Amazon used sales data to create knockoffs of popular goods and promote its brands in India. Its name is the Solimo Project. The objective is to identify and target “referenced” goods, then “replicate” them. The approach is as follows: “use data from Amazon.in to create items and use the platform to distribute those items to our consumers.”

This is how the firm used this approach in India, according to a Reuters study: it copied its most popular items and used sales data from sellers on the platform to compete directly with them.

How does Amazon copy products?

The Reuters investigation reveals how Amazon collected private sales data, then contacted the very manufacturers that produced those products to replicate them. The aim is for the company to be able to push its brands through searches in its online store once it has been acquired.

This investigation is one more drop in that glass that is getting fuller and fuller with these types of accusations. In 2018 the European Union initiated an investigation into Amazon for this issue and ended up accusing it two years later in a legal process that is still ongoing.

In the United States, there have also been long talk of practices that stifle sellers who use Amazon to distribute their products. If a product is very popular, it becomes vulnerable to clone and sold under Amazon’s brand, which is why the papers cited by Reuters demonstrate these methods in India.

According to these stories, the Solimo project’s goods were listed 10% to 15% below those of its rivals, and even the same manufacturers were utilized. The consultants gave us an example of John Miller’s apparel, a well-known Indian brand: they wanted to display John Miller’s outcomes in second or third place, and Amazon’s products in first.

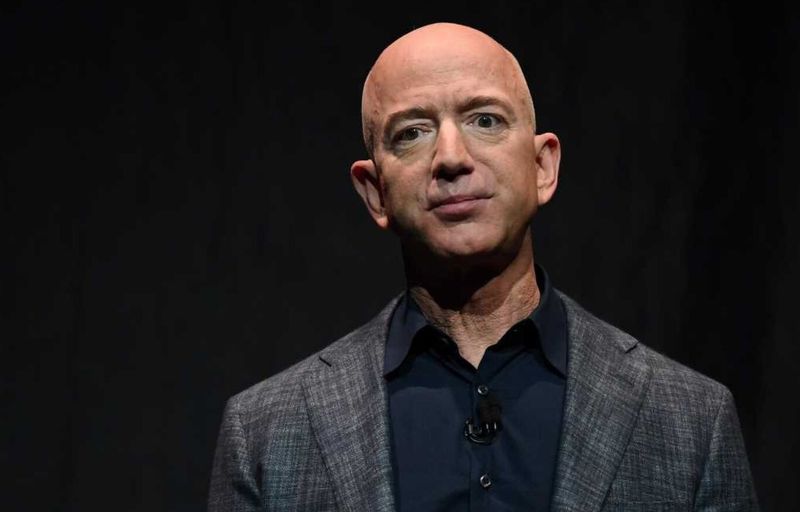

In 2020, the House of Representatives Committee on the Judiciary alleged that Amazon was engaged in anticompetitive behavior. However, Amazon refuted these accusations. Jeff Bezos himself indicated in July of that year that “we have a policy against using seller-specific data that helps our private label business,” he said.

Those statements contrasted with research conducted by Yahoo! Finance in 2019 that showed how the team developing proprietary products at Amazon had a “free buffet” when it came to that access to third-party data.

Interestingly in 2018 Bezos published a letter to investors in which he admitted that “third-party vendors are giving our products a big kick in the ass.” At that time sales of third-party products had gone on to account for 58% of Amazon’s total sales.

Amazon insists: They prohibit using sellers’ data for their benefit or that of any other seller

The company further adds that “Amazon does not give preferential treatment to any seller in its store” and that “Amazon’s policy strictly prohibits the use or sharing of non-public seller-specific data for the benefit of any other seller, including private label sellers.”