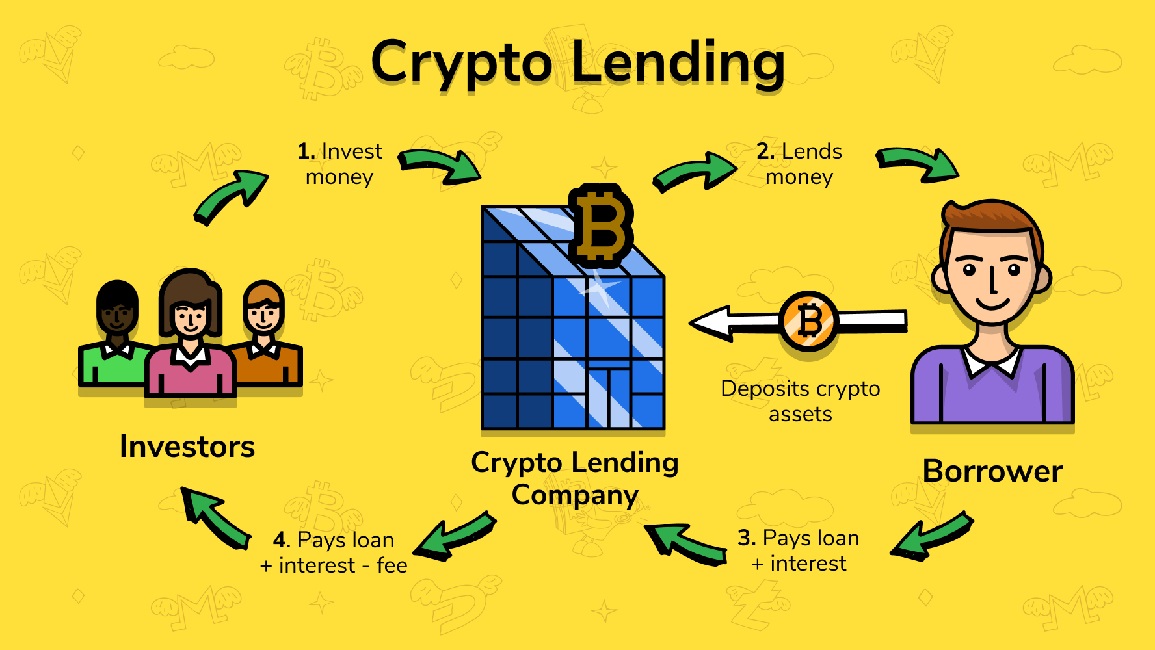

Today we are going to explain what crypto lending is and explain how it works, also, we have selected the best platforms for the job. Crypto lending is one of the cornerstones of the DeFi -Decentralized Finance- ecosystem that has been consolidating in the Ethereum blockchain in recent years. It is a financial practice analogous to traditional loans between individuals, involving two types of actors with opposing but interchangeable interests:

On one side, there are borrowers who have the opportunity to use their cryptocurrency funds as collateral to obtain a loan – which can be in the form of fiat, stablecoin, or any other cryptocurrency.

On the other hand, lenders, who put their idle cryptocurrency funds to work, lending them to the former in exchange for a fixed or variable interest rate.

What is crypto lending?

At first glance, this may not seem very revolutionary – after all, it is nothing more than a reformulation of traditional collateralized loans, transferred to the crypto environment. However, the fact that their design is not disruptive does not mean that they are not of crucial importance for the development of decentralized finance based on blockchain technology. Credit and debt are basic pillars of the economy and financial markets – since they allow increasing the amount of productive capital, by reallocating it from inactive positions to others that will put it to use. In this way, lenders generate a return – through the interest rate they charge – and borrowers gain access to the capital they do not have – to create value, and after repaying the loan, earn the difference they have generated.

What is new, however, is the non-permissible, open and composable nature that crypto lending has developed under the DeFi movement. Attributes that help optimize interest rates across platforms, and facilitate the emergence of new products – such as the flash loans developed by Aave, which we will discuss later.

