What is Kyber Network (KNC) and how does it work? In the crypto world, most protocols and applications have a native token that is required to access the service offered, or to capture part of the profits generated by the commissions derived from it – as if it were a share that gives access to a dividend. If someone wishes to acquire such a token, they must go to an exchange to purchase it (usually using fiat, ETH, BTC, or one of the many existing stable coins), which is often a cumbersome process – as it often requires passing an identity verification or KYC process. To avoid this cumbersome identity verification process, avoid handing over your data, and have absolute control of your funds and private keys, DEX-like protocols such as Kyber Network would soon appear.

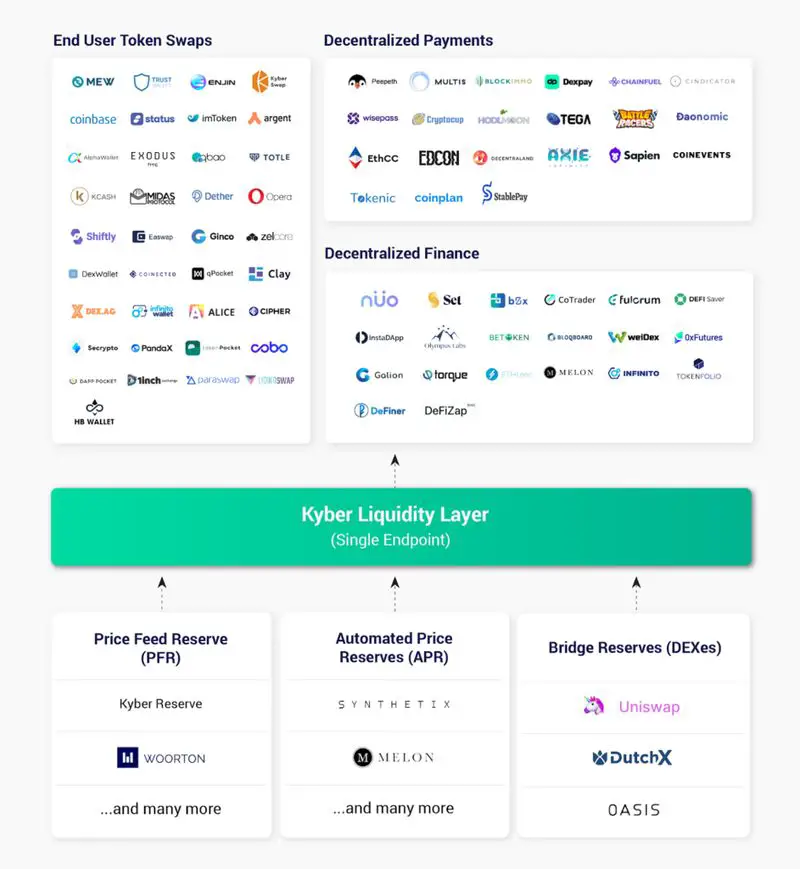

The project wants any token holder of any token to easily convert one token into another as quickly and easily as possible; so, Kyber’s mission is to enable seamless token-to-to-token exchange for an entire ecosystem of decentralized finance (Defi) applications on Ethereum.

On the other hand, the vast majority of decentralized exchanges often do not have sufficient liquidity to support active trading, and the costs to make changes to trade can be high when the order book is held on-chain.

In any case, all Defi applications need access to good sources of liquidity, which is a crucial aspect of providing good services. Currently, decentralized liquidity is composed of several sources including DEX (Uniswap, OasisDEX, Bancor), decentralized funds, and other financial resource applications. The more dispersed the sources, the more difficult it will be for anyone to find the best rate for conversion, or even to find enough liquidity to meet the required needs.

Kyber is a fully on-chain liquidity protocol, running on the Ethereum network, that can be implemented on any smart contract-enabled blockchain. The Kyber protocol aggregates liquidity from various sources into a single pool, which in turn provides a destination point for users to make multiple token exchanges in a blockchain transaction, and thus enables instantaneous conversion of digital assets (e.g., cryptocurrencies) and cryptocurrencies (e.g., Ether, Bitcoin, ZCash) thus providing high liquidity to any market.

Anyone can trade as a Kyber reserve to earn spreads on transactions and make their tokens available to other users, dApps, and financial platforms within the ecosystem, while their KNC token (Kyber Network Crystal) facilitates smooth trading on the network and connects their users.

The Kyber team has always aimed to be able to integrate with other protocols, so they have focused on providing developers with an architecture that allows anyone to incorporate the technology into any blockchain that works with smart contracts. As a result, a variety of different apps, providers, and wallets use Kyber’s infrastructure, including Set Protocol, bZx, InstaDApp, and the Coinbase wallet. Beyond apps, providers, and wallets, Kyber also integrates with other platforms such as Uniswap, thus sharing liquidity pools between the two protocols.

