The latest Meta earnings report shows that Facebook has been able to restore user growth and allay market fears, albeit revenue growth has slowed in Q1 2022 as a consequence of the Ukraine conflict, among other things.

Meta earnings report 2022 Q1

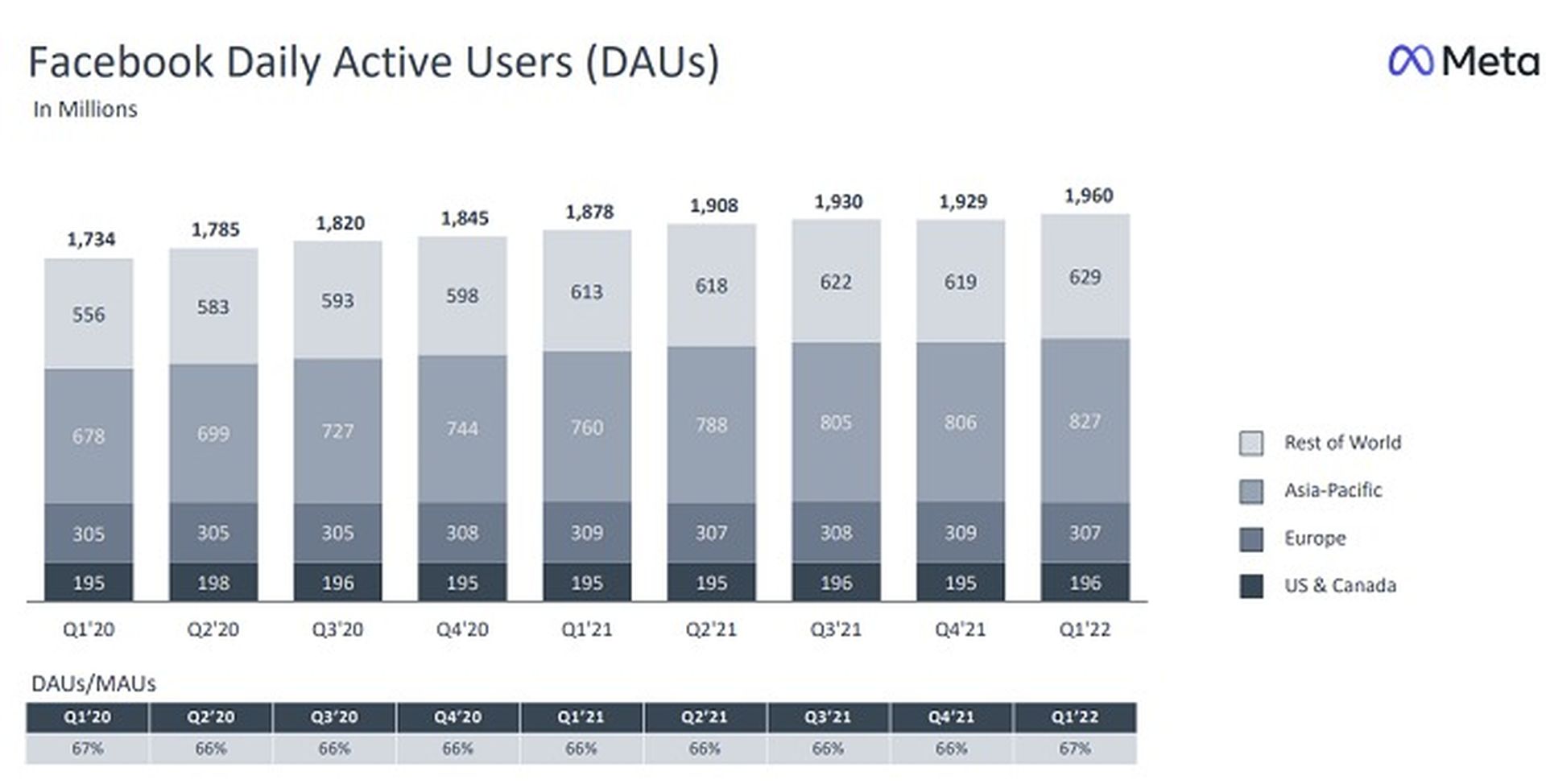

Facebook parent company Meta surged 18% in extended trading on Wednesday following earnings that eclipsed forecasts even as sales disappointed. First and foremost, for March 2022, Facebook DAUs were 1.96 billion on average, up 4% year over year.