For lenders, crypto lending can be a good source of revenue, offering obvious advantages over similar products offered by traditional markets. By way of example, in most Western countries, a savings account currently typically offers an interest rate of between 0% and 1%. In contrast, on most crypto lending platforms, stablecoins linked to the dollar exchange rate -DAI, USDC, USDT, BUSD- usually offer an interest rate of between 5% and 8% -although on occasion they have been offered at 15% APR.

For borrowers, obviously, the benefits are not so obvious – since, as we have explained, it is essential to deposit collateral to back the loans. In general, collateralization requirements are usually more than 100% of the capital to be borrowed – so it would be more correct to speak of over-collateralization, rather than collateralization. Evidently, as long as the requirements are those, it will be difficult to develop credit instruments that help the neediest individuals -for example in those countries where there is a low level of banking penetration, an ideal breeding ground for a movement like DeFi.

History of crypto lending

Long before the current decentralized crypto lending services -most of them part of Ethereum’s DeFi ecosystem- appeared, the possibility of offering similar services in a rudimentary way would be addressed in forums such as BitcoinTalk -there are threads that speculated about the creation of something like “Bitcoin banks” as early as 2010. And shortly thereafter, the first loans between individuals – a type of informal p2p exchanges – would begin to take place, obviously involving a good deal of trust, but allowing BTC “holders” to generate a return for something that was basically passive capital.

But it would not be until 2017, in the midst of ICO fever, that crypto lending would become a hot topic. At first, centralized entities specialized in such a service would emerge, which would carry out registration processes -and therefore KYC-, and would offer banking gateways for fiat to crypto conversion -as well as conversions between the different cryptocurrencies. These entities would allow depositors to borrow cash to spend or invest in other sectors, or even other cryptocurrencies – such as ETH – that would be used to participate in the numerous ICOs that were dizzyingly following one another.

It is important to understand the paradigm shift that all this implied. Until then, cryptocurrencies had been a type of investment that left capital parked -both for individuals and institutional investors- without generating any type of return beyond the appreciation of the market price -a return that, if realized, became a taxable event subject to tax liability. And suddenly, with the emergence of lending services, lenders could start generating a passive return on their funds, and borrowers could receive cash or other crypto assets for trading, arbitrage or market-making.

So, on the one hand, holders gained access to capital that they could use to pay off debts or buy consumer goods -without incurring taxable events-; or put it to work -without the need to abandon the long position in the crypto asset and, therefore, without a potential loss of long-term realized gains.

Among this first batch of centralized institutions specialized in crypto lending services, we find important players that today have consolidated their position in the market:

- Blockfi: Founded in mid-2017 by Zac Prince and based in New York.

- Unchained Capital: Founded in 2017 by Joseph Kelly and based in Austin, Texas.

- Celsius Network: Founded in June 2017 by Alex Mashinsky – one of the inventors of the VOIP protocol – Nuke Goldstein and S. Daniel Leon, and based in London, UK.

Obviously, not all of these platforms would respond to the same model. While Blockfi would adopt a structure and business model similar to that of most centralized exchanges -such as, for example, Coinbase-; Celsius Network would conduct an ICO in March 2018 to launch its CEL utility token -which would provide its stakers with a whole series of advantages when using the platform, such as better returns for their deposits. It would not be the first, as Salt Lending would put its SALT token up for sale in the summer of 2017. Another centralized crypto lending platform that would follow the model of Celsius and Salt, and would launch its own utility token via an ICO would be Nexo – from the fintech group Credissimo.

This is the case for centralized lending platforms. And before them, in 2016, MakerDAO -a decentralized lending protocol based on collateralized debt positions through ETH and other crypto assets, which allows loans to be obtained in DAI, its own stable currency-, would start selling directly to individual and institutional investors -without ICO- its MKR governance token. Another platform that would bet on a decentralized lending model would be EthLend -the ICO of its LEND token would take place in November 2017, but subsequently, the project would change its name to Aave. EthLend would start out as a decentralized peer-to-peer lending platform, but upon becoming Aave would adopt a pooled liquidity model.

