MakerDAO is a decentralized lending platform based on Ethereum, peer-to-contract (i.e. between the user and the smart contract, without intermediaries). MakerDAO allows opening collateralized debt positions with cryptocurrencies – mainly ETH, but also other ERC20 tokens – to mint the stable coin DAI (a stable coin pegged to the US dollar). Dai’s stability is not only achieved through a system that controls the collateralization threshold of open CDPs (Collateralized Debt Position) but also through autonomous feedback mechanisms and incentives for external actors. Once generated, Dai can be freely sent to others, used as payment currency for goods and services, or held in the form of long-term savings.

To understand what MakerDAO is, the first thing to understand is what Dai, the first product of the Maker organization, is.

Dai is a type of stablecoin. The concept of stablecoin (stable currency) is quite simple: it is a token (like bitcoin and ether) that exists on a blockchain. But unlike bitcoin or ether, it has no volatility, although that is relative because the price of Dai does fluctuate, the thing is that compared to crypto-assets like ETH or BTC, we can consider Dai as a stablecoin.

Dai is pegged to the US dollar, and each one is equivalent to one dollar. What makes this coin unique compared to all other existing stablecoins is that each Dai is backed by Ether instead of a third party claiming to have the required collateral. In general stablecoins like Tether, TrueUSD, and the like are backed by projects that hold USD in bank accounts and issue tokens on the blockchain collateralized by these dollars. The problem is that in these cases we have to trust that this third party intermediary has the right amount of USD and does not generate artificial inflation, plus any of these projects could refuse to exchange their cryptocurrencies for dollars for any regulatory reason, their bank accounts could be frozen, or they could directly defraud the holders of those cryptocurrencies.

This goes against the crypto spirit which is characterized by being permissionless (i.e. it does not require permission from a third party).

Maker Dai is a stable coin that lives entirely on the blockchain and its stability is not contingent on an intermediary so there is no need to rely on the legal system, but given that Ether is volatile, maintaining correlation with the USD poses interesting challenges.

History of MakerDAO

The Maker protocol is an open-source project started in 2014 to create a permissionless credit system that allows users to obtain loans secured by cryptocurrencies. These loans are created by smart contracts that mint Dai, a stable currency pegged to the US dollar. The protocol was built by the Maker Foundation along with several external teams and, over time, the foundation has been reducing its level of control, which it has gradually ceded to a decentralized autonomous organization (DAO) known as MakerDAO that governs the protocol. The DAO is made up of individuals from around the world who hold the MKR token that gives its holders the right to vote to decide on major changes.

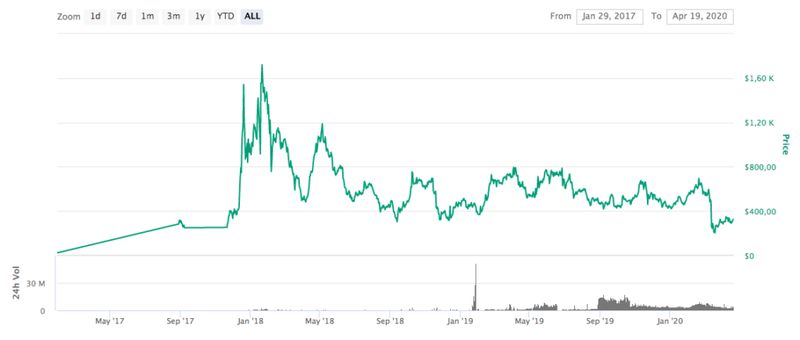

The project was started in 2015 and did not conduct an ICO, but decided to privately sell MKR tokens to fund development. Maker’s stable coin Dai was launched in early 2018 and has experienced significant traction since then.

Dai was initially only backed by Ether (Single Collateral Dai), and since it was the only stable coin that did not require a company to back it with US dollars, it became an integral piece of the growing Defi ecosystem.

While the SCD proved to be effective, the intended goal was to transition to a Multi Collateral Dai (MCD) that could accept other assets as backing to generate Dai, as well as implement other key design changes.

