same. According to estimates of annualized electricity use published on the website digiconomist.net by digital currency economist Alex de Vries, Bitcoin’s energy use has decreased by more than a third during the last few weeks.

Mining new tokens cause Bitcoin’s energy consumption, which has alarmed environmentalists and consumer groups concerned about pollution and utility bills. Bitcoin miners generate new tokens by validating transactions through an inherently energy-inefficient process and utilizing specialized machines to solve challenging puzzles. The amount of computing done by all those machines has resulted in energy consumption that rivals that of entire countries.

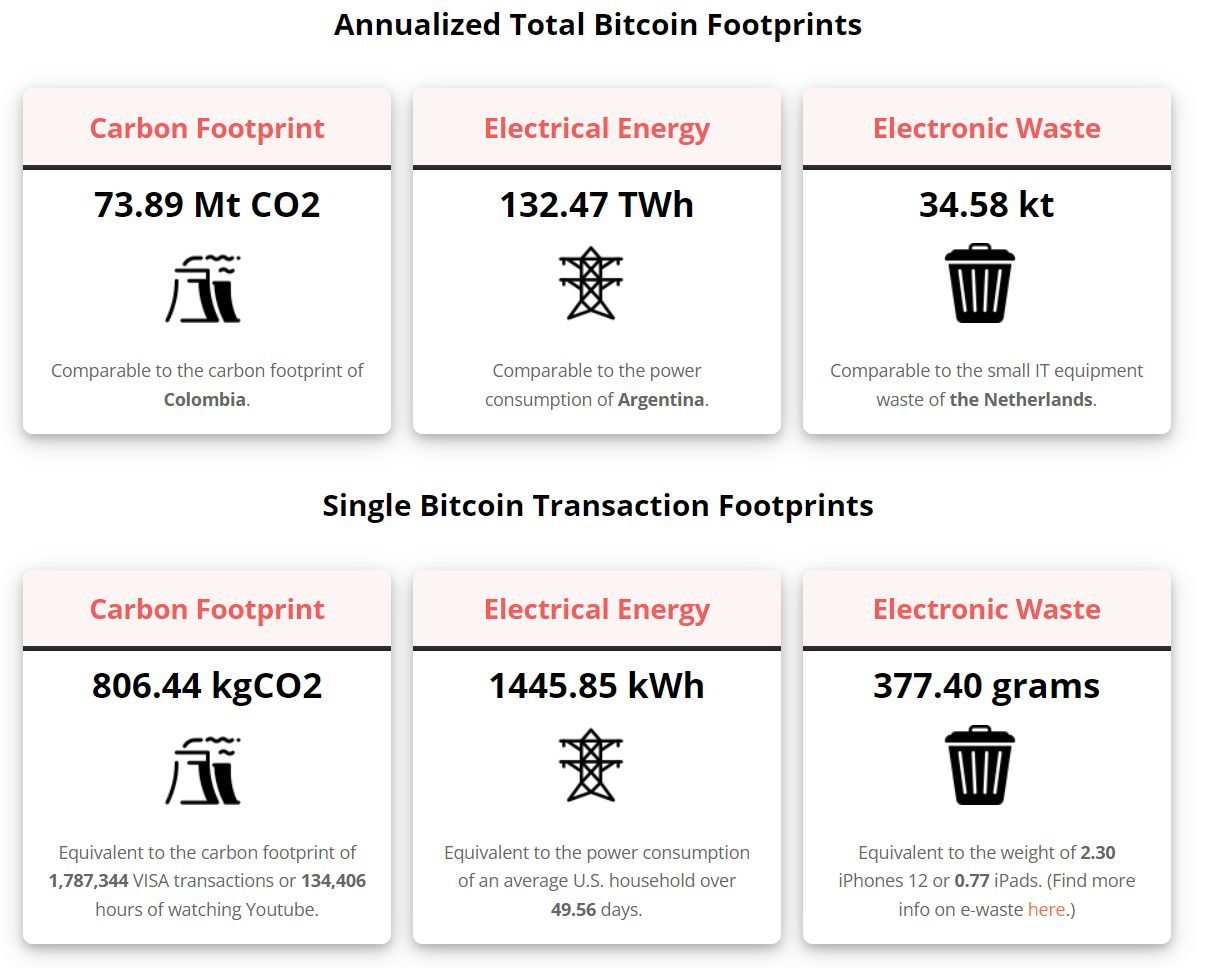

Bitcoin’s annualized energy consumption has decreased from roughly 204 terawatt-hours (TWh) per year on June 11 to about 132 TWh per year on June 23. Although its electricity use has decreased, it is still extremely high and equal to Argentina’s annual electrical consumption.

Bitcoin’s annualized energy consumption has decreased from roughly 204 terawatt-hours (TWh) per year on June 11 to about 132 TWh per year on June 23. Although its electricity use has decreased, it is still extremely high and equal to Argentina’s annual electrical consumption.

The value of the Bitcoin network determines how much energy it uses. The more valuable it is, the greater the incentive for miners to increase production—possibly by investing in new equipment. In November 2021, the price of bitcoin reached a pinnacle, peaking at over $69,000. Since that high point, de Vries calculated that the blockchain used between 180 and 200 TWh of electricity annually. That about equals the annual electricity consumption of all data centers worldwide.

Since the price of bitcoin has been declining for months, there hasn’t been a noticeable decrease in energy consumption. According to studies de Vries published last year, the Bitcoin network can support mining operations that suck up around 180 TWh yearly if the price stays over $25,200. Since miners have already invested in their equipment, they are likely to keep it operating for as long as they can continue to earn tokens for a profit.

