Today we are going to review What EBITDA is and how to calculate it. Organizations, regardless of the sector of activity to which they are oriented, have as a general and main purpose to be profitable over time, so economic analyses tend to be made on a regular basis, supported by financial indicators that reflect the status of the organization at a given time.

The financial indicators will guide investors and stakeholders on the direction that the organization in question should follow or take to ensure that the estimated or planned profits are obtained. One of the most important and widely used financial indicators as a “guide” for a primary analysis is the EBITDA indicator, which is one of the best known in the financial area.

What is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation and Amortization. It analyzes the capacity of an organization or company to generate profits.

It is an indicator that refers to the gross operating profit calculated before the deductibility of financial or tax expenses (it excludes them), which can be positive or negative.

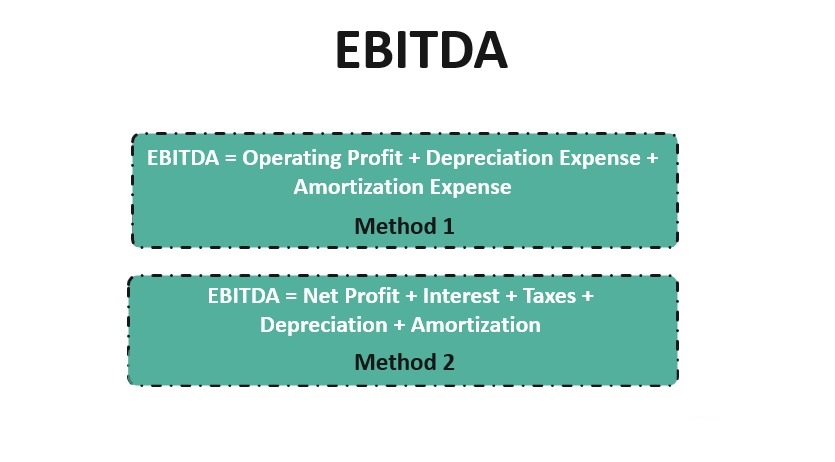

How to calculate EBITDA?

It is usually calculated using the following formula:

EBITDA = Operating income (EBIT) + Depreciation (provisions) + Depreciation and Amortization

EBITDA = (Revenues – fixed costs – administrative and selling expenses) + Depreciation + Amortization

As for fixed costs and administrative and sales expenses, these refer to personnel costs, advertising, rent, utilities: water, electricity, telephone, internet; equipment renewal, etc. In the case of amortization, these include the amortization of tangible assets and the amortization of intangible assets, and in the case of depreciation, this includes the impairment of assets, including inventories.

It is important to remember that the value is a very pure result, which does not take into account certain circumstances, so this indicator does not reflect the real financial situation, but rather reflects an interpretation of the probability that a project may or may not generate liquidity. It may be the case of an organization or company with a very high EBITDA, but at the same time with very high debt, so it is recommended (if you want to establish the real financial situation of an organization) to compare it with other indicators (such as sales and enterprise value, among others). Its use is recommended mostly at an internal level, for example in management reports.

Examples

The calculation is actually very simple, but an example for an organization X is detailed below. Let’s assume, that company X obtained a net income of $200,000, administrative expenses of $50,000, cost of sales of $70,000, $10,000 corresponding to amortization and $20,000 of depreciation. Then:

EBITDA = (Revenues – fixed costs – administrative and selling expenses) + Depreciation (provisions) + Amortization.

EBITDA = ($200.000 – $70.000 – $50.000 ) + $10.000 + $20.000

EBITDA = $80.000 + $10.000 + $20.000

EBITDA = $120.000

You can also use an amortization schedule calculator to find out more.

What is the difference between DFN and Ebit?

DFN indicates the issuer’s ability to acquire additional debt and refinance maturing debt, so unlike EBIT, DFN is more meaningful in assessing the leverage of debt issuers. It is a widely used term within Europe (with year-end closed data), as it reflects the ratio of net debt to shareholders’ funds (income).

What does negative EBITDA mean?

A negative EBITDA value reflects that a certain project is not viable, so many companies use it as a sufficient reason or justification to know that the project will not generate the expected profits or earnings.

When is it considered optimal?

The optimal level of EBITDA goes hand in hand with the economic sector to which the project belongs (for example, the technology sector will generally have a higher debt than the agribusiness sector), as well as the level of leverage it has, so that debt is not always synonymous with a negative outlook, since if the company has the resources to pay it, then it will not be a negative factor.