In today’s article, we are going to cover why Singapore High Court blocks NFT sale, and what this could mean for the NFT and metaverse industry as a whole.

In one of the first instances of its kind, a Singapore court has issued a freezing injunction against the sale of a Bored Ape non-fungible token. A court has ruled that an NFT shouldn’t be sold until a disputed ownership issue is resolved, after the fact that it was foreclosed on as collateral for a loan. Reed Smith LLP Singapore’s Hagen Rooke, who wasn’t involved in the case, explained that the law does recognize both fungible and non-fungible tokens as a type of property to which court orders can be attached.

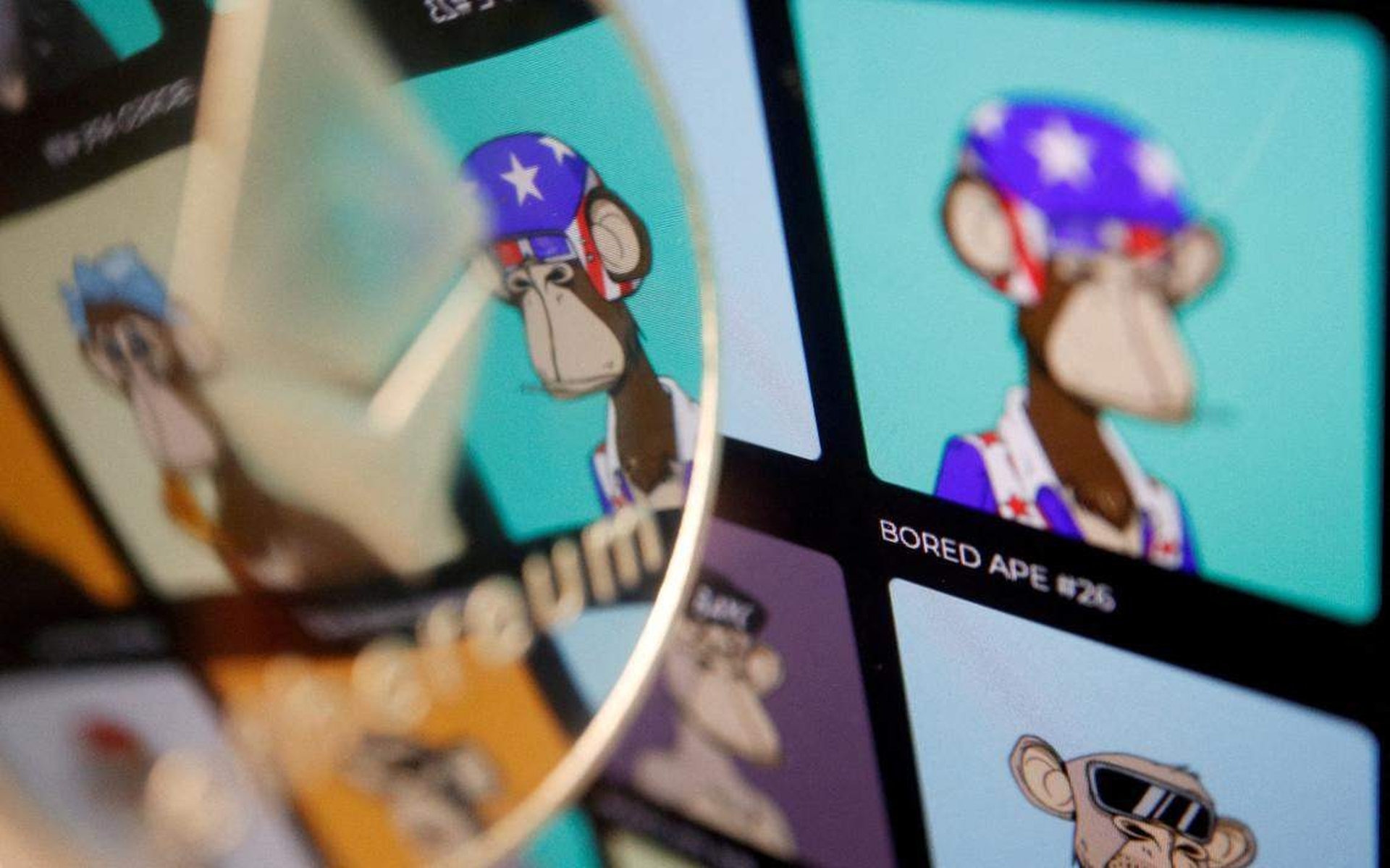

For anybody who is unfamiliar, Bored Ape Yacht Club (BAYC), simply known as Bored Ape, is a non-fungible token (NFT) collection built on the Ethereum blockchain. The collection includes cartoon apes’ profile pictures that are generated algorithmically.

“It is the first decision in a commercial dispute where NFTs are recognized as valuable property worth protecting,” said Shaun Leong, lead counsel for the case and equity partner of Withersworldwide. “So more than merely strings of numbers and codes imprinted on a blockchain, the implication is that NFT is a digital asset and people who invest in it have rights that can be protected.”

Why did the Singapore High Court blocks NFT sale?

A Singapore citizen who is a prominent dealer in digital currencies and cryptocurrencies, according to the case paperwork, has used NFTs as collateral for crypto loans on NFTfi, a platform that allows individuals to use NFTs as collateral. According to the filing, chefpierre.eth is a frequent lender on the platform.

According to the complaint, the BAYC NFT, No. 2162, is “one of the Claimant’s most treasured possessions, and is irreplaceable to him,” stating that he had “no intentions to ever part with or sell it.” He secured a crypto loan based on its scarcity and value, according to the filing.

In April, the claimant requested a refinancing of a loan secured by the NFT in question, but after some back-and-forth, chefpierre offered a tight deadline for repayment. According to the filing, chefpierre foreclosed on the NFT when the claimant was unable to pay. The claimant is claiming “unjust enrichment” as part of his case.

A partner at Singapore advisory firm Holland & Marie Chris Holland, who was not involved in the case said that:

“Having courts acknowledge a person’s potential ownership rights in a NFT is a positive for the industry,”

“It’s also a reminder to NFT buyers to be vigilant about the rights and control they give to third parties over an NFT. For example, it appears that the borrower does not know the ‘in real life’ identity of the lender. That creates a significant complexity for the borrower’s legal proceedings.”

Rights discussions in the NFT industry

According to Leong, this is only the beginning of many rights discussions in the NFT and metaverse industry:

“With the advent of the Metaverse, I would not be surprised that the next set of challenges revolve around disputes over ownership of virtual land, and preserving that virtual land on the blockchain pending resolution of the ownership dispute,”

“NFT issuers (especially those of high value NFTs) or key NFT marketplaces may increasingly be encouraged to have an open registry of NFTs where the ownership of the specific NFT is formally disputed in courts of law.”

We hope that you found this article on Singapore High Court blocks NFT sale informative. If you did, you might also like to check out New Spotify NFT feature is in testing, of Attackers exploit code to mint hundreds of NBA: The Association NFTs.