Compound Finance is a decentralized cryptocurrency lending protocol, a financial practice that shares many characteristics with traditional peer-to-peer lending platforms, the main difference being its “trustless” nature – that is, the fact that it uses blockchain technology to dispense with central authorities acting as intermediaries.

Thus, Compound Finance involves two main actors with opposing, though interchangeable, interests: on the one hand, lenders, who deposit their cryptocurrencies in the protocol’s liquidity pools in exchange for an interest rate; and on the other, borrowers, who can use their cryptocurrency funds as collateral to obtain a loan – in a stablecoin or another cryptocurrency different from the one deposited.

On the surface, this may not seem groundbreaking, but having a credit market with competitive interest rates is critical to any financial infrastructure – and until recently, the cryptocurrency sector lacked one. Without interest rates, many crypto assets will have negative nominal or real returns, as various dilutive factors – such as inflation of the money supply – can occur, discouraging investment.

What is new compared to traditional credit markets is the non-permissive and open nature of the Defi ecosystem’s cryptocurrency lending protocols. Attributes that help optimize interest rates across platforms and facilitate the emergence of new products. On this basis, Compound is presented as an open-source protocol based on blockchain technology, designed specifically for decentralized money markets, and with algorithmically set interest rates.

As with all decentralized cryptocurrency lending platforms, Compound users can generate a return -APR- by depositing their assets in liquidity pools. Such return will come from the interest rate paid by those users -borrowers- who deposit their assets as collateral to withdraw loans. This means that on the platform one can simply park one’s capital and generate an income from the interest paid by other users, or, if necessary, proceed to apply for a loan and swell the list of borrowers -thereby starting to pay interest instead of receiving it. This is interesting because we have two user profiles with apparently conflicting but interchangeable interests – one can start as a lender and end up as a borrower.

To obtain a loan in Compound, you only have to deposit crypto assets and activate their status as collateral. Each asset type has a different Collateral Factor – a percentage that determines the number of other cryptocurrencies you can withdraw as a loan, with your original deposit acting as collateral. If you deposit $100 of a given asset, and it has a Collateral Factor of 50%, this means you can borrow $50 worth of other cryptocurrencies. Once you are approved for a loan, Compound constantly tracks the collateralization level of your positions – which will fluctuate, due to the volatility of the price of the asset acting as collateral, and other factors such as accrued interest. If a lender does not take care of its position – by keeping the collateralization factor below the set limit – it risks having the capital it has pledged as collateral automatically liquidated – i.e. put up for sale at a discount, thereby losing a portion of it.

The pooled liquidity model introduced by Compound – instead of lending assets directly to another user, they are deposited in a series of smart contracts that autonomously manage the granting of loans – would represent a revolution. Before its introduction, most decentralized lending projects – such as EthLend – had been limited to exploring peer-to-peer models that required order books, were less efficient/liquid, and consequently had generated less traction.

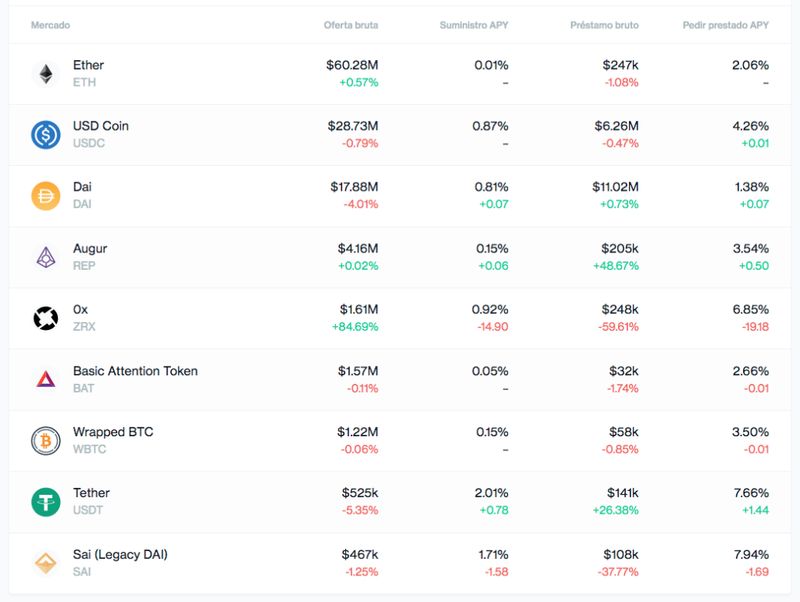

Currently, Compound supports markets for 8 crypto assets: ETH, USDC, DAI, REP, BAT, WBTC, ZRX, and USDT. One can access them through cryptocurrency wallets such as Metamask, Argent, or Trust Wallet; but also through aggregators such as 1inch or specialized Defi dashboards such as Zerion and InstaDapp -very useful because they allow liquidity providers to compare in real time the returns obtained and the current APR of each Compound market, with the one offered by other protocols.