The issue is that miners risk incurring losses in electricity bills if the price of Bitcoin falls too far. As a result, older, less efficient equipment that is losing money may be put on hold or retired, which is what we are starting to see now. Since June 13th, the price of one Bitcoin has remained below $24,000.

The issue is that miners risk incurring losses in electricity bills if the price of Bitcoin falls too far. As a result, older, less efficient equipment that is losing money may be put on hold or retired, which is what we are starting to see now. Since June 13th, the price of one Bitcoin has remained below $24,000.

While long-term holder Marathon Digital has refused to rule out selling bitcoin for the first time since October 2020, Riot Blockchain sold 250 of the 466 bitcoins it mined in May to raise around $7.5 million.

Even those bigger players don’t own enough bitcoin to affect the price of the token significantly. However, researchers warned that some mining firms risk losing business if their revenues keep declining or if they have taken out debts backed by bitcoin.

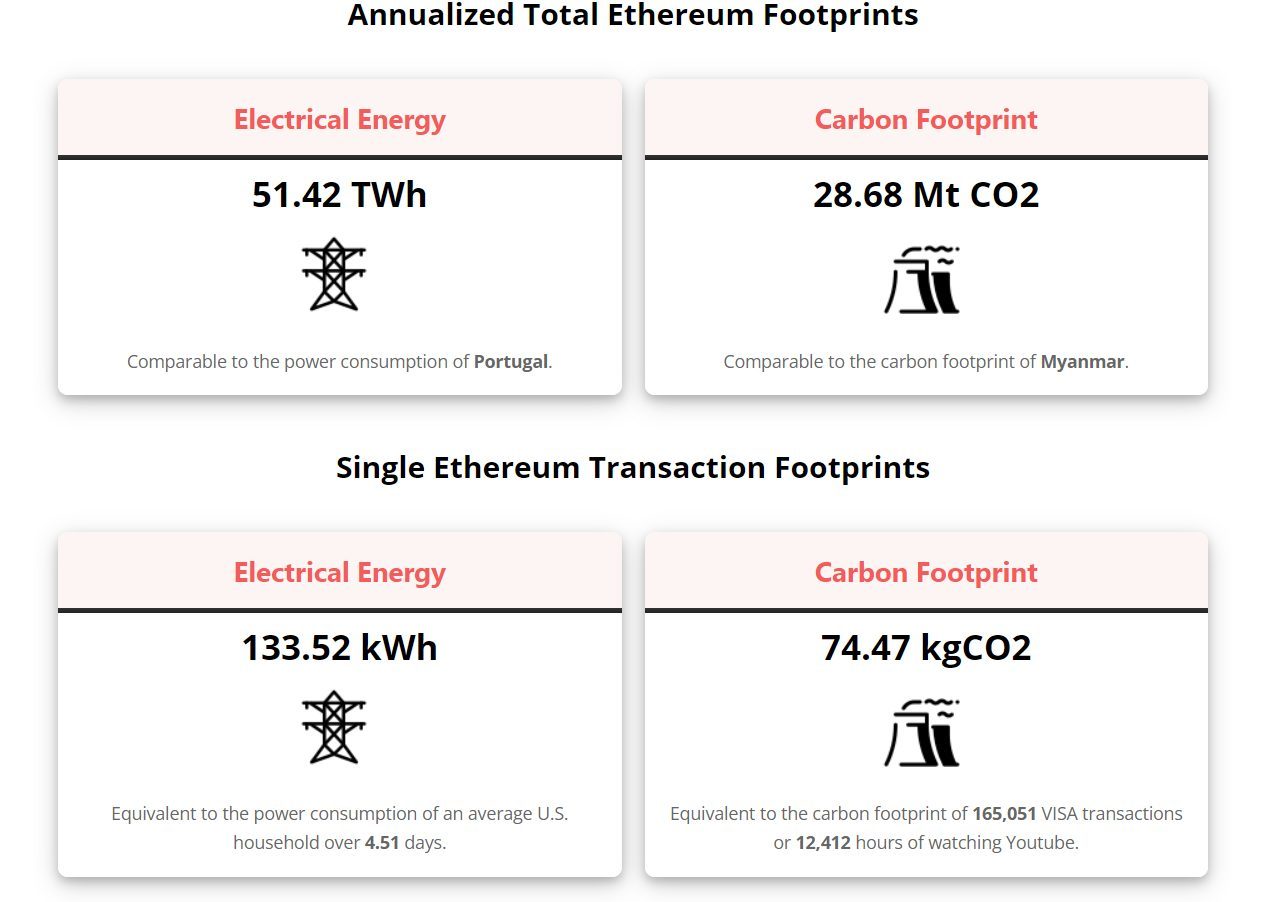

Not just Bitcoin, either. The ledger maintenance technique used by Ethereum is also energy-intensive. Although it has slightly recovered during the previous week, its price has similarly fallen this month. Yesterday, Ethereum used almost half as much electricity as it did in late May.

Not just Bitcoin, either. The ledger maintenance technique used by Ethereum is also energy-intensive. Although it has slightly recovered during the previous week, its price has similarly fallen this month. Yesterday, Ethereum used almost half as much electricity as it did in late May.

A significant effort has been made to purge cryptocurrency. Because other blockchains, unlike Bitcoin (and Ethereum at present), other blockchains do not employ puzzle-solving to validate transactions, so they are far less energy-intensive. Emissions can be reduced by using renewable energy, but some people are still concerned that in that situation, local neighbors would have to compete with crypto miners for electricity.

A Crypto Climate Accord has even been proposed to discover how to eliminate emissions. As long as some blockchains, like Bitcoin, continue to consume astronomical quantities of electricity, the issue they are all attempting to solve will persist.