During that time, three of the big decentralized lending platforms would be founded which, unlike MakerDAO and Aave, would decide not to conduct an ICO and dispense – at least initially – with a governance token:

- The first, Compound, is to date one of the flagship protocols of the DeFi ecosystem – with over $90 million in deposits and integration with most wallets – and the first to adopt a pooled liquidity system. After an initial stage without a governance token, in 2020 it would announce the launch of COMP, its governance token.

- The second major decentralized lending platform to be launched in 2017 without an ICO would be Dharma – although in 2019 it would pivot to a new model as a wallet with a built-in “savings account”, thanks to the native integration of the Compound protocol.

- The third would be dYdX, a decentralized protocol specialized in lending for margin trading, founded in 2017 in San Francisco by Antonio Juliano.

After the ICO fever, a long bear market would follow for two years, which, however, would not prevent crypto lending from flourishing. At first, centralized services such as Blockfi would emerge; but soon, thanks to the accelerated adoption of DAI as one of the pillars of the DeFi ecosystem, and the launch of the first version of the Compound protocol, decentralized lending services would also flourish.

After some time, the market would show signs of improvement and the bulls would start to regain control, which would give a new boost to lending services. In this new phase, some of the main players in the cryptocurrency sector, such as the Binance exchange, would join the business. Complementing their service offering with a wide range of lending products – with returns as high as 15% APR, as in the case of BUSD stablecoins and USDT – allows centralized exchanges such as Binance to build customer loyalty through a one-stop shop approach.

How does crypto lending work?

As the cryptocurrency industry grows, the DeFi ecosystem – and more specifically, lending services – will play an increasingly important role. It is therefore essential to understand the functioning of the systems that provide the service, and which, far from being homogeneous, present two clearly differentiated typologies: on the one hand, centralized institutions that follow a business model similar to that of traditional exchange houses; and on the other, decentralized protocols/applications in which the process is largely managed by smart contracts. Also, as we shall see, there are notable differences for users depending on whether they are lenders or borrowers.

Centralized lending platforms -such as Blockfi- are actually very similar in their operation to traditional fintech -with the difference that their core business involves cryptocurrencies. Just like fintech, they follow KYC processes -customer identification-, have asset custody systems, and tend to negotiate credits with other financial institutions. The interest rates offered by these types of centralized institutions to BTC or ETH lenders tend to be significantly higher than those of their decentralized counterparts.

In the case of decentralized lending platforms – such as MakerDAO, Compound, Aave or dYdX – we are dealing with protocols and not traditional institutions. For this reason, their access is completely open, users are not obliged to go through a KYC-type process, nor is a custody service offered – it is the users themselves who are responsible for the custody of their own funds. In general, such protocols determine the variable interest rates to be paid by borrowers -borrowers- through algorithms that constantly monitor the relationship between supply and demand. The exception to this system would be MakerDAO: as the name suggests, it is the holders of the MKR token who say the parameters to which the CDPs – collateralized debt positions used to issue loans in the stable DAI currency – are subject through DAO-type governance processes.