History of Compound

Compound Finance would be founded in 2017 in San Francisco, by Robert Leshner and Geoff Hayes. The platform would be conceived as an open cryptocurrency lending protocol, capable of promoting credit markets with more efficient interest rates, and great improvements in user experience over the p2p systems tested until then. Unlike EthLend, one of the preceding decentralized lending protocols, Compound would opt for a “pooled liquidity” model – meaning that loans would be drawn from community pools of funds, managed by smart contracts, and where interest rates would be determined algorithmically based on supply and demand.

In May 2018, Compound would raise around $8 million in a funding round, led by such prestigious crypto-specialized investment funds as Coinbase, Polychain Capital, Andreessen Horowitz, Bain Capital Ventures, Transmedia Capital, Abstract Ventures, and Danhua Capital.

In mid-2019, version 2 of the protocol would be launched, which would introduce the concept of cTokens – the token that a pool’s liquidity providers would receive, as a pro-rata representation of their stake in the pool’s assets, plus accrued interest.

Thanks to all these functionalities, Compound has today become one of the pillars of Ethereum’s Defi ecosystem – with more than $90 million deposited in its liquidity pools and integration with most aggregators and cryptocurrencies.

Although the platform would not conduct an ICO during its funding rounds, it would end up launching a governance token called COMP in 2020.

How does Compound work?

In Compound, the interest rates of each market are determined algorithmically based on supply and demand, while the return produced by lenders’ deposits – a compound interest, as the name of the protocol indicates – is accumulated constantly, using each Ethereum block as a time reference. The loans do not set maximum return terms – as long as one remains below the maximum collateralization factor determined by the crypto assets deposited as collateral, one will have full operational freedom. The debt can be paid off at one’s convenience, one can continue to withdraw cryptocurrency loans until the limit determined by the aforementioned Collateral Factor is reached and, of course, there will be a mechanism to collateralized through new asset deposits the positions that remain open.

Deposits

When a user or a Defi-like application becomes a liquidity provider and deposits an asset in one of the markets available in the protocol, it will automatically start generating a variable interest from the capital it leaves parked. The interest will accrue steadily, at intervals that will coincide with Ethereum’s block time – that is, the time that elapses between the creation of one block of transactions and the next – which is equivalent to about 15 seconds on average. Users who deposit crypto assets in Compound and act as liquidity providers – lenders – will be able to withdraw their principal plus interest at any time.

It is important to understand the underlying mechanics: by depositing assets in a liquidity pool – a marketplace – lenders are making capital available to other users – borrowers – which they can withdraw in the form of loans. Ideally, such loans should be productively used by lenders – in such a way that by generating a return, they can repay the loan and earn a spread. In return for making capital available to other users that would otherwise be considered idle, borrowers – lenders – also earn a return – thanks to the interest rates that borrowers pay.

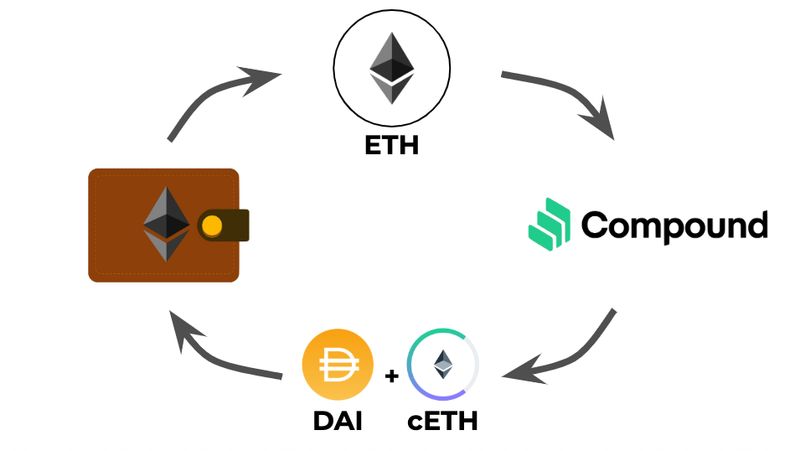

Since both the capital deposited and the interest generated accumulates in a common pool for each market, Compound would introduce in version 2 of the protocol a mechanism – an ERC20-compliant token – that would represent the pro-rata share of each liquidity provider. These tokens, called cTokens, are received at the time of deposit and can be exchanged for the underlying assets – the original principal plus accrued interest – at any time. And because they are ERC20 tokens, they can be easily exchanged through DEXs – or even deposited into liquidity pools of other protocols, such as Uniswap, to earn commissions.

Liquidity providers or lenders can make their deposits using the protocol’s official interface or through applications such as Dharma, aggregators such as 1inch, or dashboards such as Zerion and Instadapp, which connect with Compound’s smart contracts.

