The disappearance of Huawei in Europe has had major changes in the market shares of many brands, but the most notable in the mid-range is Xiaomi.

The landing in 2017 of Xiaomi in Spain was very important. Not only because the company already had some market share even though it was not officially in our country, but because it was the prelude to what was to come.

Until that moment, except for ZTE and Huawei Chinese brands had not tried to storm the old continent. OPPO made a brief foray but soon retracted sails.

However, the U.S. veto of Huawei accelerated the plans of many companies, which have in part been slowed by the pandemic.

Xiaomi and Samsung sweep through the mid-range

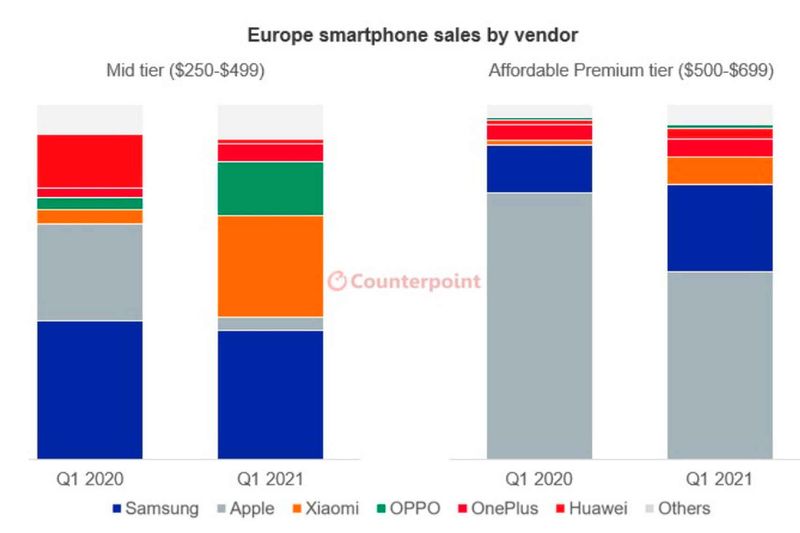

A great example of how the market has changed in the last year can be seen in the chart published by Counterpoint Research.

In the first part, on the left, we see how in the mid-range segment Xiaomi has grown disproportionately without affecting Samsung. Yes, there is an important bite to Huawei, but that increase seems similar to the growth of OPPO.

The one that has seen its share strongly reduced is Apple, which shines with its own light in the high-end and ultra-high-end, but in the mid-range almost disappears.

It is important to note that these two columns, from the first quarter of 2020 and 2021, refer to phones between $250 and $499, and there Apple does not have much to say.

If we look at the right-hand side, we also see a decrease in the Cupertino firm, although not as marked. In the high end (phones costing between 500 and 699 dollars), Samsung has greatly increased its sales, and Xiaomi has also grown, although much less than in the mid-range.

Taking a closer look

In spite of everything, we cannot lose sight of the fact that, although the first quarter of each year is good for Apple, it is the third quarter in which it shines the most because it coincides with the launch of the new iPhones each year.