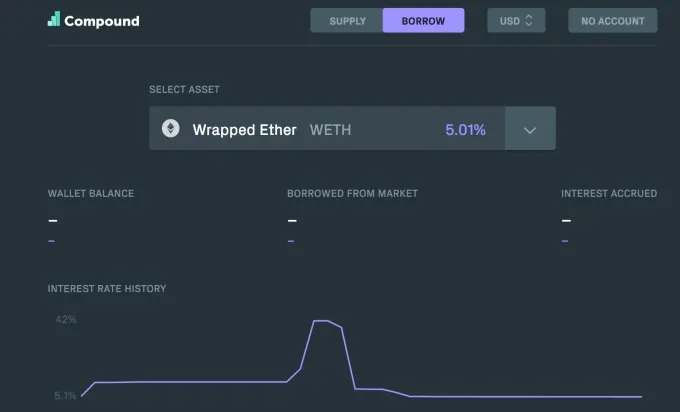

That interest rates on decentralized lending platforms are generally variable and calculated – in most cases – algorithmically, can lead to sharp spikes in interest rates on an ad hoc basis – imagine a sudden increase in demand for a particular asset for whatever reason, leading borrowers to agree to pay higher interest rates, and providing a handsome return to lenders. This phenomenon is exacerbated when the liquidity of certain assets is not very high, causing interest rates to fluctuate sharply when a significant amount of capital flows in or out of deposits.

A clear example of this phenomenon would occur as a result of the famous Synthetix snapshotting: for a period of time, at the beginning of each week, there would be a brutal demand for SNX token loans by users who would deposit them on the Synthetix exchange just before the snapshot of their balances, thus cheatingly opting for more rewards from the protocol – and right after, repaying the amount borrowed.

It must be understood, however, that although crypto lending is often compared to traditional savings accounts, lenders’ deposits are not protected by banking authority guarantee funds – although centralized platforms sometimes refer custody to third parties that do provide some form of coverage. In the case of decentralized platforms, initiatives have appeared to alleviate this lack of guarantees, such as Nexus Mutual -for hedging against failures in the protocol code- or Opyn -which acts as an asset value hedge through option-type contracts.

In the case of the borrowers -borrowers-, the risk they assume is related to the collateral they deposit, which must be kept within a certain threshold -to ensure the solvency of the protocol and not jeopardize the lenders’ deposits. Thus, lenders must be vigilant to always keep their positions overcollateralized, otherwise they may be liquidated – to date, the settlement systems have generally worked well, with exceptions such as in the case of MakerDAO during “Black Thursday” on March 12, 2020.

In fact, such settlement systems are one of the competitive advantages of centralized and decentralized crypto lending systems over traditional financial sector products. Unlike mortgages and the real estate backing them – which are subject to lengthy foreclosure and settlement processes – cryptocurrencies are a highly liquid and easy-to-sell collateral type – the process can take mere seconds.

Although in the aforementioned case of the failed MakerDAO settlements the problem came from the saturation of the Ethereum network -during a time of high volatility-, it is important to keep in mind that all decentralized lending protocols can be subject to risks linked to smart contracts -basically, bugs in the code. If a hacker discovers one of these bugs, he can exploit the code to his advantage and seize some of the deposited funds. Obviously, DeFi protocols are well aware of this problem, which is why they usually carry out exhaustive code audits before putting any update into production.

Finally, we should note that, in general, many jurisdictions do not have clear regulations regarding the nature of crypto assets in general – and stablecoins in particular. As a result, it is sometimes complicated for an individual to know their tax obligations arising from their lending activities – especially in countries such as the U.S. where financial regulations are stricter. Such concerns lead many users to opt for decentralized applications and protocols – such as Compound, Aave, and MakerDAO – where no KYC process is required to access the service – so the user can perform the entire transaction while preserving his or her anonymity.

Platforms

Crypto lending offers all participants a wide range of opportunities to increase the productivity of their assets -generating a return- as well as their liquidity -since these assets suddenly gain new uses and are traded in new instances. It is essential, however, to understand the different motivations that lead to participate in lending operations – depending on whether one acts as a lender or borrower, or whether one opts for centralized platforms or DeFi ecosystem protocols.

- First, there are the “holders” of a given crypto asset, who have the possibility of depositing it on custodial platforms such as Blockfi or decentralized protocols such as Compound or Aave, in exchange for annual compound interest (APY). The DeFi ecosystem has developed numerous tracking tools – an example would be LoanScan – as well as aggregators – such as Instadapp – that allow you to know at all times what are the interest rates offered by the different lending protocols. Decentralized platforms usually offer high-interest rates for stablecoins -between 4 and 15%-, but low for the main crypto assets -annual returns for ETH are usually below 1%. For BTC and ETH, the best returns are offered by centralized platforms such as Blockfi.