The Asia Pacific continent, where the app is still expanding into developing countries and seeing steady adoption, accounted for the majority of Facebook’s usage growth, the Meta earnings report indicates.

The Asia Pacific continent, where the app is still expanding into developing countries and seeing steady adoption, accounted for the majority of Facebook’s usage growth, the Meta earnings report indicates.

Despite the fact that Facebook’s usage rates decreased by 2 million in Europe and only increased modestly in the United States, you will note that Facebook’s daily usage rates have been declining for some time. For a long period, Facebook use has fluctuated in both markets, and it’s possible that the service has now reached its optimal take-up levels.

Despite this, there are still a large number of individuals in these markets that log into Facebook on a regular basis. This is probably due to the app’s essential interactive role, but we would want to see how long people spend in the app before spending the majority of their online time elsewhere, according to the Meta earnings report.

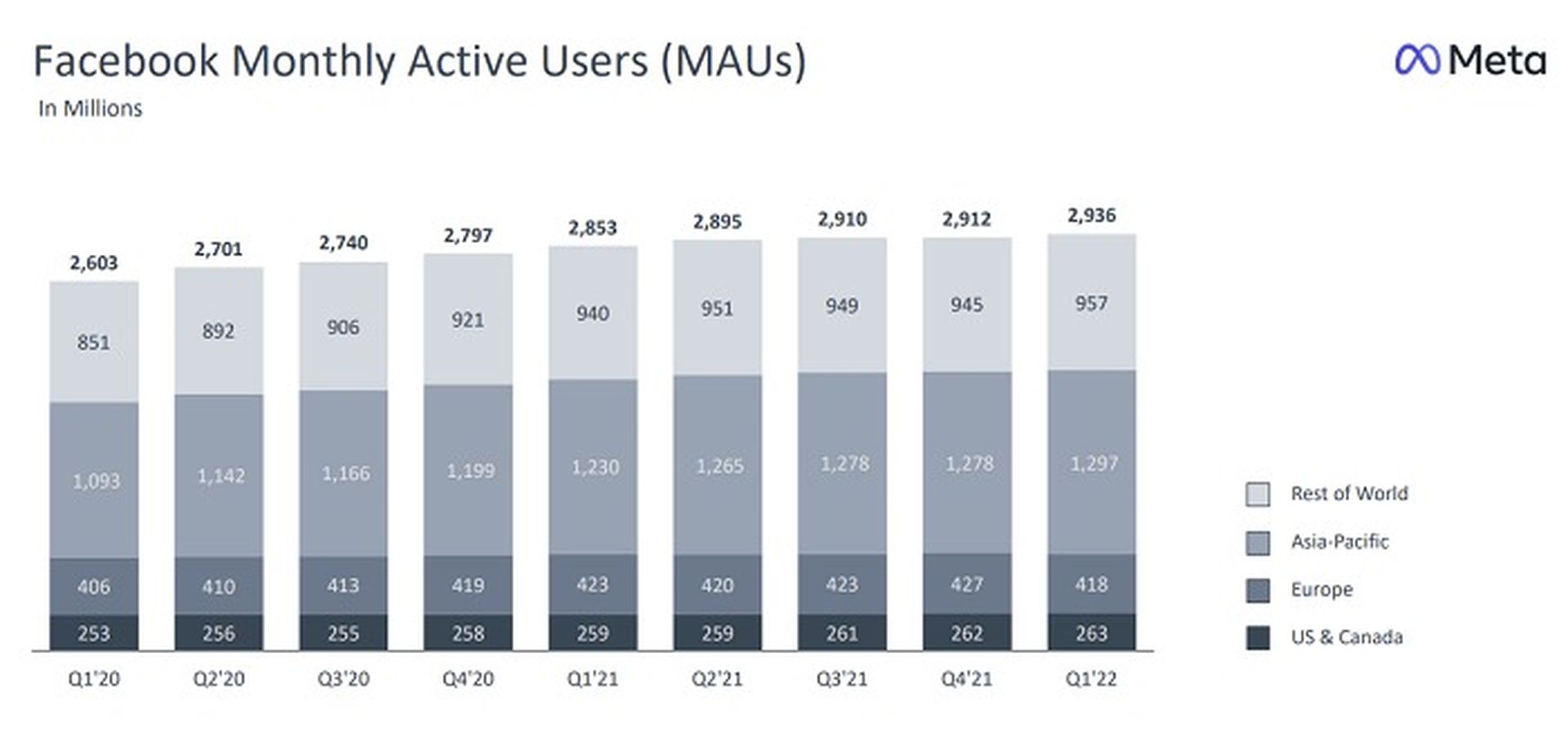

Facebook monthly active users rose by 3% year over year to 2.94 billion. Meta earnings reports shows that the app’s popularity in Europe has fallen significantly (-9 million), which may suggest that it is losing favor with consumers in some regions.

However, it is possible that this is because Russian bans were in effect. According to reports, as of February 2022, Facebook had over 70 million users in Russia. In early March, following Meta’s restriction of state-owned media outlets, the Russian communications regulator banned access to Facebook entirely.

However, it is possible that this is because Russian bans were in effect. According to reports, as of February 2022, Facebook had over 70 million users in Russia. In early March, following Meta’s restriction of state-owned media outlets, the Russian communications regulator banned access to Facebook entirely.

If that’s the case, then Facebook may have lost a lot more active users than what this Meta earnings report indicated – but it isn’t the company’s fault, and it certainly doesn’t reflect a shift away from the app. However, depending on how things go, this number could make Meta’s user numbers appear considerably worse in Europe during Q2, Meta earnings report suggests.