The protocol enables a wide range of implementation possibilities for liquidity providers, such as decentralized exchanges and other decentralized protocols. At the other end of the spectrum, end-users, cryptocurrency wallets, and smart contracts can perform instant “trustless” token exchanges with the best conversion rate among all liquidity providers.

There are a wide variety of blockchains with diverse characteristics focused on solving different use cases, which has contributed to creating a large number of emerging digital ecosystems. To support these emerging ecosystems, the Kyber protocol is playing a key role by facilitating liquidity between different stakeholders in the respective ecosystems. Beyond all this, the Kyber Network team is working on standardizing the design of the reserve-based liquidity model and actively developing solutions for cross-chain (linking between blockchains) such as PeaceRelay and Waterloo Relay Bridge, to create a liquidity network connecting different blockchains.

The Kyber Network team is focused on both protocol contributors, network maintainers, and the KNC holder community eventually working together on the governance of Kyber. As Kyber grows, having an appropriate decentralized governance framework in place will be crucial for deciding on major upgrades, treasury sharing, and other additional protocol features, as well as standardizing key aspects of deployments.

Kyber Network (KNC) history

Loi Luu, Yaron Velner, and Victor Tran are the founders of the project. Luu previously created Oyente, the first open-source security analyzer for Ethereum smart contracts, and co-founded SmartPool, a decentralized mining pool project. Velner has been actively participating in Ethereum’s bug bounty program, and Tran is one of the main developers also of SmartPool.

The team has a very full advisory board featuring Vitalik Buterin, as well as an extensive list of partners including Request Network, Wax, Toshi, Gifto, ICON, Wanchain, and MyEtherWallet, to name just a few.

In August 2017, Kyber successfully launched its beta version of testnet and, in the first quarter of 2018, launched its main net. During the rest of 2018, the team added support for ERC20-ERC20 conversions (KyberSwap) and created a set of APIs for developers.

Throughout 2019, they solidified their position as the leading liquidity protocol for the Defi ecosystem. In addition to reaching several key milestones such as $400M and 2M ETH in swaps and 500K in on-chain trading, making it clear that they are building a solid ecosystem where the number of integrated DApps and Kyber-focused liquidity providers is growing rapidly.

In 2020, the intention is to make further progress with a focus on 3 areas that will further drive the value of the decentralized ecosystem:

- Cementing Kyber’s position as a liquidity layer for Defi by having the majority of both users and project creators using Kyber as their sole provider.

- Implementing Katalyst: a major protocol update to encourage the participation of key stakeholders in the Kyber ecosystem.

- Expanding value creation options for KNC (Kyber Network Crystal) holders and placing them at the heart of Kyber governance through KyberDAO.

How does Kyber Network (KNC) works?

In essence, Kyber is a decentralized way to exchange ETH and different ERC20 tokens instantly, with no waiting or registration required. To do this, Kyber uses a diverse set of liquidity pools or groups of different crypto assets called “pools” that any project can tap into or integrate.

The Kyber protocol works by using pools of cryptocurrency funds called “reserves,” which currently support over 70 different ERC20 tokens20. Reserves are essentially smart contracts with a pool of funds. All reserves are controlled by different parties with different prices and funding levels.

Kyber Network maintains liquidity through a dynamic pool of reserves, and all reserve entities in the system are grouped. Having multiple entities in the pool prevents monopolization and keeps exchange rates competitive. When a user requests a swap, the smart contract exchanges through the reserving entity with the best exchange rate for the user. The reserves make money on the “spread” or the differences between the bid and ask prices.

A very simple example of how this works would be to imagine two people in the following situation:

- A owes B 0.5 ETH, but it turns out that A only has BAT (Basic Attention Token).

- B wants ETH and not BAT, so they use the Kyber protocol to settle the transaction.

- A sees on the Kyber Network interface that the conversion rate for the transfer is 1 ETH = 150 BAT and enters a request to Kyber to convert 0.5 ETH into BAT and send it to B.

- The Kyber contract (which controls the token reserve store) first verifies that A has included enough BAT in the contract for the conversion.

- After approval, the contract sends the 0.5 ETH to the address of B. With the Kyber Network’s standard contract wallet, it will appear to B that the funds are coming directly from A’s address.

- Finally, A’s BAT, plus a small fee, is added to the pool in which the ETH originated.

The Kyber protocol works with two types of transfer: basic and token to the token. A basic token exchange has the quote token (ETH) as the source or destination token of the exchange request.

The exchange occurs in a single blockchain transaction, and the execution flow of a basic token exchange where a user would want to exchange BAT tokens for ETH would work as follows:

- The user sends 1 ETH to the protocol contract and wishes to receive BAT in return.