- Another use case, for more sophisticated investors, is interest rate arbitrage – via carrying trade type strategies. Thus, as a borrower, one can borrow a crypto asset – say a stablecoin – with a low-interest rate on a DeFi protocol such as Aave or Compound, and look for other platforms where the same asset earns the lenders a higher APY. The difference between what you pay in interest in Aave or Compound and what you receive in interest in the platform where you deposit the asset will be the profit generated by the arbitrage. Obviously, there are risks, as the interest charged by both Aave and Compound is variable, and the tables can turn – suddenly, what was a profit can slowly turn into a loss.

- One of the areas where crypto lending is most prominent is, obviously, access to leverage through decentralized protocols. In MakerDAO, for example, the operation is as simple as depositing ETH, issuing a loan in the stable coin DAI, and then reinvesting it in more ETH. In essence, this will work like a leveraged long position in ETH – as the investor waits for the price of ETH to appreciate so that he can repay the loan in DAI and keep the difference as profit. The process just described can be repeated in a loop multiple times, until the limit set by the collateralization requirements is reached. In other decentralized margin trading platforms, such as dYdX, the process is much simpler, and after depositing your collateral, they allow you to borrow up to x5 leverage – and even access perpetual BTC swap contracts, collateralized and settled via USDC. As in the case of arbitrage, you have to be careful with this type of application, as in times of high volatility your position can be easily liquidated – something that is necessary to protect lenders who have deposited their funds in search of a good APY.

- As we have explained above, another advantage of lending is that it allows you to access a timely source of liquidity without having to sell part of your cryptocurrency funds – which can potentially force you to pay tax on gains if they have occurred, and lose long-term exposure to the appreciation of the asset. It is important to note that most centralized platforms force users to go through a KYC process, something that is not required by decentralized protocols such as Aave or Compound.

- One of the latest developments in crypto lending within the DeFi sphere is flash loans – a product originally designed and launched by the decentralized Aave protocol. This is a product that has no equivalent in the traditional financial sector. Basically, it is a loan with no limit on the principal amount – the limit is the existing liquidity in the protocol -, which does not require collateral, and whose only condition is that it must be repaid within the interval of a block transaction. If the amount borrowed does not return to the liquidity pool from which it was borrowed within that time interval, any transactions that have been made will be reversed. Flash loans democratize access to large amounts of liquidity to execute arbitrage transactions that, once the loan is repaid, leave the user a profit margin. But it is a somewhat complex mechanism that requires technical expertise – the transactions must be programmed consecutively so that they are executed within the allowed time interval. The principle of atomicity ensures that if one transaction fails, the entire operation is reversed – so no one incurs a loss. The other side of the coin of this wonderful innovation is that it is also available to malicious actors who wish to conduct attacks – as happened with the Fulcrum platform – without the need to risk their own capital.

- Finally, we cannot forget other use cases that can also be very profitable for those who have the technical know-how to be able to put them into practice. Specifically, we are talking about settlements – an indispensable mechanism for maintaining healthy levels of collateralization and solvency of decentralized lending protocols. Any user has the opportunity to act as a liquidator of positions that have fallen below the collateralization threshold established by each protocol, and in exchange for providing this service, obtain a juicy commission.

In the future, it is likely that crypto lending services will become even more widespread, and will be able to offer microloans with very favorable prompt payment conditions for all those users who do not have access to traditional financial circuits, either because they are underbanked countries, or because they have a poor credit scoring profile.

Centralized and decentralized crypto lending systems

BlockFi

BlockFi Lending LLC is a centralized crypto lending platform founded in 2017 by Zac Prince in New York. Its business model is focused on capturing deposits of the main traditional cryptocurrencies – BTC, ETH, LTC – since unlike stablecoins, these types of assets generally provide very low returns in decentralized protocols such as Compound or AAve. Holders of BTC, ETH or LTC can get between 4 and 6% APY on BlockFi – while on the aforementioned platforms, such return is below 1%. It should be noted, however, that depending on the profile of the lender – country of residence, risk profile, amount deposited – the effective APY will vary.

