Even though most people do not trust cryptocurrencies, most of the American people have invested in digital assets according to the latest data. A new study has revealed the degree of cryptocurrency adoption among American residents, with alternative assets supplanting traditional methods as preferred investment options.

Americans invest in cryptocurrencies over traditional savings accounts

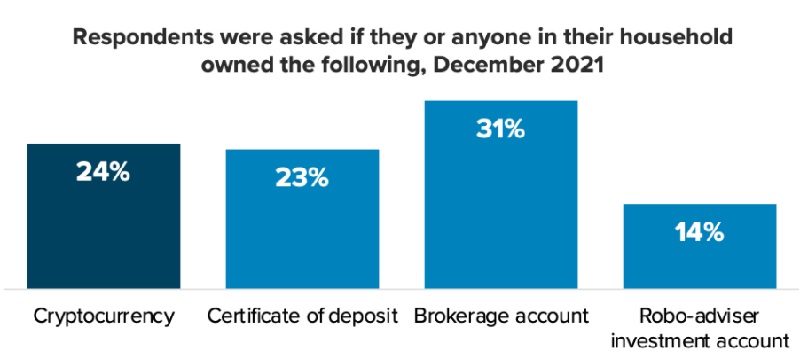

The State of Consumer Banking & Payments report of Morning Consult shows that as many as 24 percent of American adults owned cryptocurrencies in 2021.

23% of Americans have certificates of deposit, according to the study. A certificate of deposit is a savings account that holds a set amount of money for a set length of time.

Most respondents, however, kept their assets in brokerage accounts (31%). A Robo-adviser investment account was held by 14% of the participants. The study was conducted between December 23-25, 2021 among 2,200 people from the United States.

The cryptocurrency market has provided many people with the chance to earn money quickly. This is bolstered by the recent surge in cryptocurrency ownership, which corresponds with Bitcoin’s expected market expansion beginning in 2021. Last year also saw an increase in institutional investors entering the crypto sector.

Keeping money in the bank and investing in cryptocurrencies have varying outcomes depending on variables such as risk and reward. Bank savings accounts are insured and regarded as secure, while cryptocurrencies are unpredictable and lack a solid foundation.

Digital currencies, on the other hand, have given investors a chance to make money quickly over time. Despite a series of price dips in 2021, for example, the value of Bitcoin rose by at least 60%.

Saving money in the bank has come under fire in recent years, owing to the low-interest-rate environment and the influence of rising costs.

Furthermore, Morning Consult notes that:

“Look for continued adoption of cryptocurrency and related brands in the next year as younger generations lead the charge.”

At the same time, the study called on banks to devote greater internal resources to cryptocurrency exploration. The researchers anticipate that more clients will be interested in the crypto sector as a result of this shift.