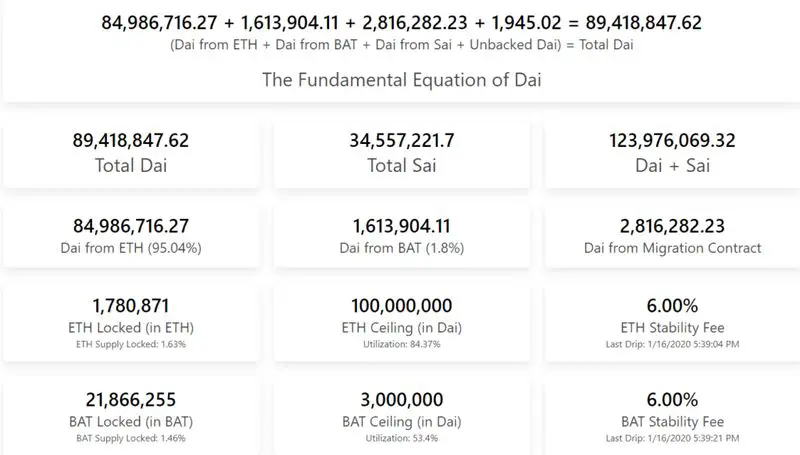

In November 2019, Dai reached its maximum debt ceiling of 100 million tokens and multi-collateralized Dai (MCD) was introduced, with BAT (Basic Attention token) as the first additional collateral available, thereafter Dai started to be backed by multiple assets, and although these two modalities continued to coexist after the introduction of MCD, The plan is for the single collateral Dai (SCD) system to be phased out completely. Thereafter, the new multi-collateralized tokens started to be called “Dai”, while those collateralized only by ETH started to be called “Sai”, furthermore CDPs collateralized by different assets started to be called “Vaults”, e.g. ETH deposited as collateral to generate Dai started to be stored in an Ether Vault, while those of BAT used as collateral started to be stored in a BAT Vault.

Beyond all this, other important design changes were made, such as the introduction of the Dai Savings Rate (DSR), which we will discuss later, allowing Dai holders to generate a yield and auctions of the collateral that created a competitive market for CDP settlements.

MKR’s market cap currently stands at $326 million, and the total USD value of the MKR contract i.e. the amount of ETH locked as collateral is $451 million, or 2.4 million ETH.

How does MakerDAO work?

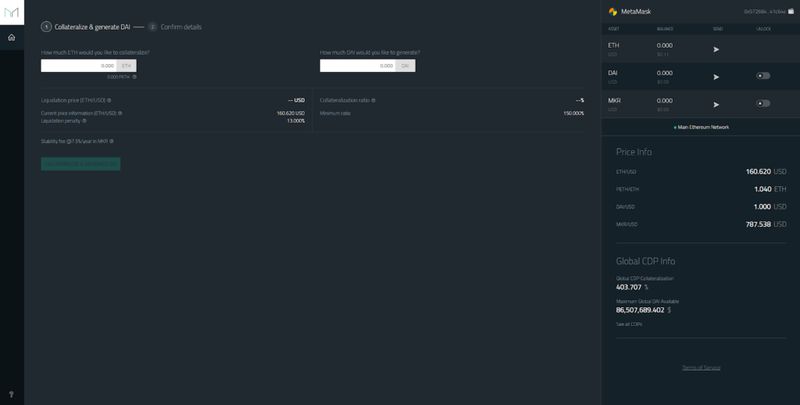

The user deposits Ether or another permitted token into Maker’s smart contract, creating a CDP (Collateral Debt Position, or Collateralized Debt Position).

The collateralization ratio is 150%, which means that the price of the deposited ETH has to be 150% of Dai being lent. If we want to borrow 100 Dai, for example, it will be necessary to deposit ETH, (or BAT) for a value of 150$ (remember that 1 Dai is equivalent to one US dollar).

As mentioned before, ETH is a highly volatile asset, so its price can increase or decrease in a relatively short time, if the price of Ether falls below the collateralization ratio, in this case, 150$, the CDP will be automatically closed. This is done to ensure that there is always enough capital backing the amount of Dai being lent.

If the value of the ETH held as collateral is worth less than the amount of Dai it is supposed to back, then Dai would not be worth a dollar and the system could collapse.

Maker combats this by liquidating the CDP and auctioning the ETH before the value of the ether is less than the amount of Dai it is backing, so as the price of ETH falls below the collateralization ratio (150%) the CDP is “liquidated” and the ether within the CDP is auctioned for Dai until the Dai that was extracted from the CDP is recovered. This action is carried out by so-called “keepers”, traders who use programs to scour the blockchain for CDPs at risk.

Let’s imagine that for 1 ETH at $150 we borrow 80 Dai (borrowing 100 would be very risky as any drop in the price of ETH below $150 would automatically liquidate the CDP), with 80 Dais borrowed the value of the collateralized ETH has to be at least $120 (150% of 80), if the price of ETH drops to say $118 and the user has not had time to re-collateralize it, the CDP will automatically close. In such a case, the user keeps his Dai and gets back the ETH left over after the auction (if there is any leftover), minus a 13% penalty that goes to MakerDao, the Dai that is recovered after auctioning the locked ETH in the CDP that is canceled is burned and disappears.

There is another scenario in which the CDP is not closed because the collateralization ratio is maintained, and after the time that the user considers can voluntarily close its debt position by returning Dai loaned plus an interest called “stability fee”, this interest can fluctuate, and is determined by the DAO after a vote of the MKR holders.

The stability fee is used as a mechanism to keep Dai anchored with USD, thus acting as an instrument of monetary policy.

