On Wednesday, Facebook stock nosedived 20% after the company released disappointing fourth-quarter results. The numbers disappointed Wall Street enough to send the firm’s stock tumbling 20%.

Despite some predicted patterns emerging in the last quarter, including Apple’s iOS privacy changes dampening its advertising business, Facebook’s core app, Meta, is no longer attracting new users.

Why did Facebook stock drop?

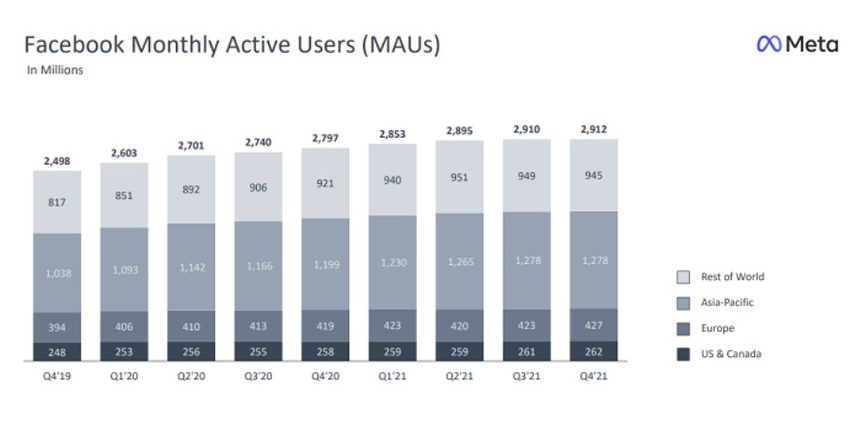

Facebook’s monthly active users (MAUs) remained unchanged during the fourth quarter of 2021 and the fourth quarter of 2022, at 2.9 billion.

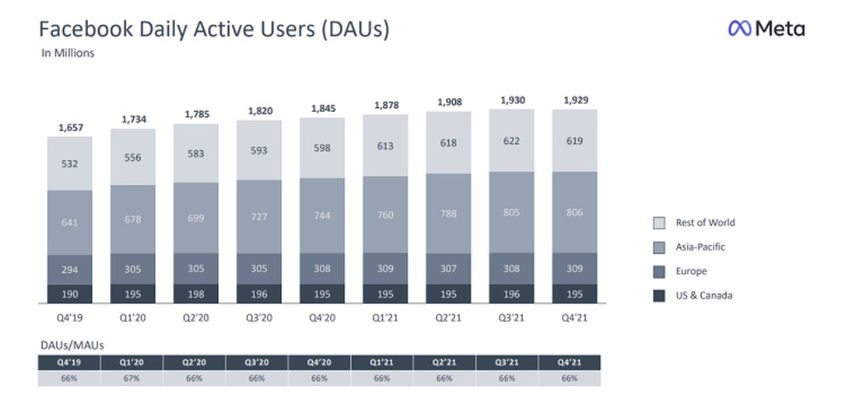

Worse, its daily active users (DAUs) dropped from 1.93 to 1.929 billion in the same period, a first for Facebook, which is known for its growth-at-all-costs attitude.

Some of this is self-evident. With just over a billion humans on the planet, it’s becoming increasingly difficult for Facebook to get new users. The firm is also putting more effort than ever before into its “family” of applications, including WhatsApp and Instagram, newer apps that still have a long way to go toward achieving mass popularity.

The company that was formerly called Facebook revealed its plans to rebrand as a “metaverse” business in the same quarter that usage slowed among users.

The bright side for Meta is that it still maintains the world’s biggest social graph. The not-so-good news? Even if a user decline was predicted, it’s just one more thing pointing to Facebook – and, by extension, the “Family of Apps,” as Meta refers to it – appearing like a relic from the past rather than a gleaming vision of the future.