Berkshire Hathaway, the investment firm run by billionaire investor Warren Buffett, reduced its Visa and Mastercard holdings while boosting its position in Nubank, Brazil’s largest fintech bank that is also popular among the country’s Bitcoin investors.

In a securities filing on February 14, the industrial business revealed that it had bought $1 billion of Nubank Class A stock in the fourth quarter of 2021. On the other hand, Visa and Mastercard stock was sold for $1.8 billion and $1.3 billion, respectively.

Warren Buffett dubbed the “Oracle of Omaha,” is well-known for his conservative investment style, particularly in hot markets such as fintech. The seasoned investor had previously mocked Bitcoin (BTC), claiming it was an asset that “does not create anything.”

Buffett’s new investment in Nubank, on the other hand, shows that he has been warming to fintech recently. In July 2021, Buffett committed $500 million to the firm. After Nubank went public on the New York Stock Exchange (NYSE), its returns on the aforementioned investment were worth $150 million in December 2021. Buffett has yet to indicate any interest in selling his Nubank stake.

Buffett invests $1 billion in Nubank

Buffett’s investment in Nubank demonstrates his recognition of the fintech industry’s underlying theme, as well as his readiness to align himself with firms that are active in the cryptocurrency space.

In May 2021, Nubank acquired Easynvest, a trading platform that started offering a Bitcoin ETF (exchange-traded fund) in June 2021. The ETF is named QBTC11 and is sponsored by QR Asset Management and traded on the B3 stock market, which is Brazil’s second-oldest bourse.

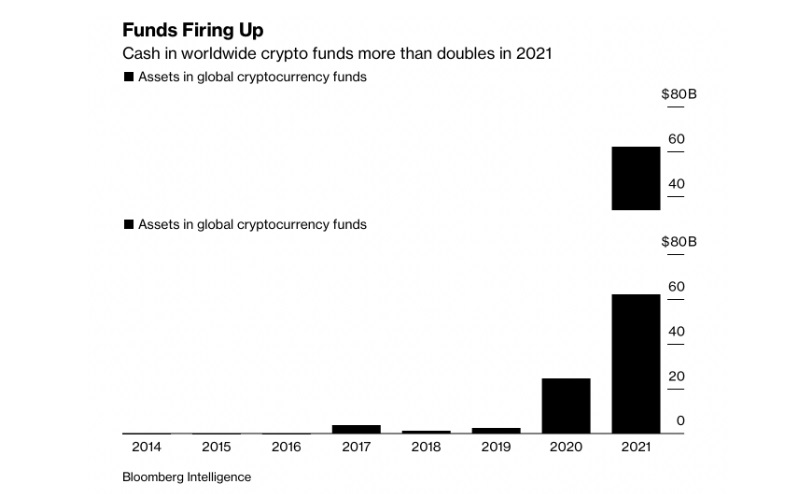

This is due in part to a rise in crypto-related investment products in 2021. Notably, their numbers increased from 35 to 80 during the year, according to data from Bloomberg Intelligence, while their asset valuations rose to $63 billion as opposed to $24 billion at the beginning of 2021.

Another firm in Buffett’s investment portfolio, Bank of New York Mellon Corp.’s chief financial officer Amy Portney said that digital assets may eventually become a “meaningful source of income” for investment banks as Bitcoin investment vehicles gain popularity.

Another firm in Buffett’s investment portfolio, Bank of New York Mellon Corp.’s chief financial officer Amy Portney said that digital assets may eventually become a “meaningful source of income” for investment banks as Bitcoin investment vehicles gain popularity.

Meanwhile, Leah Wald, the CEO of crypto-asset manager Valkyrie Investments, expected an increase in cryptocurrency-related investment vehicles’ capital flows, calling them a “phenomenon that’s starting to take off”

Wald: “If you look at inflows from a volume perspective, not only has it been steady even with the price corrections that Bitcoin is notoriously famous for, but you’re seeing a lot of institutions jump in.”

Buffett invests in firms close to Bitcoin

Buffett may not invest in Bitcoin himself, but he is already obtaining indirect exposure as firms in his portfolio enter the cryptocurrency market.

U.S. Bancorp, for example, a fifth-largest US bank that operates in the United States, Canada and Mexico, began offering a cryptocurrency custody service for its institutional investment managers just months before Bitcoin hit its all-time high of $69,000 in October 2021.

In addition, in October 2021, Bank of America announced the creation of a cryptocurrency research program, noting increasing institutional interest.

BNY Mellon made the surprise announcement that it would store, transfer, and issue Bitcoin and other cryptocurrencies for its asset-management clients just months before.

Announcing the creation of the BNY Mellon Digital Assets unit – A team dedicated to building the first multi-asset custody and administration platform for traditional and digital assets, including #cryptocurrencies. https://t.co/aZ7wMfAXqg pic.twitter.com/L54TFVpJNv

— BNY Mellon (@BNYMellon) February 11, 2021

Greg Waisman, co-founder and chief operating officer of crypto wallet service Mercuryo:

“The Nubank investment can be tagged as Buffett’s way of supporting the fintech/crypto world without taking back his criticisms of the past. Even an indirect exposure is bound to increase the positive sentiment that may push more investors into the space.”