BlockFi also offers its users the possibility to obtain quick loans in USD, GUSD and USDC, backed by any of the 3 traditional cryptocurrencies mentioned above. The loan application process takes no more than 2 minutes and in approximately 90 minutes customers receive the money in their wallet or bank account. Prompt repayment of the loans does not entail any penalties.

The fact that BlockFi loans are also offered on the GUSD stablecoin is due to the fact that Gemini is the third-party custodian of the funds deposited by lenders. Gemini is a digital asset exchange founded in 2014 by the Winklevoss brothers and based in New York. It is an entity fully regulated by the NYFDS and offers coverage of deposited funds of $200M – the highest in the market. For that reason, and the fact that it enjoys a hack-free track record, it is one of the benchmark entities for many institutional investors.

Nexo

Nexo is another centralized crypto lending platform, founded in 2017 by fintech Credissimo, and based in Switzerland. Just like BlockFi, Nexo users can deposit their cryptocurrency funds in exchange for very competitive interest rates – especially for traditional crypto assets – and obtain loans using their deposits as collateral.

Once customers deposit their cryptocurrency funds in Nexo’s wallet, the process of obtaining a loan is very fast. One of the most interesting aspects of the platform is that, in addition to accepting a wide range of digital assets as collateral for loans, it allows trading in more than 40 fiat currencies.

Unlike BlockFi, Nexo offers a number of advantages to its users – higher returns for their deposits, lower commissions – if they use the platform’s native token – also called NEXO – in their operations.

SALT

SALT, an acronym for Secured Automated Lending Technology, is one of the first crypto lending platforms – it was founded in Denver in 2016.

Unlike BlockFi and NEXO, on SALT users who wish to use the network‘s services must become members – for which, they must purchase and hold a position in the platform’s native token, also called SALT. Otherwise, the operation is similar: the interested party deposits their cryptocurrency funds, which will act as collateral in the event of requesting a loan – for a minimum of $5,000 and a variable maximum depending on the jurisdiction in which the applicant resides.

By staking with SALT tokens, users of the platform obtain a series of advantages – just as was the case with NEXO. On the other hand, the system is designed to allow borrowers -borrowers- to keep their loan balance in balance. In times of high volatility, if the value of the collateral increases, users will be able to apply for more credit; while if the opposite situation occurs, and the value of their collateral falls, they will have to deposit more crypto assets to readjust the balance.

MakerDAO

MakerDAO – one of the first Ethereum projects, founded by Rune Christensen at the end of 2014 – can also be considered, in a way, a decentralized crypto lending protocol. However, unlike what we have seen in relation to other projects of this type, the main goal of MakerDAO is to create, from the collateralized debt positions of users, a decentralized, “trustless” and censorship-resistant stable coin, called DAI.

The operation is as follows: the user who wishes to receive DAI loan deposits as collateral a cryptocurrency – originally ETH, although after the adoption of the MCD system in 2019, other assets such as BAT, USDC, and BTC would be accepted – which must always respect a collateralization threshold – determined by the holders of the MKR governance token. When the CDP – the collateralized debt position – falls below that threshold, it is liquidated.

As we can imagine, the main users of this type of lending service are traders or investors who wish to have long exposure to ETH – or to one of the other forms of collateral supported in MCD. This is because the IAD that is borrowed is generally used to automatically buy new units of the same collateral that has been deposited – which is essentially like opening a long position on margin.

Dharma

Founded by Nadav Hollander in 2017 in San Francisco, decentralized lending platform Dharma would raise more than $7 million in its funding rounds – involving such prestigious funds as Coinbase Ventures, Polychain, and Y Combinator – but ruled out conducting an ICO and launching a native token.

