Nvidia has placed a fresh order for 300,000 H20 AI GPUs with TSMC to meet unexpectedly strong demand from Chinese tech giants, according to Reuters. This strategic move comes just weeks after the Trump administration reversed an April ban on the H20, a China-specific chip designed to comply with U.S. export controls while remaining powerful enough to handle AI inference workloads effectively.

The decision represents a shift in Nvidia’s China strategy. CEO Jensen Huang had previously suggested during a Beijing visit that H20 production would remain paused unless customer demand justified restarting it—a process that would take approximately nine months. However, with existing stockpiles of 600,000-700,000 H20 units quickly depleting, Nvidia has evidently identified sufficient momentum to justify this substantial new order.

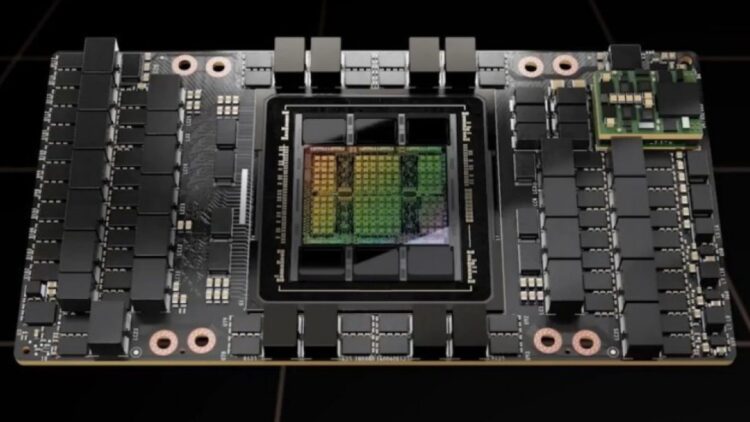

While the H20 lacks the raw power of Nvidia’s flagship H100 or newer Blackwell series, industry experts note it’s finely tuned for AI inference tasks and can even outperform the H100 in certain workloads. Chinese tech heavyweights including Tencent, ByteDance, and Alibaba had already stockpiled these chips before the April ban, frequently pairing them with DeepSeek’s cost-optimized AI models.

Despite the reversed ban, regulatory hurdles remain. Nvidia still requires export licenses for these shipments, and the Commerce Department has yet to approve them. In the interim, the company is requesting Chinese customers to provide detailed order forecasts and documentation, indicating a more controlled distribution approach.

The financial stakes are significant for Nvidia. Following the April ban, the company warned of a potential $5.5 billion inventory write-off and an additional $15 billion in lost sales. For context, Nvidia sold approximately 1 million H20 chips in 2024, making this latest TSMC order represent nearly a third of last year’s total volume.

Political opposition is mounting, with twenty U.S. national security experts, including former officials from the Bush and Trump administrations, urging the Commerce Department to reinstate the H20 ban. They argue the chip is “a potent accelerator of China’s frontier AI capabilities” that could bolster China’s military AI efforts and weaken U.S. export control policies.

Despite this pressure, Nvidia appears to be betting that maintaining its software ecosystem dominance in China outweighs short-term political risks. The company recognizes that if Chinese developers fully migrate to competing solutions like Huawei’s, the long-term strategic loss could far exceed immediate political fallout. In the broader U.S.-China tech rivalry, the H20 has evolved from merely another product into a symbol of the complex intersection between commerce, technology, and geopolitics.