Galaxy Digital, a company, published a report titled “On Bitcoin Energy Consumption: A Quantitative Approach to a Subjective Question.”

After Tesla CEO and founder Elon Musk said last week that he would stop selling vehicles in Bitcoin due to the energy expenditure produced by the cryptocurrency, new research could put in check this statement made by the tycoon. Said study claims that the traditional banking system consumes much more energy than the digital asset’s network.

Michael Novogratz’s cryptocurrency company, Galaxy Digital, published a report titled “On Bitcoin’s Energy Consumption: A Quantitative Approach to a Subjective Question,” in which access is given to its methodology and calculations.

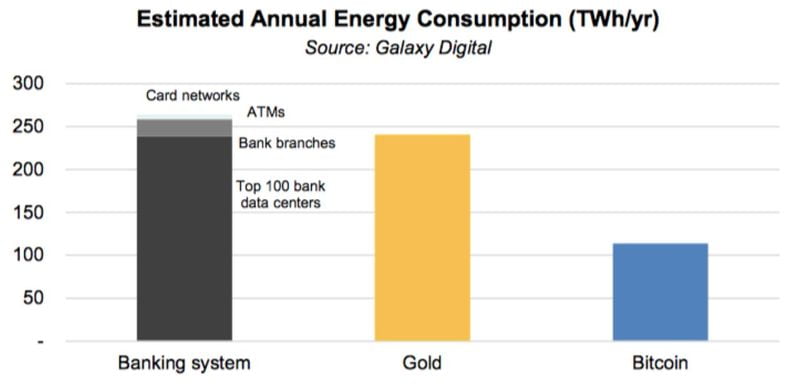

Prepared by Galaxy’s mining arm, the study postulates that Bitcoin’s annual electricity consumption is 113.89TWh, including power for miner demand, miner power consumption, pool power consumption, and node power consumption. Also, this amount is at least twice less than the total energy consumed by the banking system and the gold industry annually, according to Galaxy’s calculations.

While Bitcoin’s energy consumption is transparent and easy to track in real-time through the use of tools such as the Cambridge Bitcoin Electricity Consumption Index, assessing the energy use of the gold industry and the traditional financial system is not so straightforward, Galaxy Digital Mining claimed, CoinTelegraph notes.

“The banking sector does not directly report electricity consumption data,” the report explained, adding that the retail and commercial banking system requires multiple layers of settlement, while Bitcoin offers one final settlement. If Galaxy’s estimates of energy use by banking data centers, bank branches, ATMs, and card network data centers are taken into account, the total annual energy consumption of the banking system is estimated at 263.72TWh globally.

On the other hand, to calculate the gold industry’s energy consumption, Galaxy Digital Mining applied estimates of the industry’s total greenhouse gas emissions provided in the World Gold Council’s report “Gold and Climate Change: Current and Future Impacts”.

According to the study’s calculations, the gold industry uses approximately 240.61 TWh per year. “These estimates may exclude key sources of energy use and emissions that are second-order effects of the gold industry, such as the energy and carbon intensity of tires used in gold mines,” Galaxy noted.

Galaxy Digital’s analysis of Bitcoin’s energy consumption comes as a potential savior for cryptocurrencies that are facing significant market slumps following Tesla CEO Tesla’s decision to stop accepting the most popular cryptocurrency as payment for car purchases due to environmental concerns.

“Cryptocurrency is a good idea on many levels and we believe it has a promising future, but this can’t come at a great cost to the environment,” Musk tweeted last week.