Preparing tech followers for the potential of a quite long legal battle, the news of how IRS back taxes Microsoft has created an echo through the tech world.

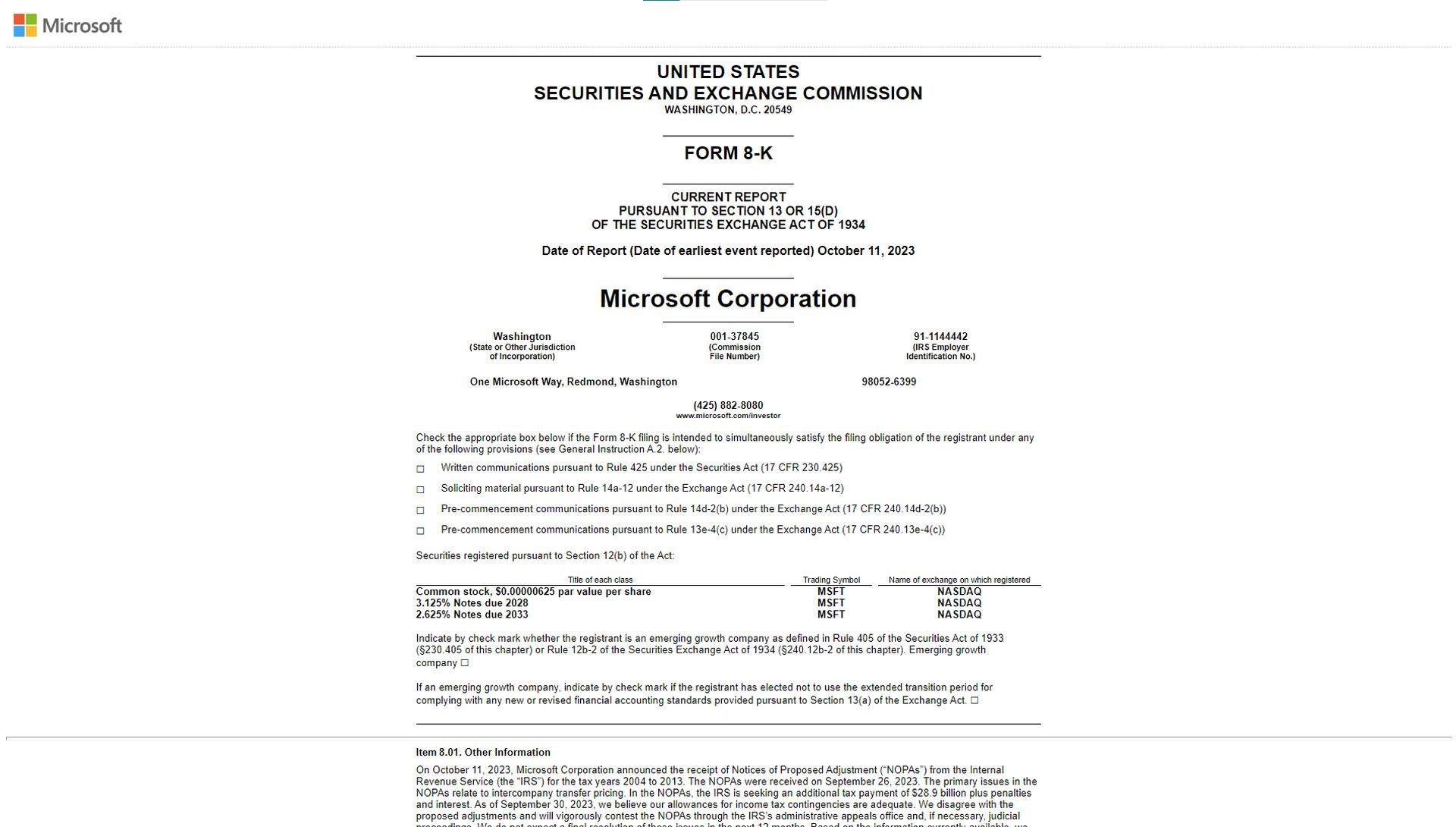

The Internal Revenue Service (IRS) has recently informed tech giant Microsoft that it is facing a substantial back tax bill of $28.9 billion, along with associated penalties and interest. This hefty sum is said to cover the tax years spanning from 2004 through 2013, as per an official filing with the Securities and Exchange Commission (SEC).

The news of how IRS back taxes Microsoft surprised the tech giant

In response to the IRS’s audit, Daniel Goff, the company’s Corporate VP for Worldwide Tax and Customs, took to a blog post to address the issue. Goff emphasized that Microsoft has significantly overhauled its corporate structure and operational practices since the period under scrutiny. He pointed out that while the IRS’s concerns are pertinent to the past, they do not reflect the company’s current protocols. Taken from his blog post, Goff explains:

We strongly believe we have acted in accordance with IRS rules and regulations and that our position is supported by case law. We welcome the IRS’s conclusion of its audit phase which will provide us with the opportunity to work through these issues at IRS Appeals, a separate division of the IRS charged with resolving tax disputes.

Potential tax cut benefits

Goff also asserted that the IRS’s proposed adjustments fail to take into account the amounts Microsoft paid under the Tax Cuts and Jobs Act. He suggests that this oversight could potentially reduce the final tax liability by a substantial $10 billion. Additionally, Microsoft contends that the IRS is at odds with the way the company allocated profits internationally, employing a system of transfer prices referred to as cost-sharing.

Microsoft’s stance

Unwavering in their position, Microsoft has made it clear that they do not concur with the IRS’s “proposed adjustments” and are prepared to mount a robust challenge. The company anticipates a protracted resolution process, expressing doubt that the dispute will be settled within the next year:

It is important to note that the IRS Appeals process will take several years to complete, and if we are unable to come to a direct agreement with the IRS, Microsoft will then have an opportunity to contest any unresolved issues through the courts.

This development comes on the heels of Microsoft’s recent legal victory over the Federal Trade Commission (FTC), which attempted but failed to secure a preliminary injunction against the tech giant’s ambitious plan to acquire Activision Blizzard for a staggering $68.7 billion. The acquisition is slated to be finalized on October 13th.

As Microsoft braces for what is likely to be a protracted battle with the IRS over how IRS back taxes Microsoft, the tech world eagerly watches for updates. This high-stakes financial dispute not only highlights the evolving landscape of corporate taxation but also underscores the intricate nature of global economic operations in the tech industry.

In order not to miss out on the surprising news, keep an eye on this space for further developments on this gripping financial saga.

Featured image credit: Matthew Manuel / Unsplash