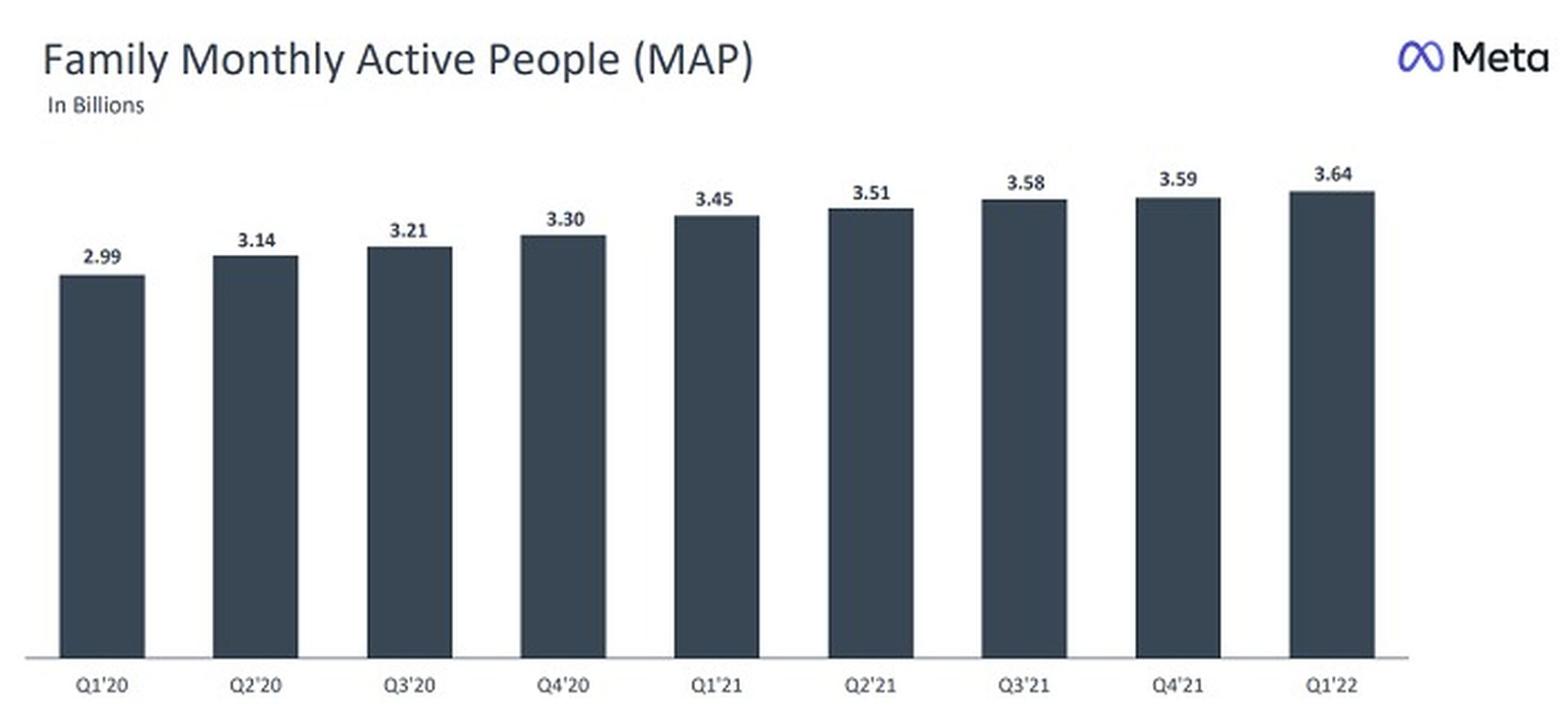

Overall, according to Meta earnings reports, the statistics reveal that Facebook is still immensely popular, and Meta’s “Family of Apps” chart, which incorporates unique users from Facebook, Messenger, Instagram, and WhatsApp, has continued to rise.

This chart differs from Facebook usage in isolation by suggesting that there are approximately 700 million non-Facebook users using these other applications every month.

This chart differs from Facebook usage in isolation by suggesting that there are approximately 700 million non-Facebook users using these other applications every month.

Meta does not break down the usage statistics for its other platforms, but given that WhatsApp has over 2 billion users across a variety of markets, it appears to suggest there’s a lot of overlap between Facebook and Instagram use. According to rumors, Instagram has almost 2 billion users on its own, according to the Meta earnings report.

However, the more significant question is how long people are spending on Meta’s applications – because while most individuals will go on to see what their friends and relatives have shared each day, we believe that many are now investing a considerable amount of time in TikTok and YouTube instead.