- The protocol contract queries the first reservation to find out its exchange rate between ETH and BAT.

- Reservation 1 offers an exchange rate of 1 ETH for 850 BAT.

- The protocol contract consults the second reserve to find out the exchange rate between ETH and BAT.

- Reserve 2 offers an exchange rate of 1 ETH for 865 BAT.

- This process is performed in the same way as the other reservations.

- After iteration, Reserve 2 is found to have offered the best exchange rate between ETH and BAT.

- The protocol contract sends 1 ETH to reserve 2.

- The reservation sends 865 BAT to the user.

On the other hand, a token-to-token exchange is one in which the quote token (ETH) is neither the source nor the destination. The exchange as in the other case is done in a single blockchain transaction. Here is an example where a user wants to exchange BAT tokens for DAI.

- The user sends 50 BAT to the protocol contract and wishes to receive DAI in return.

- The protocol contract sends 50 BAT to the pool that offers the best rate of BAT to ETH.

- The protocol contract receives 1 ETH in return.

- The protocol contract sends 1 ETH to the pool that offers the best rate between ETH and DAI.

- The protocol contract receives 30 DAI in exchange.

- The protocol contract sends 30 DAI to the user.

When requesting an exchange, the user must specify the source and destination tokens, the minimum acceptable rate, and send the corresponding amount of the source token. The user will receive the destination token immediately if the transaction is successful, otherwise, the source token will be refunded in full.

There are some different functions in Kyber Network to be aware of, these are:

- Users, which Kyber calls “takers”: These can be individuals, apps, wallets, exchanges, etc., and send and receive tokens to/from the network.

- Reserve entities: They are in charge of providing liquidity to the platform. They can be internal or hosted by a previously registered third party and can be either public or private depending on whether or not the public contributes to their reserves. Reserves must implement the smart contract functions defined in the reserved interface to register to list their tokens. By allowing external booking entities, Kyber Network avoids centralization and opens the door to low-volume token listings. Booking administrators profit through the spreads they set for their bookings. They also get the benefit of higher volume when accessing the Kyber Network in general. The details of how reservations determine to price and manage their token listing are not dictated in the protocol and are entirely up to each reservation, as long as the implementation complies with the Reservation Interface. This opens the door to a wide range of reservation types that can be part of the network.

- Registered reservations: are those in charge of matching taker requests.

- Maintainers: refer to anyone who has permission to access the functions of adding/deleting reservations and token pairs, such as a DAO or the team behind the implementation of the protocol. A distinction can be made between two types of maintainers, protocol maintainers, who focus on both protocol-level governance and the unified provisioning of KNC (The Kyber token, which we will discuss later), and network maintainers, who focus on the economic and technical features of the implementation on their blockchain.

All of these roles interact with the Kyber Network smart contract in different ways.

At the heart of the design, the smart contract protocol provides a single interface to the best available exchange rates for each token to be taken from a pool of liquidity from among a variety of sources. The protocol architecture has the following properties.

- Aggregated liquidity pool: The protocol aggregates several liquidity sources into a liquidity pool, which makes it easier for takers to find the best rates offered on each request.

- Diverse liquidity sources: The protocol allows connection to different types of liquidity sources. Liquidity providers can employ different strategies and different implementations to provide liquidity to the protocol.

- Permissionless: The protocol is designed to be permissionless so each developer can set up various types of reserves, and any end-user can provide liquidity. Implementations must take into account several security vectors, such as spam reservations, which can be mitigated by staking mechanisms.

Since the main function facilitated by the Kyber protocol is the exchange of tokens between takers and liquidity sources. The protocol aims to provide the following properties for token exchanges:

- Instant settlement: takers do not have to wait for their orders to be fulfilled, as the process of finding the match for the exchange and settlement occurs in a single blockchain transaction. This allows exchanges to be part of a series of actions that take place in a single function of the smart contract

- Atomicity: when takers make an exchange request, their exchange is fully executed or otherwise reversed. This all-or-nothing aspect implies that takers are not exposed to the risk of a partial swap execution.

- Public verification of rates: anyone can verify the rates offered by the reserves and have their transactions settled instantly by simply checking with the smart contract.

- Ease of integration: Trustless exchanges (no need to rely on a third party) of tokens can be directly and easily integrated into other smart contracts, enabling multiple exchanges in one smart contract function.

KNC

Kyber’s native token is called Kyber Network Crystals (KNC) and is an ERC-20 token.

All reserves are required to pay a fee into KNC for the right to manage the reserves. The fees are used in part for operational costs and in addition to rewarding third parties that bring transaction volume to the network. After using the proportionate amount of KNC on these two things, the remaining tokens are burned (taken out of circulation).

The company minted a total of 226,000,000 KNC during the ICO and distributed just over 60 percent among public participants. There are currently about 180,432,603 KNC in circulation. This number will fluctuate over the next two years as the founders’ and advisors’ supply token enters the market.