If the supply of Dai increases its price about the USD would fall, and in that case, the DAO could vote to increase the stability fee so that users find it more expensive to generate new Dai, and the closing of CDP’s is incentivized (the stability fee is linked to time, it is annual, so if it increases, the longer the CDP is open the more interest must be paid), in this way its supply would be reduced and the price would increase to reach the exact parity with the USD, and the same could be done in the opposite case.

This mechanism has proven to be extremely versatile, which has allowed Dai to maintain its peg to the USD despite the January 2018 market collapse and the volatility that followed.

There is still another mechanism to control Dai’s flow to keep it anchored to the value of the USD, which is known as the Dai Savings Rate, or DSR.

The DSR is an interest rate applied to Dai deposits.

In November 2019, the MakerDAO system implemented a major upgrade. The upgrade introduced some new concepts, including the Dai Savings Rate, an interest rate that applies to all Dai deposited in a particular smart contract. This interest rate is paid from funds generated by stability fees and its rate is also decided by vote through MakerDAO.

The DSR provides the MakerDAO government with another tool. Instead of maintaining the Dai/USD parity through a supply reduction/expansion mechanism, it became possible to use the DSR to influence the demand for Dai. An increase in the Dai savings rate would increase the demand to buy Dai at an exchange, deposit Dai purchased in the DSR contract, and thus generate interest. Conversely, lowering the rate would encourage users to sell Dai to invest elsewhere.

The Maker Token (MKR)

The DAO (decentralized autonomous organization) is backed by a second token in the system, whose value is not stable but is used to help maintain the stability of Dai, this token is MKR or maker coin.

MKR is a token that runs on the ethereum blockchain (like the rest of the Maker ecosystem) and has governance rights over Maker smart contracts.

For example, the number used in the examples above (the CDP Collateralization Fee, Stability Fee, and DSR) are set by a vote of MKR holders. In exchange for regulating the system, MKR holders are rewarded with fees.

However, there is a handicap for owning MKR. In case the collateral deposited in the system is not enough to back the existing amount of Dai, MKR is used to raise the additional collateral needed, and this is done by selling it in the open market. This provides a strong incentive for MKR holders to responsibly regulate the parameters within which CDPs can create Dai since ultimately it will be their money that is compromised if the system fails, not that of the Dai holders. Another important aspect of how MKR works is the fact that when the stability fee is paid, an equivalent dollar amount of MKR is purchased, which is then burned, and the same is done with the 13% penalty on the value of the collateral in ETH that is charged when a CDP is closed. This reduces the supply with the result that MKR holders are rewarded. This means that MKR is a deflationary currency.

Despite being developed over the years by some of the best developers in the blockchain space, enduring rigorous auditing at the bytecode level, and having a stablecoin (Dai) that has performed very well despite the occasional market crash, we all know that nothing is perfect. To keep the system as secure as possible and avoid the unforeseeable, the Maker team has added a process called “Global Settlement”. When Global Settlement is activated, the entire system is frozen and all Dai and CDP holders receive the deposited collateral. For example, if Global Settlement is activated and I have 150 Dai, and ether is worth $150, I can exchange my 150 Dai for an ether directly through a smart contract. The collateral contained in the CDPs will be similarly delivered to their owners. A group of trusted people who hold the keys to the global settlement can activate it if they see something going wrong. This might lead one to think that this is a centralized system, but in reality, it is not. The only thing a Global Settlement can do is return collateral deposited by users. It cannot steal your ether or Dai, nor interact with the system on your behalf. In the worst-case scenario what could happen is that you end up exposed to the volatility of your collateral until the problem is solved.

MakerDAO Applications

One of the MakerDAO team’s goals regarding Dai was to solve the problem of the extreme volatility of cryptocurrencies and to do it in a decentralized way.

In the project’s whitepaper, the team cites several examples such as Bitcoin dropping 25% in a single day or rising over 300% in just one month. The MakerDAO team is well aware that stable digital assets are imperative to enable blockchain technology to reach its full potential. Because of this, it introduced Dai, which is backed collateral.

In the Dai Stablecoin System whitepaper, the team also describes numerous potential uses for Dai, related to what is known as the addressable market. Those trading in prediction markets or using gambling applications already face a great deal of risk due to their predictions and can minimize the potential additional risk by transacting with a stable token rather than a volatile cryptocurrency.

On the other hand, CDPs within the system will provide the option of permissionless leveraged trading for hedging, leverage, derivatives, and financial markets. And is that although it has not been mentioned, thanks to the PDCs it is possible to perform a fully decentralized leverage since anyone can take the Dai they borrowed and use it to buy more ether, even repeat this action several times, by doing this, basically you are buying ETH “on margin” this is one of the most widespread practices among users of PDCs.

Beyond all this, both governments and charities could increase their efficiency and reduce corruption with Dai due to its transparent accounting system.