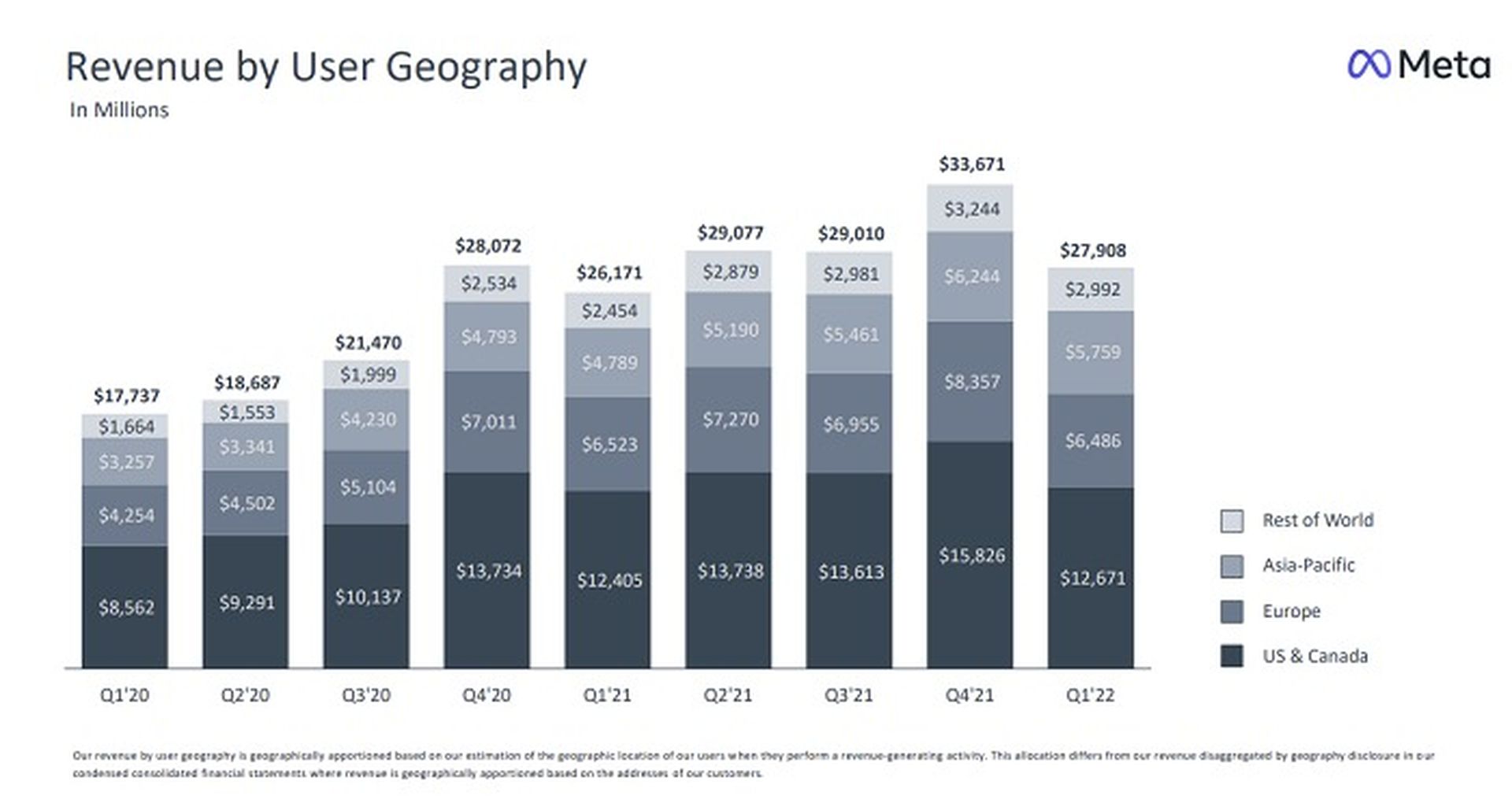

According to these numbers, the cost to acquire a new user appears quite low. Additionally, this is likely the more informative statistic since Meta hasn’t released any official information on it for some time. In terms of revenue, Meta generated $27 billion in profits during the quarter, up 7% from last year:

The company’s revenue will drop in its main two advertising markets, but it does note that ad impressions delivered across its apps grew 15% year over year, according to Meta earnings report.

The company’s revenue will drop in its main two advertising markets, but it does note that ad impressions delivered across its apps grew 15% year over year, according to Meta earnings report.

