The EV market is expanding day by day. Automotive manufacturers are experiencing a sales plunge, mainly due to the disruption of supply chains caused by the COVID-19 pandemic. After the supply and demand of cars and parts stabilize in 2023, they will be ready for emerging opportunities. They are already positioned for these opportunities as they had anticipated a sales bounce back years ago. Those who take the initiative in a diverse and changing environment are most likely to be winners.

The EV market’s rise in the world

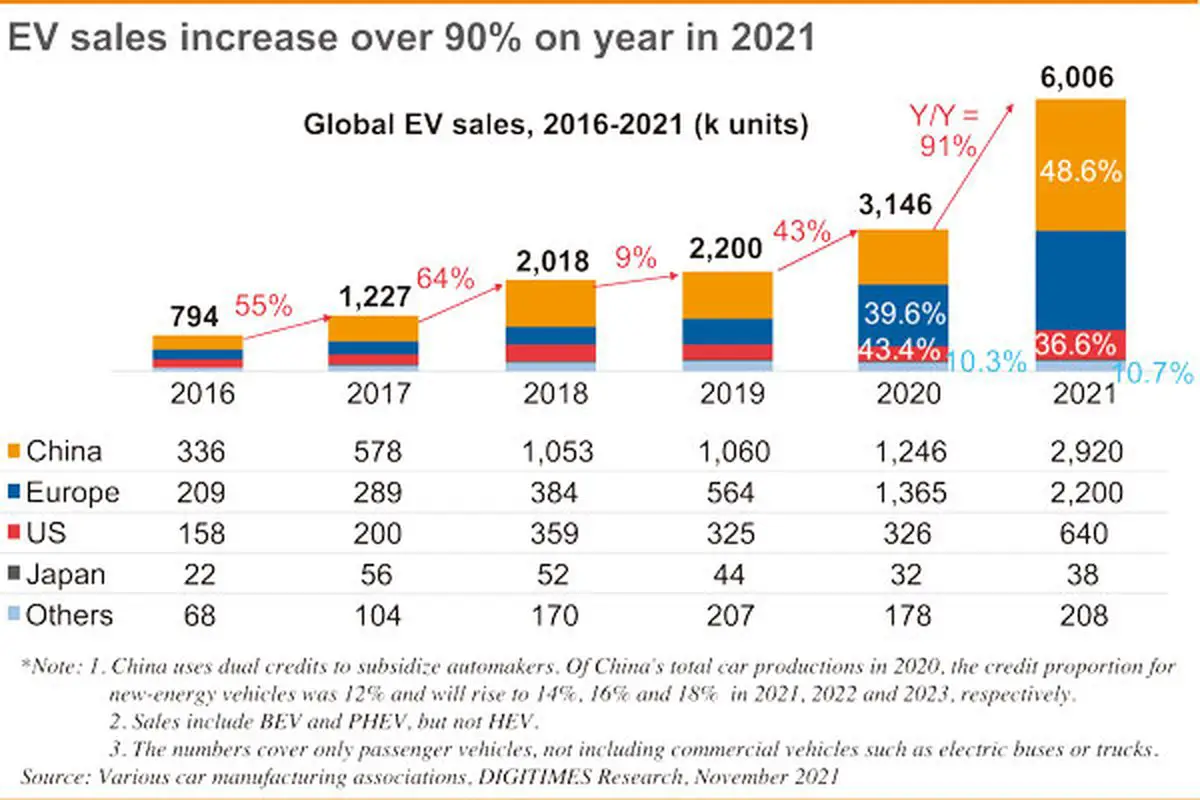

The global sales of EVs will reach 6.066 million in 2021 with a sequential increase of 91%. Many carmakers are now focusing on electric vehicles. China is still taking the lead in terms of penetration ratio among the major markets, with annual EV sales of 2.92 million units in 2021 accounting for 14% of China’s car market, up from 6.2% in 2020 and all the way up to 18% in 2023.

The China market is followed by the European market, which will increase from 564,000 units in 2019, to 1,365,000 units in 2020, to 2,210,000 units in 2021, with growth rates of 142%, 61%, and 59%, respectively. The European Union (EU) has adopted a “carrot-and-stick” policy, imposing carbon emission standards and offering massive subsidies to consumers. It is projected that the European market in 2021 will reach 2.2 million units, with a penetration rate exceeding 15%. When carmakers intention to avoid hefty penalties plus the promotion of multiple countries, it is estimated that global EV sales can reach 27 million units in 2025, with a chance to reach a penetration rate of 30%.

Automakers like Geely, BYD, NIO, and Xpeng have caught global attention because they are producing affordable electric vehicles (EVs) at a fast clip. These automakers are not only competing against each other but also against global car giants such as General Motors, Ford, Volkswagen, Toyota, and Nissan, who are pouring massive resources into the EV space. Various incentives from the Chinese government are propelling these new automakers to the forefront of the global automotive industry. Many automobile manufacturers have taken a public stance regarding US-China trade tensions, which would pose a challenge to their long-term business strategy.