Dharma’s original idea was to allow users to deposit their crypto assets for a return – in the form of an interest rate – as well as get loans backed by them. But unlike the centralized platforms described above, it would go for a non-custodial model – that is, the user would keep control of the private keys to their funds at all times – thanks to a mechanism called Dharma key. Another of Dharma’s innovations is that it would guarantee lenders a constant interest rate once a borrower has requested the funds on loan. The only crypto assets that the platform’s lending service would offer, however, would be ETH and DAI.

In the wake of the enormous success enjoyed by rival platform Compound, Dharma would decide to refocus its business strategy and become a cryptocurrency exchange with a built-in “savings account” – thanks to a native integration of Compound’s decentralized protocol.

Compound

San Francisco-based decentralized crypto lending platform Compound would be founded in 2017 by Robert Leshner and Geoff Hayes, with the goal of establishing credit marketplaces for crypto assets that were more efficient, and presented less friction from a UX standpoint, than the p2p systems tested until then. In 2018, Compound would raise over $8 million in its funding rounds – in which prominent VCs such as Andreessen Horowitz, Polychain Capital and Coinbase would participate.

The compound is a decentralized, open-source lending protocol programmed on the Ethereum blockchain. Its operation is based on a series of on-chain liquidity pools, where users who wish to do so can deposit their crypto assets to generate a return, and allow other users to withdraw loans – the interest rates earned by lenders and paid by borrowers are algorithmically determined based on the supply and demand of each asset.

In other words, a user will be able to deposit their assets and simply generate a return or use the deposit as collateral to apply for a loan. It is important to highlight as advantages of Compound its open nature -which means that it has been integrated by numerous applications and wallets of the DeFi ecosystem-, the speed with which it works -immediately after depositing tokens in the Compound contract interest starts to accrue- and the fact of having a type of tokens -called cTokens- that represent the deposited collateral, accumulate interest and can be traded in secondary markets -since they are redeemable at any time.

Although Compound would not conduct an ICO during its funding rounds, it would end up launching a governance token in 2020, called COMP.

Aave

The decentralized lending protocol Aave would originally launch under the name ETHLend in 2017 – the year it would conduct the ICO of its native token Lend. The platform is based in London and its founder and CEO is Stani Kulechov.

While ETHLend would use a peer-to-peer lending system, the development of the Aave protocol would mean taking a punt on the platform’s strategy and adopting Compound’s “pooled liquidity” model.

In Aave, users can participate as depositors – providing liquidity to the market to obtain passive income – or as borrowers – obtaining over-collateralized (no time limit) or under-collateralized (within the interval of a block transaction) loans. Being an open-source, non-custodial protocol like Compound, Aave has been natively integrated by numerous DeFi applications and wallets.

As with Compound, interest rates are calculated in Aave algorithmically – based on the liquidity of each pool, and the supply and demand of each asset. Cryptoassets accepted by the platform includes DAI, USDC, TUSD, USDT, sUSD, ETH, LEND, BAT, KNC, LINK, MANA, MKR, REP, SNX, WBTC and ZRX.

Two of the most interesting aspects of Aave are the ability for borrowers to switch from fixed to variable interest rates – and vice versa – as well as flash-loans, loans that do not require collateral or set a limit amount – the limit is the liquidity of each pool – but must be repaid within the interval of a block transaction.

dYdX

dYdX is a decentralized crypto lending protocol that, like MakerDAO, is focused on a very specific use: in this case margin trading without custody of funds – the user maintains control of their private keys thanks to the fact that all operations are carried out on the Ethereum blockchain.

dYdX was founded in 2017 in San Francisco by Antonio Juliano, a former Coinbase engineer.

In dYdX users have the option to simply deposit funds -ETH, DAI, and USDC- to get a return in the form of interest rate, or also use them as collateral to obtain loans that will be used to open long or short positions with leverage. The last product to be launched in the market would be perpetual BTC swap contracts based on cross-margin -collateralized and settled through USDC.