Loans

To request a loan, interaction with the protocol can be done through the same interfaces or applications as described above. We will now proceed to list the main elements involved in the operation and the dynamics established between them.

- Collateral: as explained above, the user who wishes to apply for a loan in Compound must first deposit funds to act as a guarantee – also known as collateral. To do this, the function that allows the deposited assets to perform this function must be activated. It is important to note that, although these cannot be exchanged or transferred while they are acting as collateral for a loan, they will generate interest – as is the case with all deposits of those users who are merely lenders. This means that in Compound there is no opportunity cost for the borrower – since one can be both a liquidity provider and a lender/borrower.

- Collateralization Factor: the Collateral Factor is an indicator that determines the maximum amount of crypto assets that a user will be able to borrow, based on the type of collateral and amount of collateral deposited as security. For example, if a user deposits $200 in ETH as collateral, and the collateralization factor established for this asset is 75%, the maximum amount of crypto assets that can be borrowed will be $150. It should be noted that the Collateral Factor is not a homogeneous indicator, but will vary depending on the nature of each crypto asset – depending on the risk or volatility, there will be cryptocurrencies that have lower factors than others. On the platform, it is possible to consult the updated Collateralization Factors of all assets that are accepted for deposit.

- Enter the market: the assets deposited in Compound cannot be used as collateral automatically, but it is necessary to first enable this function -called “enter the market”- with each of them. Once this has been done, the asset will continue to generate interest, but will also allow loans to be withdrawn on a collateralization factor basis – by acting as collateral.

- Account liquidity: earlier, we explained how the collateralization factor of an asset allows us to calculate the maximum amount we can borrow. But what happens when one has deposited multiple crypto assets as collateral, all of them with different Collateral Factors? How can we know the credit limit we have available in such a situation? Fortunately, Compound provides functionality that calculates the liquidity of each account – a value denominated in ETH, which determines the maximum amount of any crypto assets that the user will be able to borrow.

- Price oracle: in a platform like Compound, where it is necessary to calculate the liquidity of accounts and determine insolvencies, it is necessary to have a system that provides prices of the various supported assets, consistently. Such a system is an oracle, which is responsible for calculating the price as the average of the quotes transmitted by some of the most liquid exchanges in the market. The integrity of the information provided depends on a series of rules codified in the contract of the oracle in question.

- Loan balance: this is the value resulting from adding the amount that has been withdrawn in the form of a loan plus the accrued interest – i.e. the total amount that the user will have to pay back.

- Interest rate: as with similar services in the traditional financial sector, Compound requires an interest rate to be paid on the number of assets borrowed. The prevailing interest rate – different for each crypto asset – is applied continuously with each Ethereum block, and accrues to each borrower’s loan balance. Borrowers are not obliged to pay off their debt within any specific timeframe – unless the Compound oracle declares them insolvent – but can pay off part or all of the loan whenever they wish.

- Liquidation: the account of a user who has requested a loan is considered insolvent when the balance owed on the loan exceeds the liquidity of the account -liquidity which, as we have explained, is determined by the collateralization factor of the various assets used as collateral. Insolvent accounts can be liquidated by other users – which means paying the portion of the loan that exceeds the liquidity of the account and, in return, receiving part of the collateral as compensation. The incentive for liquidators lies in the liquidation discount, which currently stands at 8% – i.e. they will not receive the same amount of money they have disbursed to liquidate part of the borrower’s debt but will earn, in this case, 8%.

- Repayment of a loan: once the balance of a loan – the amount originally withdrawn plus accrued interest – is repaid, the user regains control of the collateral in his or her account, and can do with it as he or she wishes. The compound also has a feature that allows users to repay loans on behalf of other accounts.

Governance of Compound

Originally, from its launch in late 2018, Compound would operate as a decentralized protocol, but whose updates would be dependent on a central administrator – the Compound Finance development team. This would change as of April 2020, when a community governance system would be announced, designed to replace the administrator’s central authority. Similar to other projects such as MakerDAO, approval of any protocol-level changes – from the functionalities offered by smart contracts to the assets supported and their Collateral Factors – would be in the hands of the holders of a new governance token called COMP.

The idea of Compound’s founding team is that this transition to a community governance system will occur gradually, to ensure the security and stability of the platform.

COMP is an ERC20 token that not only allows owners to participate in the protocol’s decision-making processes but also to delegate their vote to applications or other individual users, such as Defi experts – which would represent the emergence of a new category of participants, emulating professional politicians in the real world. This means that to participate in Compound’s governance system you will not need to own the token in question – it will be enough for a COMP holder to delegate his or her voting rights to you. Another interesting feature is that the token also includes code that allows you to query the historical electoral weight of a particular Ethereum address – which can be very useful for iterating complex voting systems.

