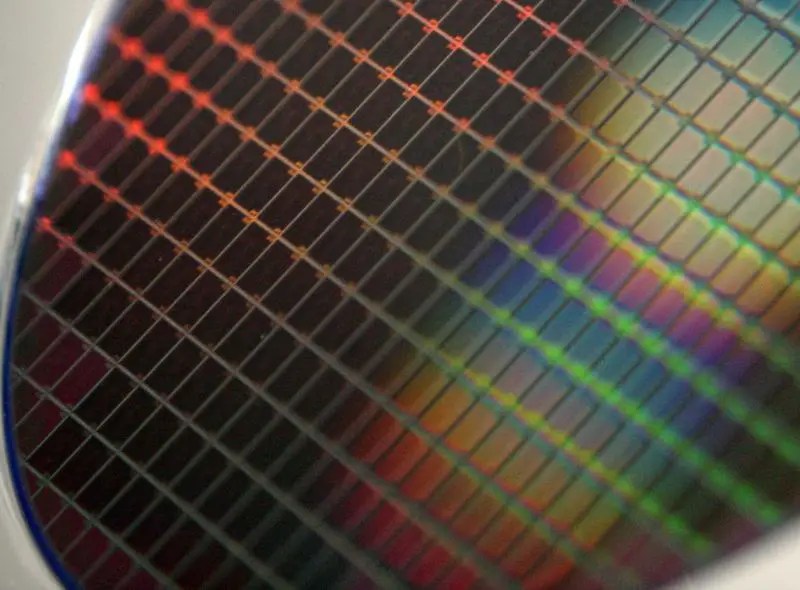

Entering the microprocessor market is by no means a piece of cake. Designing and producing high-integration semiconductors is much more complex than manufacturing chips for simpler equipment. And it also requires more resources. This is why we can now count the companies that compete effectively in this market on the fingers of one hand.

To discover, especially at this delicate juncture, that a company specializing in the design of high-integration semiconductors has decided to enter the general-purpose microprocessor market is a breath of fresh air. This company is the British company Imagination Technologies. It was founded in 1985, and today we can find its integrated circuits in a wide range of consumer electronics devices, such as smartphones or video game consoles. Even in some cars.

However, its specialty, the backbone of its current business, is the design of low-power graphics processors, computer vision chips, and integrated circuits for artificial intelligence. The reason this company has decided to enter the general-purpose microprocessor market is due to the positive momentum it has gained over the last few years.