Kyber Network Crystal (KNC) is an integral part of the protocol and will play a key role in the economic, governance, and treasury aspects of all protocol implementations. Networks that do not have KNC as a key part of their use and governance will not be considered or supported by the project or the community. The particular use of KNC in the different blockchains will depend on the specific implementation in each of them.

KNC facilitates the smooth operation of the Kyber Network reserve system. To operate and provide liquidity the reserves must have KNC in their possession to pay for their transactions on the network, since Kyber Network charges transaction fees, in KNC, to these reserves. Yet with the implementation of Katalyst, the next protocol update will change this, and it will be the takers who will be responsible for the fees.

Entities that leverage Kyber’s liquidity network, by registering and connecting to its networks, such as DApps (decentralized applications), or companies earn fees in KNC after each transaction they facilitate on Kyber Network. For example, a DApp platform integrated with a protocol API will receive commissions in KNC for directing more users to the network and thus helping to generate greater adoption.

As the protocol is rolled out, there are several ways to implement a staking mechanism with KNC, which could act as a barrier against potential malicious actors and thus safeguard the integrity of the Kyber ecosystem. For example, reserves could be required to deposit KNC in staking to become part of the network, or relayers and validators could also be required to facilitate cross-chain transactions between Kyber-based networks on different blockchains.

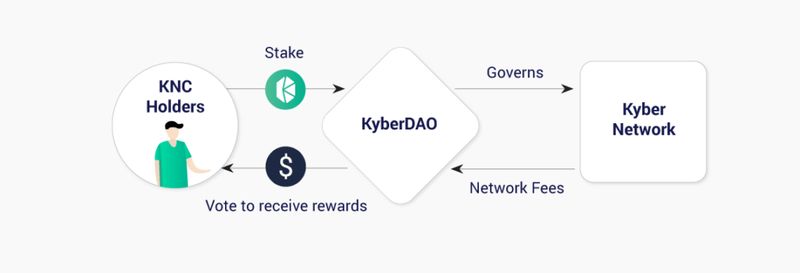

Kyber will introduce a new staking mechanism for its token model. This new model will allow KNC holders to receive part of the network’s commissions by depositing KNC in staking and participating in KyberDAO, something that is planned for 2020.

The team is also working on cross-blockchain transactions so that KNC tokens can be easily moved from one chain to another. For that, they are exploring various cross-chain technologies (e.g. PeaceRelay and Waterloo) so that they can enable this feature in a technically feasible way.

As mentioned above, the project also has in hand the upcoming launch of a DAO (Decentralized autonomous organization). Through KyberDao KNC holders will be able to decide on key parameters such as the utilization of network fees (currently 0.25% per transaction, subject to change), or the ratio/percentage between the amount of KNC burned, staking rewards, and incentives for reserve creators.

In the future, the DAO will likely also be able to decide on token inclusion, reserve approval, and network development grants. Key members of the Defi ecosystem are expected to actively participate in the governance of Kyber.

Work is also underway to develop a KNC-based treasury that network maintainers and DAO members will be able to leverage to fund the development, commercialization, and growth of the Kyber protocol through open grant programs.

Kyber Network (KNC) applications

The most straightforward and basic function of Kyber is to instantly exchange tokens without registering an account, which anyone can do using an Etheruem wallet such as MetaMask. Users can also create their reserves and contribute funds to a reserve, but this process is still quite technical, something Kyber is working to make easier for users in the future.

The team is developing a system to allow liquidity to move freely and transparently between different blockchains. With project Waterloo or PeaceRElay, they are trying to make relaying between Ethereum and EOS, or Ethereum and Ethereum Classic, viable. And they hope to make it possible for any blockchain to interconnect with other blockchains to achieve greater liquidity.

Kyber has recently implemented in its protocol “limit orders” in its transactions. This allows users to set a specific price at which they would like to exchange a token instead of accepting whatever price currently exists at the time of the trade. However, unlike other exchanges, Kyber users never lose custody of their crypto-assets during trading.

Kyber’s goal in the coming years is to consolidate its position as a unique solution to drive liquidity and token exchange on Ethereum. In 2020, Kyber plans a major protocol upgrade called Katalyst, which will create new incentives and growth opportunities for all stakeholders in its ecosystem, especially KNC holders. The upgrade will mean more use cases for KNC, including using KNC to vote on governance decisions, as mentioned earlier, through KyberDAO.

Kyber Network is an interesting protocol that brings speed, security, and liquidity to the cryptocurrency exchange process. The project is positioning itself as the main liquidity provider in the Defi ecosystem of the Ethreum network, and its future is promising, especially considering the imminent update of its protocol (Katalyst), and the launch of KyberDAO.