COMP aims to decentralize the decision-making process in Compound, so it does not present a mechanism for capturing value or an investment opportunity – although as with most tokens of this type, participation in the governance of the protocol will be rewarded with some sort of commission (fee) that will be applied to users of the services offered by the protocol.

During the initial period, a portion of the governance tokens will be distributed among Compound team members and shareholders – funds that invested in the financing round that took place in May 2018, such as Polychain or Andreessen Horowitz. The latter will be able to exercise the voting power that the tokens will grant them, or delegate it to whomever they see fit. It is important to note, however, that most of COMP’s money supply will remain in escrow and will not participate in the governance of the protocol. Until the process of decentralizing the governance system is complete, the token will not be made available to the public through any DEX, airdrop-type distribution systems or as an incentive for those who supply liquidity to the platform – a practice some are now calling liquidity mining.

Compund (COMP) token distribution scheme

- 2,396,307 COMP for Compound Labs shareholders.

- 2,226,037 COMP for the founders and the development team – subject to a 4-year vesting period.

- 372,707 COMP reserved for future team members.

- 5,004,949 COMP reserved for users of the protocol-probably to be used as an incentive for liquidity providers, as mentioned above.

Functioning of the governance process

Anyone who owns 1% of COMP’s money supply or to whom such amount of tokens has been delegated, will have the possibility to submit any proposal for improvement/change in the protocol. It is also intended to encourage all teams of external developers working in one way or another with the Compound protocol to actively participate in its governance. Examples of proposals that may be raised by a participant in the governance process include:

- Support a new asset on the platform.

- Change the collateralization factor of any of the cryptocurrencies already supported by the platform.

- Modify the interest rate model of a market or any other parameter or variable of the protocol that the current administrator can modify.

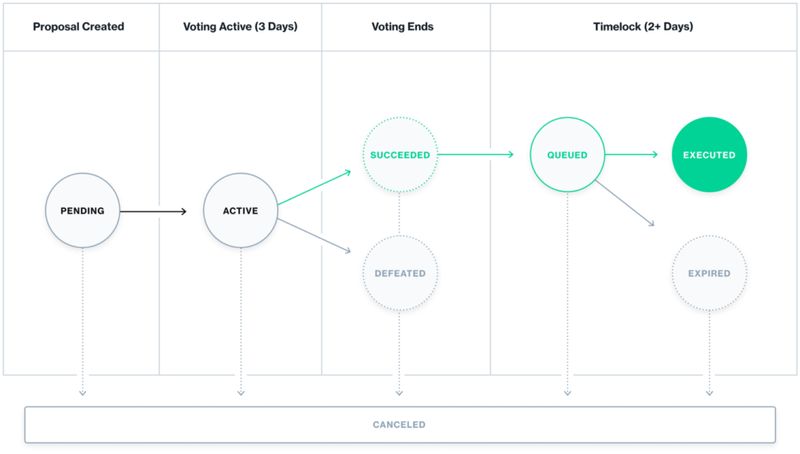

It is important to understand that the proposals are not presented in the form of suggestions to be developed by the technical team that has so far been in charge of Compound’s development but is already implementable code. All proposals are subject to a 3-day voting period, and any Ethereum management with own or delegated voting power will be able to speak in favor or against. If the proposal achieves a majority of yes votes – with a minimum turnout of 400,000 – it may be implemented after 2 days.

The compound will make available to users a Governance Explorer, with a complete history of all proposals, votes received, and other metrics. During the deployment phase, protocol administrators will maintain the ability to stall the governance system. When it has been sufficiently tested, and its security and decentralization are assured, the test sandbox will be suspended and the remaining tokens will be distributed to Compound users.

Compound applications

Like most decentralized cryptocurrency lending protocols, Compound offers a wide range of applications, which will vary depending on whether the user accesses the platform primarily as a lender or as a borrower. Some of these applications are listed below:

The most obvious use case for liquidity providers – whether individual users or Defi-type applications – is to put capital to work that would otherwise sit idle – and either generate no return or may even be diluted by inflation.

More sophisticated investors, on the other hand, will be able to take advantage of the imbalances that often occur between Compound’s interest rates and other cryptocurrency lending platforms, to perform carry trade arbitrage and thus make a profit. They may also participate as liquidators to help maintain the stability of the system and be rewarded for it.

Compounding also allows you to gain long exposure to an asset with self-leverage – you can deposit a particular asset that you believe will appreciate, borrow a stable currency with a favorable interest rate, and then buy back the same asset that was deposited as collateral. If this asset appreciates more than the interest rate of the stable currency loan, you can pay off your debt by earning a difference.

Finally, Compound allows one to obtain liquidity from cryptocurrency funds, without having to sell them – which is considered a taxable event and also prevents one from benefiting from the potential future appreciation of the asset one is disposing of.