Despite having a new factory and a production facility that runs 24 hours a day, Sony can’t produce enough image sensors to meet demands. The explosion in the number of camera modules in smartphones is triggering a shortage. Sony, the world’s number 1 in CMOS sensor production, is struggling to fulfill its orders.

Sony Semiconductor Division Chief Terushi Shimizu says that Sony controls more than 50% of the world market (or even more if we limit ourselves to high-end sensors) but despite massive investments, “We have to apologize to our customers because we can’t produce enough.”

Sony invested 2.29 billion euros to produce camera sensors

In addition to the 2.29 billion euros invested during this fiscal year in the current production sites, the Japanese giant is currently building an additional factory on the Nagasaki site which already produces sensors. This new plant (the first in 12 years since the commissioning of Kumamoto Tec in 2007), which costs a whopping 820 million euros and which will start manufacturing in 2021, could allow the Japanese tech company to reach its goal of controlling 60% of the market in 2025. Of course this target also depends on how Samsung would react, since the Korean company has indeed grown strongly in the recent years.

With this new factory, Sony will increase its 300 mm wafer production capacity from 109,000 to 138,000 per month. Depending on their specifications, it can take from several weeks to six months to produce a wafer.

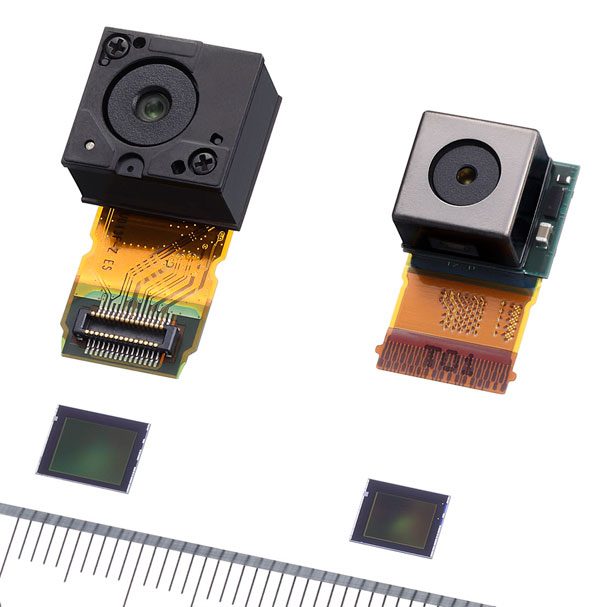

Current phones are dominated by impressive camera features. iPhone 11 Pro, Huawei Mate 30 Pro, Samsung Galaxy Note 10 Plus, has four to six camera modules each. The number of camera modules has exploded in the recent years, but factories did not expand at the same scale. The company is the leading supplier of smartphone cameras, including custom sensors of Huawei P20 Pro and P30 Pro, but they also produce for the “real” cameras. From Olympus to Panasonic, from Nikon to Canon, the whole industry depends on Sony.

Looking at the financial statements, PlayStation has been the money maker for the Japanese giant for years now. But look closely and you will realize that the following department is no longer semiconductors, but cameras and other imaging solutions.