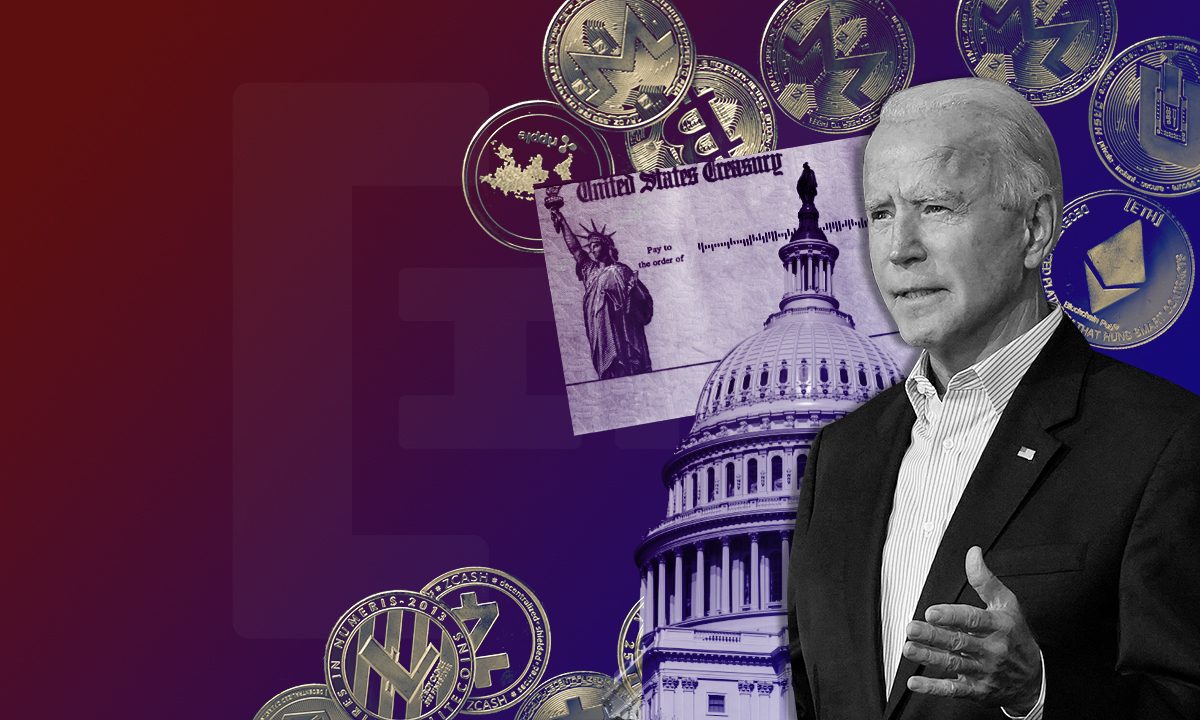

A cryptocurrency executive order is about to sign by U.S. President Biden. According to a Reuters report, which cited an informed source, President Joe Biden is expecting to sign an executive order on cryptocurrency policy this week.

According to the report, the order, which may aim to appoint a person with regulatory power over the crypto market, might be announced as soon as Wednesday.

CFTC wants to be in charge of cryptocurrency

The Commodity Futures Trading Commission (CFTC) chair Rostin Behnam said last month at a Senate committee hearing that his agency wanted to be in charge of regulating the cryptocurrency spot market.

During a congressional hearing, Benham was asked whether a lead agency for crypto regulation should be formed and responded that his organization, as well as the Securities and Exchange Commission, should share the responsibility.

It’s been suggested — especially by Michael Fasanello, director of training and regulatory affairs at Blockchain Intelligence Group in January — that a new official would be assigned responsibility for several cooperating agencies.

According to Fasanello, the aforementioned organizations include the CFTC, SEC, Financial Crimes Enforcement Network, and Office of the Comptroller.

Some regulators, however, including SEC Commissioner Hester Pierce, have stated that adding a new regulator to an already “fragmented regulatory system” for financial products should not be a top priority.

Apple co-founder says Bitcoin is “Pure Gold”

Crypto regulation in the US

In recent years, the US government has taken a more stringent approach to regulating cryptocurrency. With greater reporting obligations placed on exchanges, as well as closer attention paid to stablecoins, whose value is usually linked to fiat currency or commodities, regulation in the country has gradually increased.

The Treasury Department announced a new reporting requirement on individuals who conduct transactions in Bitcoin or other cryptocurrencies valued at more than $10,000 with the Internal Revenue Service last year.