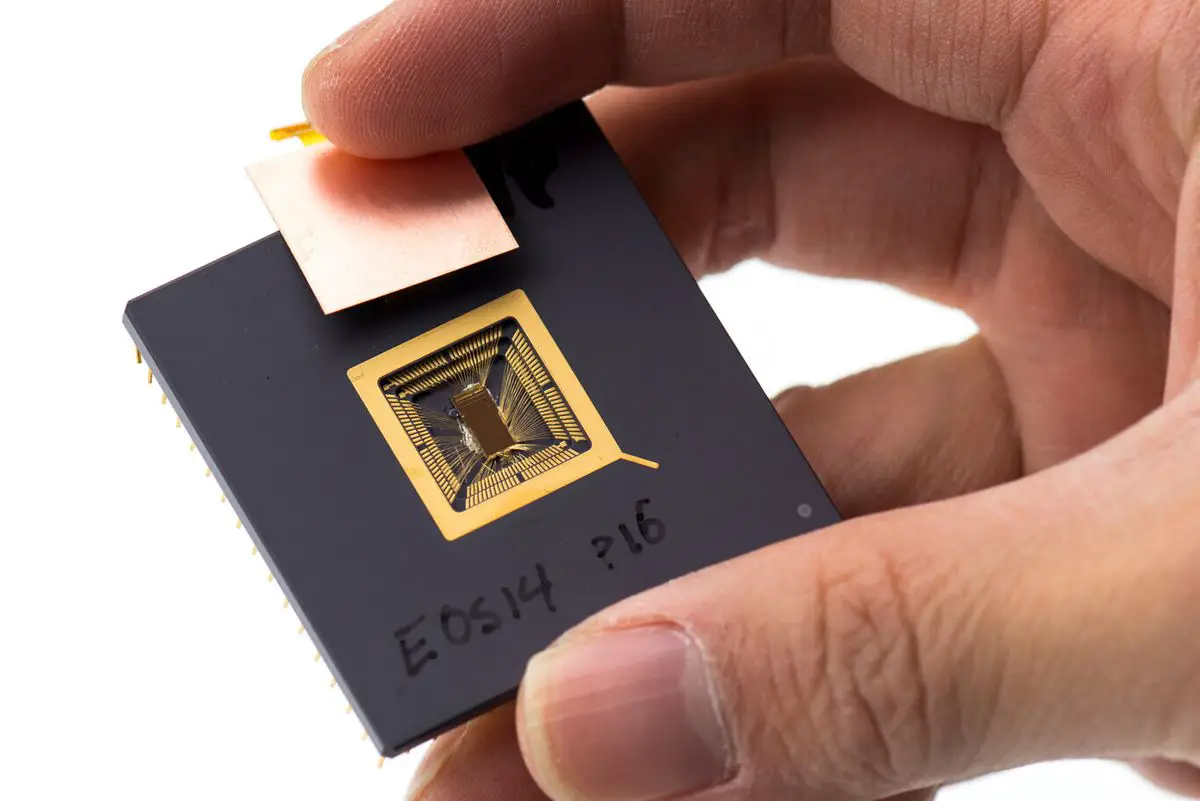

Imagination Technologies specializes in the design of low-power graphics processors, computer vision chips, and integrated circuits for artificial intelligence.

Imagination Technologies presented two days ago its financial results for the first half of this year, and its turnover has grown by 55% compared to the same period in 2020. Not bad at all. This growth is probably largely driven by the current huge demand for semiconductors.

This company is one of the largest suppliers of graphics chips for the automotive industry, which is currently in a delicate position because the semiconductor market is not able to meet its needs.

However, this company is much smaller than Intel and AMD. Infinitely smaller. Its turnover for the first six months of this year amounted to $76 million, a figure that leaves no doubt about its smaller size. But, precisely, its size is aligned with the type of microprocessors it will produce: chips with RISC-V architecture.

This is the decision that has prompted our attention to Imagination Technologies. And it has done so for a reason: this architecture is Europe’s best chance of becoming independent of U.S. CPUs.

RISC-V is Europe’s great hope

“The only option Europe as if it wants to be independent in supercomputing is to develop RISC-V processors. And it is a political decision. There is no other solution. These words were spoken by Mateo Valero during the conversation we had with him at the end of last February, and there is no doubt that he is a person who knows what he is talking about.

Mateo is a Professor of Computer Architecture at the Polytechnic University of Catalonia and Director of the BSC (Barcelona Supercomputing Center). He is also a renowned scientist and the leading architect of supercomputing in Spain.

RISC-V is a free hardware alternative to both the x86-64 designs from Intel and AMD and the ARM architecture CPUs that have proliferated so much in recent years. As we can deduce from its name, it is a RISC (reduced instruction set computer) design.

RISC-V is a free and open architecture. It is available to any person, institution, or company to be used and modified without paying any fee.

Its most obvious attraction is that since it is a free and open architecture, it is available to any person, institution, or company to be used and modified without paying any fee. This is a very powerful point in its favor and makes it attractive for a very wide range of usage scenarios, such as personal computers, embedded systems, or supercomputers.

It is precisely this versatility that Imagination Technologies wants to take advantage of. Moreover, it is much easier to take as a starting point an architecture such as RISC-V, which already has a solid base and does not require royalty payments, than to develop a completely new architecture and try to compete with it in a market as mature as that of general-purpose processors. From here on, everything is up in the air, but there is no doubt that this company is worth keeping a close eye on.