On Friday, Twitter unveiled a “poison pill” to resist Elon Musk’s hostile takeover bid. It is a hypothetical term that can be defined as a protective mechanism against takeovers that requires investors to retain a certain level of ownership in order for the offer to be approved.

What is the poison pill?

The move, commonly known as a shareholder rights plan, allows existing shareholders to buy larger quantities of stock at a discount, which is referred to as a “poison pill,” allowing Musk’s ownership to be diluted and his purchase to become considerably more costly and less attractive. It would also mean that Musk must negotiate directly with Twitter’s board on any attempts to acquire the company.

According to a statement from Twitter’s board of directors, which said the measure would be in place until next April, the poison pill will come into force once a person or entity acquires 15% or more of Twitter’s shares.

Will Elon Musk buy Twitter?

Elon Musk already owns 9.2 percent of the social media platform.

He offered “to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced.”

Twitter is now taking steps to defend itself with the poison pill plan against the potential of Musk increasing his stake in the firm.

On Thursday, at a conference in Vancouver, Musk said he has a “Plan B” if his takeover attempt fails, but he did not provide details.

The poison pill plan aims to delay any move that could be done by Musk, yet it does not rule out the possibility completely.

Twitter said that the decision is meant to let investors take maximum advantage of their investment by minimizing the likelihood that Musk will be interested in a hostile takeover.

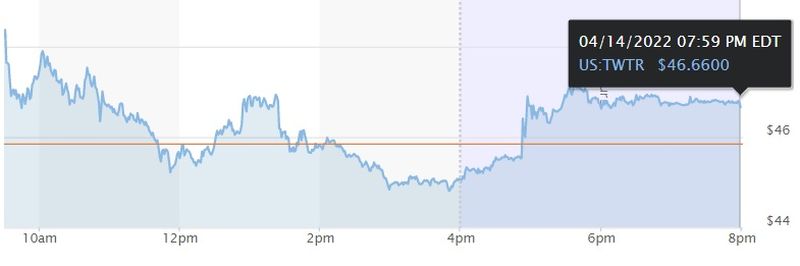

TWTR stock price

After the news regarding the intentions of Elon Musk to buy Twitter, TWTR stock price has experienced a downtrend. At the time of writing, A TWTR stock is worth $46,6600 according to MarketWatch.