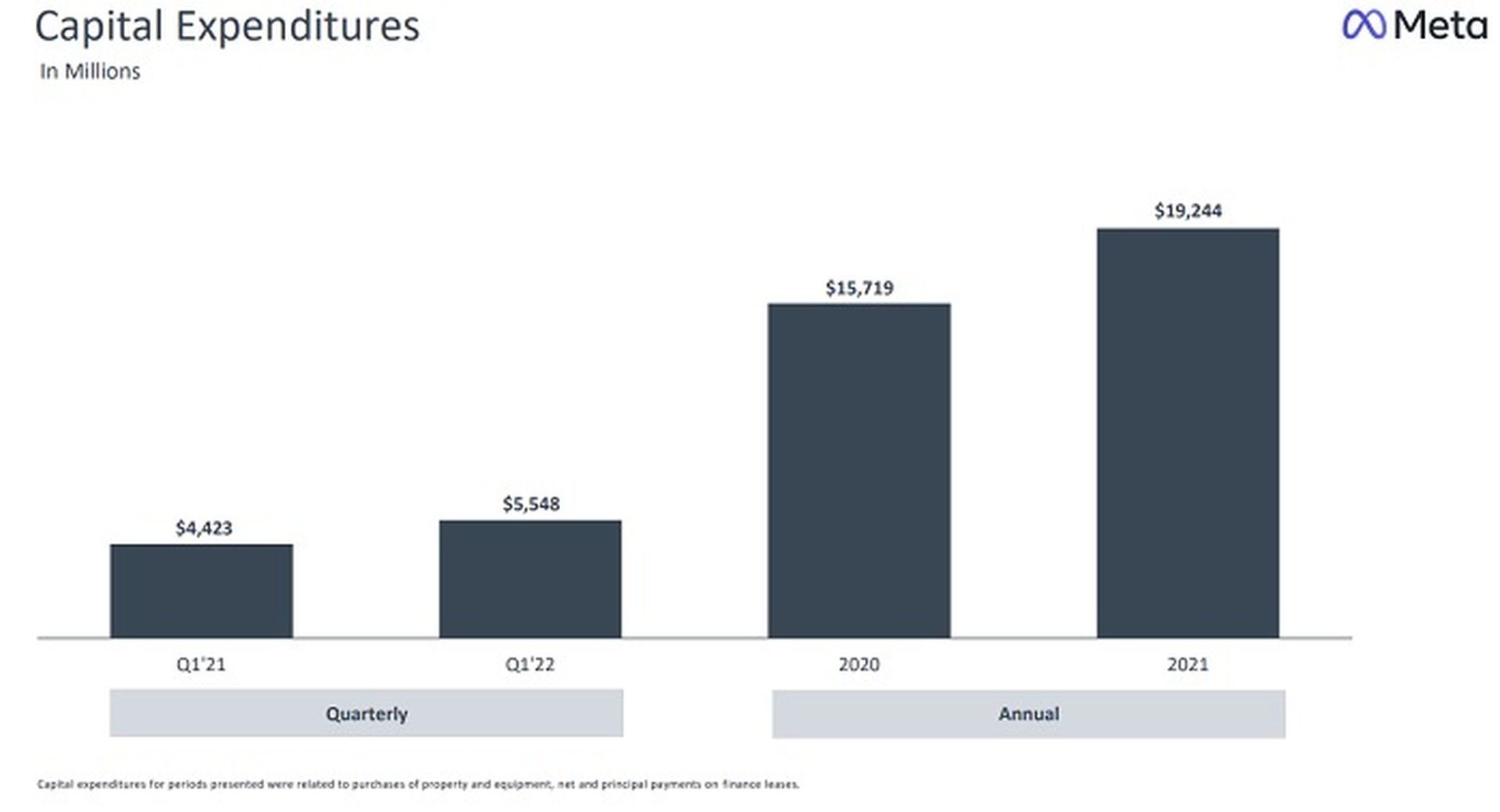

Apple’s new ATT policy, which has limited the data-gathering capacity of Meta’s platforms, has slowed down its results by $10 billion in 2022 alone. In the Meta earnings report, the firm also claims that revenue softness in the final quarter was exacerbated by the Ukraine conflict, while it also invests in innovative technologies, driving greater expenditure.

It’s known since this point whether or not a case is worth pursuing because of its focus on the future, but Meta thinks that the emphasis will ensure not just its present success, but also long-term viability. There’s still so much more to come.

The company is in a transition period, as Meta itself has acknowledged to the market in recent comments. That, naturally, will have an impact on present-day performance. The most apparent cost is increased R&D expenditures; however, it also means that every project within each of its applications must now consider the future while developing, which implies longer development cycles, complexity, and labor time as a result.

The company is in a transition period, as Meta itself has acknowledged to the market in recent comments. That, naturally, will have an impact on present-day performance. The most apparent cost is increased R&D expenditures; however, it also means that every project within each of its applications must now consider the future while developing, which implies longer development cycles, complexity, and labor time as a result.

The Metaverse may be the future, but investors are putting their faith in Zuck’s nous here, hoping he’s correct. Because as we’ve seen, Meta’s key apps are already feeling the pinch and it doesn’t appear to be changing its strategy, with costs rising steadily and additional resources being allocated towards increasingly expensive hardware releases.

If Meta truly believes in the Metaverse shift, that will likely also see it take another hit on the retail costs of its VR headsets, and eventually its AR glasses, because the real money is in mass adoption, and expanding Metaverse engagement.

In conclusion, while the market is unlikely to be overly enthusiastic about Meta’s results at present, things are not expected to improve for a long time. And if the Metaverse takes ten years to become the next plain of digital existence, as Meta has claimed, $FB holders will soon run out of patience.

Meta’s mission will be to keep evolving, with greater eCommerce connections, more income possibilities for makers in its applications, and more avenues for creators to earn money. The latter could also feed into the Metaverse, with a new fund set up to help VR producers, as well as additional training programs to assist artists and influencers in moving into the next era – hoping that they’ll bring their fans along with them.

While both platforms are seeing strong demand, Instagram continues to focus on outdoing TikTok in its own area. WhatsApp is still working on business tools, which may have significant potential in developing areas.

However, it is all about the Metaverse and laying the groundwork for the next stage in any case. There are several intriguing changes on the horizons, but they will not arrive quickly – it isn’t simply a question of flicking a switch to bring in the next phase.

Also don’t forget to check out the latest trends, for example this Sprout study shows the best times to post on social media in 2022. In addition to that, in order to examine last year’s popular ideas, take a look at the TikTok trends report 2021.

Meta stock price

$FB shares experienced a rise following the quarterly Meta earnings report, according to MarketWatch.